How To Sell A Financed Car

Here is the introduction paragraph: Selling a financed car can be a complex process, but with the right guidance, you can navigate it successfully. To start, it's essential to understand the specifics of your financed car's situation, including the outstanding loan balance, interest rate, and any penalties for early repayment. Once you have a clear picture of your car's financial situation, you can begin preparing it for sale, which may involve making repairs, gathering necessary documents, and determining a fair market price. From there, you can explore your options for selling a financed car, including trading it in, selling it to a private party, or using a service that specializes in buying financed vehicles. In this article, we'll take a closer look at each of these steps, starting with understanding your financed car's situation.

Understanding Your Financed Car's Situation

Understanding your financed car's situation is crucial to making informed decisions about your vehicle. When you finance a car, you're essentially entering into a contract with the lender, and it's essential to comprehend the terms and conditions of that agreement. To get a clear picture of your financed car's situation, you need to consider three key factors. Firstly, you should check your loan agreement for any restrictions that may impact your ability to sell, trade-in, or modify your vehicle. Secondly, determining your car's current market value will help you understand its worth and make informed decisions about its future. Lastly, calculating your outstanding loan balance will give you a clear picture of how much you still owe on your car. By understanding these three factors, you'll be better equipped to navigate your financed car's situation and make decisions that are in your best interest. So, let's start by checking your loan agreement for any restrictions.

Check Your Loan Agreement for Any Restrictions

When selling a financed car, it's essential to review your loan agreement to check for any restrictions that may impact the sale. Your loan agreement may include clauses that dictate what you can and cannot do with the vehicle, including selling it. Some common restrictions to look out for include prepayment penalties, which may charge you a fee for paying off the loan early, and requirements for notice or approval from the lender before selling the vehicle. Additionally, your loan agreement may specify that the lender has a lien on the vehicle, which means they have a claim to the vehicle's title until the loan is paid in full. Understanding these restrictions will help you navigate the sales process and avoid any potential issues or penalties. It's also important to note that some lenders may have specific requirements for selling a financed vehicle, such as requiring the buyer to assume the loan or obtain a new loan from the same lender. By carefully reviewing your loan agreement, you can ensure a smooth and successful sale of your financed car.

Determine Your Car's Current Market Value

To determine your car's current market value, you can use various tools and resources. Start by checking online pricing guides such as Kelley Blue Book (KBB) or National Automobile Dealers Association (NADA) Guides, which provide estimated values based on your car's make, model, year, trim level, and condition. You can also research your car's market value by looking at listings of similar vehicles for sale in your area, either online or in local dealerships. Additionally, you can use online marketplaces like Autotrader or Cars.com to get an idea of your car's value. Another option is to get a vehicle inspection or appraisal from a professional, which can provide a more detailed and accurate assessment of your car's value. Furthermore, you can also check with local dealerships or used car lots to see what they would offer for your vehicle. By gathering information from these sources, you can get a comprehensive understanding of your car's current market value and make an informed decision when selling your financed car.

Calculate Your Outstanding Loan Balance

To calculate your outstanding loan balance, you'll need to gather some information from your lender or loan documents. Start by finding your loan statement or contacting your lender to obtain your current loan balance. This will give you the total amount you still owe on your car loan. Next, check your loan documents or statement to find the original loan amount, interest rate, and loan term. You can use an online loan calculator or create a spreadsheet to calculate your outstanding balance. Alternatively, you can use a simple formula: Outstanding Balance = Original Loan Amount - (Monthly Payment x Number of Payments Made). By plugging in the numbers, you'll get an accurate estimate of your outstanding loan balance. Keep in mind that this calculation may not reflect any fees or interest that have accrued since your last payment. To get the most up-to-date balance, it's best to contact your lender directly. Knowing your outstanding loan balance is crucial when selling a financed car, as it will help you determine how much you need to pay off the loan and how much you can expect to receive from the sale.

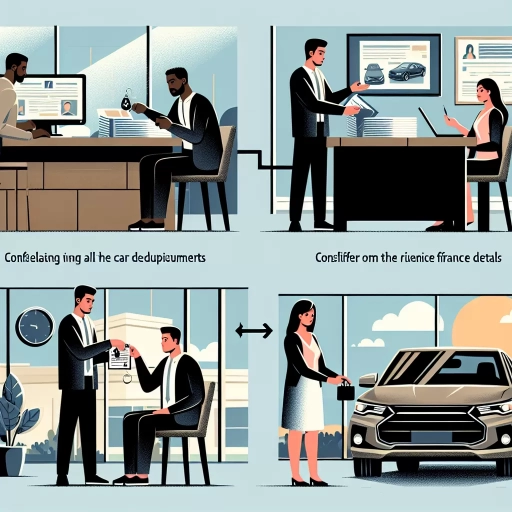

Preparing Your Financed Car for Sale

When it comes to selling a financed car, preparation is key to ensuring a smooth and successful transaction. To get the best possible price for your vehicle, it's essential to take a few steps before listing it for sale. First, you'll need to gather all necessary documents and records, including the vehicle's title, registration, and any service records. Additionally, making any necessary repairs to increase the resale value of your car can make a significant difference in attracting potential buyers. Finally, taking high-quality photos and writing an accurate description of your vehicle will help showcase its best features and build trust with potential buyers. By taking these steps, you can increase the chances of selling your financed car quickly and for a good price. To start, let's take a closer look at the first step: gathering all necessary documents and records.

