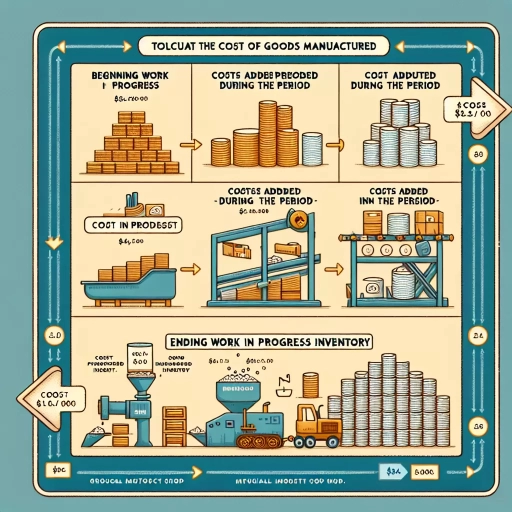

How To Calculate Cost Of Goods Manufactured

Here is the introduction paragraph: Calculating the cost of goods manufactured (COGM) is a crucial step in determining the profitability of a manufacturing business. COGM represents the total cost of producing goods during a specific period, including direct costs, indirect costs, and overhead expenses. To accurately calculate COGM, manufacturers must understand the various components that make up this cost. In this article, we will break down the process of calculating COGM into three key areas: understanding the concept of COGM, calculating direct costs, and calculating indirect costs and overhead allocation. By grasping these fundamental concepts, manufacturers can gain a deeper understanding of their production costs and make informed decisions to optimize their operations. Let's start by understanding the concept of cost of goods manufactured, which serves as the foundation for accurate COGM calculation.

Understanding the Concept of Cost of Goods Manufactured

Here is the introduction paragraph: Understanding the concept of Cost of Goods Manufactured (COGM) is crucial for businesses, particularly those in the manufacturing sector. COGM represents the total cost of producing goods during a specific period, including direct materials, labor, and overhead costs. To grasp the significance of COGM, it is essential to explore its definition and importance, as well as its relationship with inventory valuation and its impact on financial statements. By examining these aspects, businesses can better comprehend how COGM affects their operations and make informed decisions to optimize their production processes. In this article, we will delve into the concept of COGM, starting with its definition and importance, to provide a comprehensive understanding of this critical manufacturing metric. Here is the 200 words supporting paragraph for Definition and Importance of COGM: The definition of COGM is the total cost of producing goods during a specific period, including direct materials, labor, and overhead costs. It is a critical metric for manufacturers, as it helps them determine the cost of producing their products and make informed decisions about pricing, inventory management, and production planning. The importance of COGM lies in its ability to provide a comprehensive view of the costs associated with producing goods, allowing businesses to identify areas for cost reduction and optimization. By accurately calculating COGM, manufacturers can also ensure that their financial statements accurately reflect the costs of producing their products, which is essential for making informed business decisions. Furthermore, COGM is a key component of the cost of goods sold (COGS) calculation, which is a critical metric for determining a company's gross profit margin. As such, understanding the definition and importance of COGM is essential for manufacturers to optimize their production processes, reduce costs, and improve their overall financial performance.

Definition and Importance of COGM

(COGM). The Cost of Goods Manufactured (COGM) is a crucial concept in managerial accounting that represents the total cost of producing goods during a specific period. It is the sum of the direct materials, direct labor, and overhead costs incurred to manufacture products. COGM is essential for businesses to determine the cost of their products, set prices, and make informed decisions about production and inventory management. By accurately calculating COGM, companies can identify areas for cost reduction, optimize their production processes, and improve their overall profitability. Moreover, COGM is a key component in calculating the Cost of Goods Sold (COGS), which is a critical metric for evaluating a company's financial performance. Therefore, understanding the concept of COGM is vital for businesses to make strategic decisions, manage their resources effectively, and stay competitive in the market. In this article, we will delve into the details of how to calculate COGM, its importance, and its applications in business decision-making.

