How Long Does Tax Return Take

Understanding the Process of Tax Return

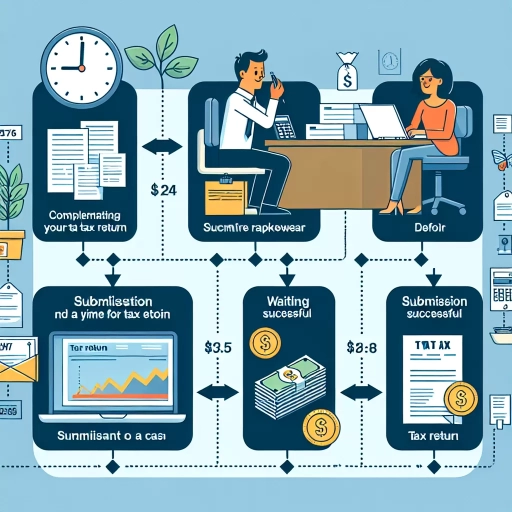

How a Tax Return Works

The tax return is a document that taxpayers submit to the Internal Revenue Service (IRS) or state tax authorities, which declare their liability for taxation. Every year, individual taxpayers calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes. Understanding how a tax return works is crucial in knowing how long the process takes. It begins with gathering the necessary income information, submitting the return, and then waiting for the acknowledgment of receipt from the IRS.

The Role of the IRS in Processing Returns

After submitting the tax return, the IRS checks if the information is accurate and matches the data they have on record. They have the right to audit any tax return at random to verify the correctness of the details provided. If they find any discrepancies or errors, they will send the taxpayer a notification to correct them. This process is generally efficient, but numerous factors can influence how long it takes for the IRS to process a tax return.

The Importance of Prompt and Accurate Filing

Filing your tax returns correctly and on time can help speed up the process. Late or inaccurate filings may require additional time for review or corrections, thus prolonging the return period. Additionally, be aware of the tax filing deadline, which is typically April 15th each year. Filing after this deadline can result in penalties, including a delay in processing your tax refund.

The Typical Timeline for Tax Returns

Electronic versus Paper Filing

The method of filing your tax returns can significantly influence its processing time. Most people find that electronic filing (or e-filing) is faster and more convenient. The IRS also prefers this method because it is easier for them to process these returns. Typically, e-filed tax returns are processed within 21 days. On the other hand, paper-filing your tax return often takes longer to process, with the IRS quoting six to eight weeks to receive your refund.

The Impact of Direct Deposit

How you choose to receive your refund can also affect the timeline. Selecting direct deposit to your bank account is the fastest method. Once your tax return is processed, the IRS will deposit your refund directly into your bank account within a few days. Conversely, having a check mailed to you will take longer as it goes through the mail system.

Potential Delays to Be Aware Of

Several factors may delay tax return processing. These include incomplete or incorrect information, the need for a detailed review, or the presence of identity theft or fraud. Additionally, if you claim certain credits like the Earned Income Tax Credit or the Additional Child Tax Credit, your refund cannot be issued before mid-February according to law. Understanding these possible hurdles can make the waiting period less stressful.

Steps to Follow if Your Tax Return Takes Too Long

Checking Your Status Online

If your return is taking longer than expected, you can check its status using the 'Where's My Refund?' tool on the IRS website. This tool provides the most accurate and complete information about your refund status and is updated daily.

Contacting the IRS Directly

If the 'Where's My Refund?' tool does not provide a satisfactory response or if it's been over 21 days since e-filing your return (or six weeks for paper returns), you should contact the IRS directly. Keep in mind that due to high call volumes, waiting times may be long.

Seeking Professional Help

If your tax return is delayed due to complex issues such as errors, audits, or identity theft, you may need to seek professional help. A certified public accountant (CPA) or a tax attorney can help resolve these issues effectively and speed up the processing of your tax return.