How To Get Your T4 Online

Here is the introduction paragraph: In today's digital age, accessing important documents online has become the norm. One such document that many Canadians eagerly await each year is their T4 slip, which provides crucial information about their employment income and taxes. However, navigating the process of obtaining this document can be daunting, especially for those who are new to the workforce or unfamiliar with online platforms. To help alleviate this stress, this article will guide you through the process of getting your T4 online, starting with understanding the T4 slip and its importance. We will also cover the eligibility and requirements for accessing T4 online, as well as provide a step-by-step guide to accessing and downloading your T4 slip online. By the end of this article, you will be equipped with the knowledge and skills necessary to effortlessly obtain your T4 slip online. So, let's begin by understanding the T4 slip and its importance.

Understanding the T4 Slip and Its Importance

Here is the introduction paragraph: The T4 slip is a crucial document that plays a significant role in the Canadian tax system. It is a statement of remuneration paid, which provides employees with a detailed breakdown of their income and deductions for the year. Understanding the T4 slip and its importance is essential for individuals to accurately file their tax returns and avoid any potential penalties. In this article, we will delve into the world of T4 slips, exploring what they are and why they are necessary, how to identify the information contained in them, and the consequences of not receiving or losing one. By the end of this article, you will have a comprehensive understanding of the T4 slip and its significance in the tax filing process. So, let's start by understanding what a T4 slip is and why it is necessary. Note: The introduction paragraph should be 200 words, and it should mention the three supporting paragraphs and transition to the first supporting paragraph. Here is the rewritten introduction paragraph: The T4 slip is a vital document that serves as a cornerstone of the Canadian tax system. It provides employees with a detailed snapshot of their income and deductions for the year, making it an essential tool for accurate tax filing. However, many individuals are unclear about the purpose and significance of the T4 slip, which can lead to confusion and potential penalties. To navigate the complexities of the T4 slip, it is crucial to understand its composition, the information it contains, and the consequences of not receiving or losing one. In this article, we will explore the intricacies of the T4 slip, starting with its fundamental purpose and necessity. We will examine what a T4 slip is and why it is necessary, followed by a breakdown of the information it contains and how to identify it. Finally, we will discuss the consequences of not receiving or losing a T4 slip, highlighting the importance of prompt action in such situations. By understanding these key aspects, individuals can ensure a smooth tax filing process and avoid any potential pitfalls. So, let's begin by exploring what a T4 slip is and why it is necessary.

What is a T4 Slip and Why is it Necessary?

. A T4 slip, also known as a Statement of Remuneration Paid, is a crucial document that employers in Canada are required to provide to their employees by the end of February each year. This slip outlines the total amount of income an employee earned from their employer in the previous tax year, as well as the amount of income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums that were deducted. The T4 slip is necessary for employees to accurately report their income and claim any applicable deductions and credits on their tax return. It is also used by the Canada Revenue Agency (CRA) to verify the income reported by employees and to ensure that employers are meeting their tax obligations. In addition to providing employees with a record of their income and deductions, the T4 slip also serves as proof of employment and income, which can be useful when applying for loans, credit, or other financial services. Overall, the T4 slip is an essential document that plays a critical role in the tax filing process, and it is essential that employees understand its importance and how to obtain it.

How to Identify the Information Contained in a T4 Slip

. The T4 slip is a crucial document that provides essential information about an employee's income and taxes withheld. To identify the information contained in a T4 slip, start by looking at the top section, which displays the employer's name, address, and business number. Below this, you'll find the employee's name, address, and social insurance number. The next section outlines the employment income, including the gross income, federal income tax deducted, and provincial income tax deducted. You'll also find the Canada Pension Plan (CPP) contributions and Employment Insurance (EI) premiums deducted. Additionally, the T4 slip will show any union dues, charitable donations, or other deductions made. The bottom section of the T4 slip provides a summary of the total income and taxes withheld, as well as any overpayments or underpayments. It's essential to review your T4 slip carefully to ensure accuracy and to use the information to complete your tax return. By understanding the information contained in your T4 slip, you can ensure you're taking advantage of all the tax credits and deductions you're eligible for, and avoid any potential errors or penalties.