Relationship Between COGM and Inventory Valuation

(COGM) and its importance in inventory valuation. Here is the paragraphy: The relationship between COGM and inventory valuation is a crucial aspect of accounting and financial management. COGM represents the total cost of producing goods, including direct materials, labor, and overhead costs. Inventory valuation, on the other hand, refers to the process of assigning a monetary value to the goods held in inventory. The two concepts are closely intertwined, as the COGM is used to determine the value of inventory. When calculating COGM, businesses must consider the costs of direct materials, labor, and overhead, which are then added to the beginning inventory to determine the total cost of goods available for sale. The COGM is then used to value the ending inventory, which is the inventory remaining at the end of the accounting period. By accurately calculating COGM, businesses can ensure that their inventory valuation is accurate, which is essential for making informed decisions about pricing, production, and inventory management. Furthermore, accurate inventory valuation is also critical for financial reporting purposes, as it affects the company's balance sheet and income statement. Inaccurate inventory valuation can lead to misstated financial statements, which can have serious consequences for businesses. Therefore, understanding the relationship between COGM and inventory valuation is essential for businesses to ensure accurate financial reporting and make informed decisions about their operations.

Impact of COGM on Financial Statements

(cogm). The impact of COGM on financial statements is significant, as it directly affects the accuracy and reliability of a company's financial reporting. COGM is a critical component of a company's financial statements, as it represents the total cost of producing goods that are sold during a specific period. When COGM is accurately calculated and reported, it provides stakeholders with a clear understanding of a company's production costs, gross profit margins, and overall financial performance. Conversely, errors or inaccuracies in COGM can lead to misstated financial statements, which can have serious consequences, including misinformed investment decisions, inaccurate tax calculations, and damaged credibility. Furthermore, COGM is a key input in the calculation of other important financial metrics, such as gross profit, operating income, and net income. Therefore, it is essential that companies accurately calculate and report COGM to ensure the integrity and reliability of their financial statements. By doing so, companies can provide stakeholders with a clear and accurate picture of their financial performance, which is essential for informed decision-making and strategic planning. In addition, accurate COGM reporting can also help companies to identify areas for cost improvement and optimization, which can lead to increased efficiency and profitability. Overall, the impact of COGM on financial statements is significant, and companies must prioritize accurate calculation and reporting to ensure the integrity and reliability of their financial reporting.

Calculating Direct Costs

Here is the introduction paragraph: Calculating direct costs is a crucial step in determining the overall cost of a product or service. Direct costs are expenses that can be directly attributed to the production of a specific product or service, and they play a significant role in pricing and profitability. To accurately calculate direct costs, businesses must consider three key components: direct materials costs, direct labor costs, and direct overhead costs. By understanding and accurately calculating these costs, businesses can make informed decisions about pricing, production, and resource allocation. In this article, we will explore each of these components in detail, starting with the first and most tangible of the three: direct materials costs. Here is the 200 words supporting paragraph for Direct Materials Costs: Direct materials costs refer to the expenses associated with the raw materials, components, and supplies used in the production of a product or service. These costs can include the cost of purchasing or producing the materials, as well as any additional costs such as transportation, storage, and handling. To calculate direct materials costs, businesses must first identify the specific materials used in the production process and then determine the cost of each material. This can be done by reviewing purchase orders, invoices, and other financial records. Once the cost of each material is determined, the total direct materials cost can be calculated by multiplying the cost of each material by the quantity used. For example, if a business uses 100 units of a material that costs $10 per unit, the total direct materials cost would be $1,000. By accurately calculating direct materials costs, businesses can better understand the true cost of their products and make informed decisions about pricing and production.

Direct Materials Costs

. Direct materials costs are a crucial component of the cost of goods manufactured, as they represent the expenses incurred to acquire the raw materials, components, or goods used in the production process. These costs can vary significantly depending on factors such as the type and quality of materials, supplier prices, and market conditions. To accurately calculate direct materials costs, manufacturers must consider the cost of all materials used in production, including packaging materials, labels, and other ancillary items. This requires meticulous tracking and recording of material purchases, usage, and waste, as well as regular review of supplier contracts and market trends to ensure optimal pricing. Moreover, manufacturers must also account for any changes in material costs due to fluctuations in demand, supply chain disruptions, or other external factors. By accurately calculating direct materials costs, manufacturers can better manage their production expenses, optimize their supply chain, and ultimately improve their bottom line. Furthermore, accurate direct materials costs are essential for making informed decisions about pricing, inventory management, and product development, ultimately driving business growth and competitiveness. By understanding the intricacies of direct materials costs, manufacturers can gain a competitive edge in the market and achieve long-term success.