Gather All Necessary Documents and Records

When selling a financed car, it's essential to gather all necessary documents and records to ensure a smooth transaction. Start by collecting the vehicle's title, which may be held by the lender, and obtain a lien release or a letter stating the outstanding loan balance. You'll also need to gather any service records, maintenance documents, and repair receipts to demonstrate the car's condition and history. Additionally, collect any warranty information, owner's manuals, and spare keys. If you've made any modifications or upgrades, gather receipts and documentation to prove their value. Furthermore, obtain a vehicle history report to disclose any accidents, recalls, or previous damage. Having all these documents and records readily available will help build trust with potential buyers and facilitate a successful sale.

Make Any Necessary Repairs to Increase Resale Value

Here is the paragraphy: When preparing your financed car for sale, making any necessary repairs is crucial to increase its resale value. A well-maintained vehicle not only attracts more buyers but also commands a higher price. Start by addressing any cosmetic issues, such as scratches, dents, or faded paint. A fresh coat of paint or a detailing job can make a significant difference in the car's appearance. Next, focus on mechanical repairs, including oil changes, tire rotations, and brake pad replacements. Ensure that all lights, signals, and accessories are functioning properly. Additionally, consider replacing worn-out parts, such as air filters, spark plugs, or belts, to demonstrate the car's reliability. By investing in these repairs, you can increase the car's resale value, making it more attractive to potential buyers and helping you to sell it for a better price. Furthermore, providing documentation of the repairs and maintenance can also boost the car's value, as it gives buyers confidence in the vehicle's condition. By taking the time to make necessary repairs, you can maximize the resale value of your financed car and get a better return on your investment.

Take High-Quality Photos and Write an Accurate Description

Here is the first paragraph of the article: Selling a financed car can be a bit more complicated than selling a car that is fully paid off. However, with the right guidance, you can navigate the process successfully. In this article, we will provide you with a step-by-step guide on how to sell a financed car. To start, let's look at the necessary steps to prepare your car for sale. When it comes to selling a financed car, presenting it in the best possible light is crucial to attracting potential buyers and securing a good price. One of the most effective ways to do this is by taking high-quality photos and writing an accurate description. Clear, well-lit, and high-resolution photos showcase the car's features, condition, and any unique selling points, giving buyers a detailed understanding of what they're looking at. Consider taking photos from multiple angles, including the interior, exterior, and any notable features such as infotainment systems or safety features. Additionally, include photos of any flaws or damage to maintain transparency and build trust with potential buyers. When writing the description, be honest and accurate about the car's condition, including its mileage, any existing damage, and its maintenance history. Highlight the car's best features and any recent upgrades or repairs. By presenting your car in a clear and honest manner, you can build trust with potential buyers and increase the chances of selling your financed car quickly and for a good price.

Exploring Your Options for Selling a Financed Car

If you're looking to sell your financed car, you have several options to consider. One approach is to trade-in your financed car to a dealership, which can be a convenient and hassle-free way to sell your vehicle. Another option is to sell your financed car to a private party, which can potentially result in a higher sale price. Alternatively, you can use an online marketplace or consignment service to reach a wider audience of potential buyers. In this article, we'll explore each of these options in more detail, starting with the process of trading in your financed car to a dealership.

Trade-In Your Financed Car to a Dealership

When you're ready to sell your financed car, trading it in to a dealership can be a convenient option. This process involves using the value of your current vehicle as a trade-in to reduce the purchase price of a new car. To initiate the process, start by researching the market value of your vehicle using tools like Kelley Blue Book or Edmunds. This will give you an idea of what your car is worth and help you negotiate a fair trade-in value with the dealership. Next, gather all necessary documents, including the vehicle title, registration, and any service records. It's also essential to review your financing contract to understand any outstanding loan balance and any potential penalties for early payoff. When you visit the dealership, be prepared to discuss your vehicle's condition, mileage, and any upgrades or features that may impact its value. The dealer will then appraise your vehicle and make an offer based on its condition and market value. If you accept the offer, the dealer will handle the paperwork and pay off the outstanding loan balance, and you can use the trade-in value as a down payment on your new car. Keep in mind that trading in a financed car may not always be the most profitable option, as dealerships often offer lower trade-in values than private party sales. However, it can be a hassle-free way to sell your car and get into a new one, especially if you're looking to upgrade to a newer model or take advantage of current incentives.

Sell Your Financed Car to a Private Party

Selling a financed car to a private party can be a bit more complicated than selling a car that is fully paid off, but it is still a viable option. When selling to a private party, you will need to disclose the fact that the car is financed and provide the buyer with information about the loan, including the balance and the lender's contact information. This is important because the buyer will need to pay off the loan in order to obtain the title to the car. You can work with the buyer to come up with a plan for paying off the loan, such as having them pay the lender directly or including the loan balance in the sale price of the car. It's also a good idea to get everything in writing, including the sale price, the loan balance, and the terms of the sale. This will help protect both you and the buyer in case any issues arise. Additionally, you may want to consider having a lawyer review the sales contract to ensure that everything is in order. By being upfront and transparent about the financing, you can build trust with the buyer and increase the chances of a successful sale.

Use an Online Marketplace or Consignment Service

If you're not ready to pay off your loan or lease in full, you can consider using an online marketplace or consignment service to sell your financed car. These platforms connect buyers with sellers, often handling the sales process and paperwork for a fee. You can list your vehicle on websites like Cars.com, Autotrader, or Craigslist, or use a consignment service like Carvana or Shift. These services typically take care of pricing, marketing, and sales, making the process easier for you. However, be aware that you'll need to provide detailed information about your vehicle, including its financing status, and may be required to pay a fee for the service. Additionally, you'll still be responsible for paying off your loan or lease, so be sure to factor that into your sales price. By using an online marketplace or consignment service, you can reach a wider audience and potentially sell your car faster, but be prepared to provide transparency about your vehicle's financing status and to work with the service to ensure a smooth sale.