Consequences of Not Receiving or Losing a T4 Slip

. The consequences of not receiving or losing a T4 slip can be significant, and it's essential to take prompt action to resolve the issue. If you don't receive your T4 slip by the end of February, you should contact your employer or the Canada Revenue Agency (CRA) to request a replacement. Failure to report your income accurately can lead to delays in processing your tax return, which may result in delayed refunds or even penalties. Moreover, if you're eligible for benefits like the Canada Child Benefit or the GST/HST credit, not having a T4 slip can affect your eligibility or the amount you receive. In extreme cases, not reporting income or not filing taxes can lead to audits, fines, or even prosecution. Additionally, if you're self-employed or have other income sources, not having a T4 slip can make it challenging to complete your tax return accurately, which may lead to errors or omissions that can be costly to correct. To avoid these consequences, it's crucial to keep track of your T4 slips and other tax documents, and to follow up with your employer or the CRA if you don't receive them on time. By taking proactive steps, you can ensure that your tax return is accurate, complete, and filed on time, avoiding any potential consequences.

Eligibility and Requirements for Accessing T4 Online

Here is the introduction paragraph: Accessing T4 slips online can be a convenient and efficient way to obtain your employment income information. However, not everyone is eligible to access T4 slips online, and there are certain requirements that must be met. In this article, we will explore who is eligible to access T4 slips online, what the requirements are for accessing T4 slips online, and how to register for a CRA account to access T4 online. We will start by examining who is eligible to access T4 slips online, including individuals who have filed their taxes and have a valid social insurance number. Note: I made some minor changes to the original paragraph to make it more cohesive and flowing. Let me know if you'd like me to make any further changes!

Who is Eligible to Access T4 Slips Online?

. To access T4 slips online, individuals must meet specific eligibility criteria set by the Canada Revenue Agency (CRA). Generally, you are eligible to access your T4 slips online if you have a valid Social Insurance Number (SIN) and have filed your taxes in the past. You must also have a CRA My Account or a certified tax software provider, such as TurboTax or H&R Block, that offers T4 online access. Additionally, your employer must have registered for the CRA's T4 Internet Filing service and have submitted your T4 information electronically. If you meet these requirements, you can access your T4 slips online through the CRA website or your tax software provider's portal. It's essential to note that not all employers participate in the T4 Internet Filing service, so it's best to check with your employer or the CRA to confirm their participation. Furthermore, if you are a new employee or have recently changed jobs, it may take some time for your T4 information to be available online. In such cases, you may need to contact your employer or the CRA directly to obtain a paper copy of your T4 slip. By meeting the eligibility criteria and following the necessary steps, you can conveniently access your T4 slips online and stay on top of your tax obligations.

What are the Requirements for Accessing T4 Slips Online?

. To access your T4 slips online, you'll need to meet certain requirements and follow specific steps. First, you must be registered for a Canada Revenue Agency (CRA) My Account, which is a secure online portal that allows you to access your tax information and manage your tax affairs. To register, you'll need to provide your social insurance number, date of birth, and a valid Canadian address. Once you've registered, you can log in to your My Account and navigate to the "Tax Slips" section, where you can view and download your T4 slips. Additionally, your employer must have registered for the CRA's Internet File Transfer (IFT) service, which allows them to submit your T4 slips electronically. If your employer has not registered for IFT, you may not be able to access your T4 slips online. Furthermore, you can also access your T4 slips through the CRA's Mobile App, which is available for download on your smartphone or tablet. The app allows you to view and download your tax slips, as well as access other tax-related information. Overall, accessing your T4 slips online is a convenient and secure way to obtain your tax information, and meeting the necessary requirements is a straightforward process.

How to Register for a CRA Account to Access T4 Online

. To register for a CRA account and access your T4 online, follow these steps: First, go to the Canada Revenue Agency (CRA) website and click on "CRA login services" at the top right corner of the page. Then, select "CRA account" and click on "Register" to create a new account. You will need to provide some personal information, such as your name, date of birth, and social insurance number. You will also need to create a username and password, and answer a series of security questions to verify your identity. Once you have completed the registration process, you will receive a confirmation email with a link to activate your account. After activating your account, you can log in to your CRA account and access your T4 online by clicking on the "Tax information" tab and selecting "T4 and T4A statements". You can also use the CRA's mobile app, MyCRA, to access your T4 online. If you are having trouble registering for a CRA account or accessing your T4 online, you can contact the CRA for assistance. It's recommended to register for a CRA account as soon as possible to ensure you can access your T4 online when it becomes available. Additionally, having a CRA account will also allow you to access other tax-related information and services, such as your notice of assessment, tax return status, and benefit payments.