Direct Labor Costs

. Direct labor costs refer to the expenses incurred by a company for the wages and benefits of employees directly involved in the production process. These costs are a crucial component of the cost of goods manufactured, as they directly impact the company's profitability. Direct labor costs include the salaries, wages, and benefits of production line workers, assembly line workers, and other employees who are directly responsible for transforming raw materials into finished goods. These costs can be calculated by multiplying the number of hours worked by the hourly wage rate, and then adding any additional benefits, such as health insurance, retirement plans, and paid time off. For example, if a production line worker earns $25 per hour and works 40 hours per week, their direct labor cost would be $1,000 per week. Additionally, if the company provides health insurance that costs $500 per month, the total direct labor cost for that employee would be $1,000 per week plus $500 per month, or $2,000 per month. By accurately calculating direct labor costs, companies can better understand their cost structure and make informed decisions about pricing, production levels, and labor management. Furthermore, direct labor costs can be used to evaluate the efficiency of the production process and identify areas for improvement, such as reducing labor hours or increasing productivity. Overall, direct labor costs are a critical component of the cost of goods manufactured, and companies must carefully manage these costs to remain competitive in the market.

Direct Overhead Costs

. Direct overhead costs are expenses that are directly related to the production process and can be easily traced to specific products or departments. These costs are typically variable, meaning they fluctuate with the level of production. Examples of direct overhead costs include the cost of indirect materials, indirect labor, and factory utilities. Indirect materials, such as glue, nails, or paint, are used in the production process but are not directly incorporated into the final product. Indirect labor, on the other hand, refers to the wages of employees who are not directly involved in the production process, such as maintenance personnel or quality control inspectors. Factory utilities, including electricity, water, and gas, are also considered direct overhead costs. To calculate direct overhead costs, manufacturers can use a variety of methods, including the absorption costing method, which involves allocating overhead costs to products based on their usage of resources. By accurately calculating direct overhead costs, manufacturers can gain a better understanding of their production costs and make informed decisions about pricing, production levels, and resource allocation. Additionally, direct overhead costs can be used to identify areas for cost reduction and process improvement, ultimately leading to increased efficiency and profitability. By including direct overhead costs in their cost of goods manufactured calculation, manufacturers can ensure that their financial statements accurately reflect the true cost of producing their products.

Calculating Indirect Costs and Overhead Allocation

The supporting paragraph should be 200 words and have a clear topic sentence, evidence, analysis, and linking sentence to the next paragraph. Here is the introduction paragraph: Calculating indirect costs and overhead allocation is a crucial step in determining the total cost of a product or service. Indirect costs are expenses that are not directly related to the production of a specific product or service, but are still necessary for the overall operation of the business. These costs can be categorized into three main areas: indirect materials and labor costs, factory overhead costs, and overhead allocation methods. Understanding and accurately calculating these costs is essential for businesses to make informed decisions about pricing, budgeting, and resource allocation. In this article, we will explore each of these areas in more detail, starting with indirect materials and labor costs. Here is the supporting paragraph for Indirect Materials and Labor Costs: Indirect materials and labor costs are expenses that are not directly related to the production of a specific product or service, but are still necessary for the overall operation of the business. These costs can include items such as office supplies, utilities, and salaries of administrative staff. For example, a manufacturing company may have a team of quality control inspectors who are responsible for ensuring that products meet certain standards. While the inspectors are not directly involved in the production of the product, their salaries and benefits are still a necessary expense for the business. In order to accurately calculate indirect materials and labor costs, businesses must carefully track and record these expenses. This can be done by implementing a system of cost accounting, which involves assigning costs to specific departments or activities. By doing so, businesses can gain a better understanding of where their indirect costs are coming from and make more informed decisions about how to allocate resources. Here is the supporting paragraph for Factory Overhead Costs: Factory overhead costs are expenses that are directly related to the production of a product or service, but are not directly traceable to a specific product or service. These costs can include items such as depreciation on equipment, maintenance and repair costs, and property taxes. For example, a manufacturing company may have a large factory with expensive equipment that is used to produce a variety of products. The depreciation on this equipment is a factory overhead cost that must be allocated to the products that are produced. In order to accurately calculate factory overhead costs, businesses must use a method of allocation that is fair and reasonable. This can be done by using a method such as the absorption costing method, which involves allocating overhead costs to products based on the amount

Indirect Materials and Labor Costs

. Here is the paragraphy: Indirect materials and labor costs are essential components of a company's overall cost structure, playing a crucial role in the calculation of the cost of goods manufactured. Indirect materials refer to the costs of materials that are not directly traceable to a specific product or production process, such as maintenance supplies, cleaning materials, and lubricants. These costs are typically allocated to products based on a predetermined overhead rate, which is calculated by dividing the total indirect materials cost by the total production volume. Indirect labor costs, on the other hand, include the wages and benefits of employees who do not work directly on the production line, such as supervisors, quality control inspectors, and maintenance personnel. These costs are also allocated to products based on a predetermined overhead rate, which is calculated by dividing the total indirect labor cost by the total production volume. To accurately calculate the cost of goods manufactured, companies must carefully track and allocate indirect materials and labor costs, as these costs can have a significant impact on the overall profitability of a product or production process. By accurately allocating indirect costs, companies can make informed decisions about pricing, production levels, and resource allocation, ultimately leading to improved profitability and competitiveness.

Factory Overhead Costs

. Factory overhead costs are the expenses incurred by a manufacturing company that are not directly related to the production of a specific product. These costs are also known as indirect costs or overhead expenses. They are necessary for the operation of the business, but they cannot be directly attributed to a particular product or job. Examples of factory overhead costs include salaries of supervisors and managers, depreciation of equipment and buildings, insurance, utilities, and maintenance costs. Factory overhead costs are typically allocated to products or jobs using a predetermined overhead rate, which is calculated by dividing the total factory overhead costs by the total direct labor hours or machine hours. This allows companies to accurately calculate the cost of goods manufactured and make informed decisions about pricing and production. By understanding and managing factory overhead costs, companies can improve their profitability and competitiveness in the market. Effective management of factory overhead costs also enables companies to identify areas for cost reduction and process improvement, leading to increased efficiency and productivity. In addition, accurate allocation of factory overhead costs helps companies to comply with accounting standards and regulatory requirements. Overall, factory overhead costs play a critical role in the calculation of cost of goods manufactured, and their accurate management is essential for the success of any manufacturing business.

Overhead Allocation Methods

. Overhead allocation methods are used to assign indirect costs to products or departments within a company. There are several methods used to allocate overhead costs, including the direct method, the indirect method, and the activity-based costing (ABC) method. The direct method involves allocating overhead costs directly to specific products or departments based on their usage of resources. The indirect method involves allocating overhead costs to departments or products based on a predetermined percentage or rate. The ABC method involves allocating overhead costs based on the activities that drive the costs. For example, if a company has a machine that is used to produce two different products, the ABC method would allocate the cost of the machine to each product based on the number of hours the machine is used to produce each product. The choice of overhead allocation method depends on the company's specific needs and the level of accuracy required. Some companies may use a combination of methods to allocate overhead costs. For instance, a company may use the direct method for some overhead costs and the indirect method for others. The key is to choose a method that accurately reflects the costs of producing each product or providing each service. By accurately allocating overhead costs, companies can make informed decisions about pricing, production, and investment. Overhead allocation methods are an essential part of cost accounting and are used by companies to ensure that their products or services are priced correctly and that they are making a profit. By using the right overhead allocation method, companies can optimize their production processes, reduce waste, and increase efficiency. In addition, accurate overhead allocation can help companies to identify areas where costs can be reduced, which can lead to increased profitability. Overall, overhead allocation methods are a critical component of cost accounting and are essential for companies to make informed decisions about their products or services.