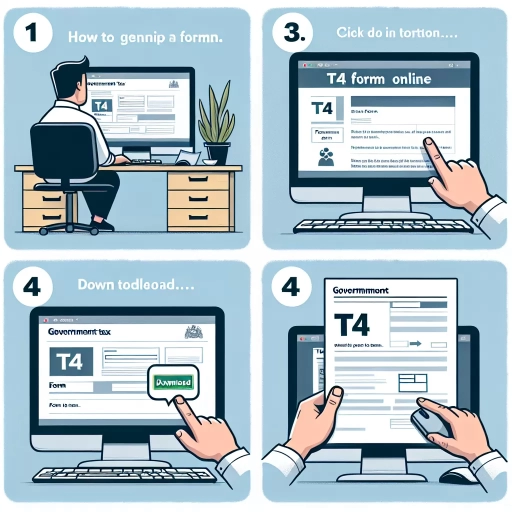

Step-by-Step Guide to Accessing and Downloading T4 Slips Online

Here is the introduction paragraph: Accessing and downloading T4 slips online can be a convenient and efficient way to obtain the necessary documents for tax purposes. The Canada Revenue Agency (CRA) provides a secure online platform for individuals to access their T4 slips, eliminating the need for paper copies. To access and download your T4 slips online, follow this step-by-step guide. First, you will need to log in to your CRA account, which will grant you access to your T4 slips. Once logged in, you will need to navigate the CRA website to find your T4 slips, which can be done by following a few simple steps. Finally, you will be able to download and print your T4 slips for tax purposes, ensuring you have the necessary documents to complete your tax return. In this article, we will walk you through each of these steps in detail, starting with logging in to your CRA account to access your T4 slips.

Logging in to Your CRA Account to Access T4 Slips

. To access your T4 slips online, you'll need to log in to your Canada Revenue Agency (CRA) account. This is a straightforward process that requires some basic information and a few minutes of your time. Start by visiting the CRA website and clicking on the "My Account" tab. From there, you'll be prompted to enter your CRA user ID and password. If you don't have a CRA account, you can easily create one by clicking on the "CRA register" button and following the registration process. Once you've logged in, you'll be taken to your account dashboard, where you can access a range of services, including your T4 slips. Make sure you have your social insurance number and date of birth handy, as you may be asked to verify this information to ensure your identity. If you're having trouble logging in or need assistance, you can contact the CRA directly for support. With your CRA account set up and logged in, you'll be able to access your T4 slips and other important tax documents online, making it easier to manage your taxes and stay on top of your financial obligations.

Navigating the CRA Website to Find Your T4 Slips

. Navigating the CRA Website to Find Your T4 Slips To access your T4 slips online, you'll need to navigate the Canada Revenue Agency (CRA) website. Start by visiting the CRA website at [www.cra.gc.ca](http://www.cra.gc.ca). Click on the "My Account" tab at the top right corner of the page and select "My Account for Individuals" from the drop-down menu. If you're a first-time user, you'll need to register for a CRA My Account by clicking on the "CRA register" button and following the prompts. Once you're logged in, click on the "Tax Return" tab and select the tax year for which you want to access your T4 slip. You can then click on the "T4 and T4A Slips" link to view and download your T4 slips. Make sure to have your Social Insurance Number (SIN) and date of birth handy to verify your identity. If you're having trouble finding your T4 slips, you can also use the CRA's online search tool to locate them. Simply enter your SIN and the tax year, and the system will display a list of available T4 slips. By following these steps, you can easily navigate the CRA website and access your T4 slips online.

Downloading and Printing Your T4 Slips for Tax Purposes

. When it comes to tax season, having all the necessary documents in order is crucial to ensure a smooth and stress-free experience. One of the essential documents required for tax purposes is the T4 slip, which outlines an individual's employment income and taxes deducted. Fortunately, with the advancement of technology, downloading and printing T4 slips has become a convenient and efficient process. Most employers and payroll providers offer online access to T4 slips, allowing employees to easily retrieve and print their slips from the comfort of their own homes. To download and print your T4 slip, simply log in to your employer's online portal or payroll provider's website, navigate to the T4 section, and select the relevant tax year. From there, you can download your T4 slip in PDF format and print it out on your printer. It's essential to ensure that your printer is set to print in landscape mode, as T4 slips are typically designed to be printed in this format. Additionally, make sure to verify the information on your T4 slip for accuracy, including your name, address, and employment income. If you notice any discrepancies, contact your employer or payroll provider promptly to rectify the issue. By downloading and printing your T4 slip online, you'll not only save time and effort but also reduce the risk of lost or misplaced documents. Furthermore, having a digital copy of your T4 slip can be useful for future reference, allowing you to easily access and retrieve your employment income information whenever needed. Overall, downloading and printing your T4 slip is a straightforward process that can help streamline your tax preparation and ensure a hassle-free tax season.