How To Set Up A Paypal Account

Delving into the digital world of transactions, it is impossible to overlook the power that PayPal holds in efficient and secure fund transfers. As an eminent force in the fintech landscape, understanding and adopting PayPal is an essential step towards optimizing your online dealings. This comprehensive guide aims to escort you through every phase of setting up a PayPal account – from comprehending the fundamental aspects, maneuvering you through the setup process, to aiding you to exploit your PayPal account at its full potential. Embarking on this journey, our first halt is dedicated to 'Understanding PayPal: the Fundamentals', where we will peel back the layers of PayPal's operation, setting the stage for successful navigation in the succeeding parts of your digital transactional adventure. Remain aboard as we delve into the fascinating realm of PayPal.

Delving into the digital world of transactions, it is impossible to overlook the power that PayPal holds in efficient and secure fund transfers. As an eminent force in the fintech landscape, understanding and adopting PayPal is an essential step towards optimizing your online dealings. This comprehensive guide aims to escort you through every phase of setting up a PayPal account – from comprehending the fundamental aspects, maneuvering you through the setup process, to aiding you to exploit your PayPal account at its full potential. Embarking on this journey, our first halt is dedicated to 'Understanding PayPal: the Fundamentals', where we will peel back the layers of PayPal's operation, setting the stage for successful navigation in the succeeding parts of your digital transactional adventure. Remain aboard as we delve into the fascinating realm of PayPal.1. Understanding PayPal: The Fundamentals

PayPal has revolutionized the way we handle our finances and how we perform transactions online. This article provides a thorough examination of the fundamentals of PayPal, offering you a clearer understanding of its concept, benefits, the process of setting up a PayPal account, and its committed focus on security features. To start, we will unravel the overarching concept of this digital financial tool and discuss the impressive benefits that have brought it into day-to-day use of millions worldwide. We will furnish a detailed, step-by-step guide on establishing your personal PayPal account, guiding you away from common mistakes and misunderstandings that can occur during this process. Lastly, we will shed light on PayPal's robust security framework, aimed at safeguarding your transactions and financial information. As an introduction, let's delve into the concept of PayPal, its creation, and the numerous benefits it has brought to modern day e-commerce and personal transactions.

1.1 The Concept and Benefits of PayPal

1.1 The Concept and Benefits of PayPal PayPal has revolutionized the financial realm by providing an ingenious and secure pathway for transaction services across the globe. Basically, PayPal operates as an online payment system providing its users with a convenient method for sending and receiving money across international borders. This digital powerhouse had its roots established in 1998 and has grown exponentially, becoming synonymous with online payments and transfers. The platform's central concept revolves around easing digital payments for small businesses, online vendors, and private individuals, thus eliminating the conventional hassles attached to checks and money orders. The advantages of using PayPal are manifold. The platform boasts a robust security system, keeping personal financial information hidden even during transactions. This encryption technology soothes worries around online monetary exchanges, earning the users' trust. Moreover, flexibility is a pivotal benefit that PayPal offers. Users can effortlessly link their bank accounts, credit, and debit cards, making both online and offline payment a breeze. Additionally, using PayPal eradicates the need for physical wallets, making it an attractive eco-friendly alternative to traditional payment methods. With the added convenience of one-click transactions, PayPal simplifies online purchases, saving users the repetitive chore of keying in personal details for every purchase. Moreover, PayPal’s international recognition enables easy transactions in multiple currencies, mitigating the bottlenecks of global commerce. The platform's buyer protection feature further solidifies PayPal's reliability, offering reimbursement in case of unsatisfactory purchases. This, coupled with the promise of speedy transactions, adds to the appeal of this digital payment giant. To small businesses and online merchants, PayPal presents a treasure trove of benefits. The platform’s ability to generate and track invoices not only aids financial management but also exudes an aura of professionalism. Moreover, the 'PayPal Here' feature enables payment processing through smartphones which is essential in today's mobile-centric world. In essence, the concept of PayPal, fortified with its multifarious benefits, makes it an indispensable tool in the current commercial landscape, setting the benchmark for digital payments. Understanding PayPal's fundamentals is the first step towards leveraging its immense potential in simplifying both personal and business transactions.

1.2 Setting Up A Paypal Account: A Detailed Explanation

1.2 Setting Up A Paypal Account: A Detailed Explanation

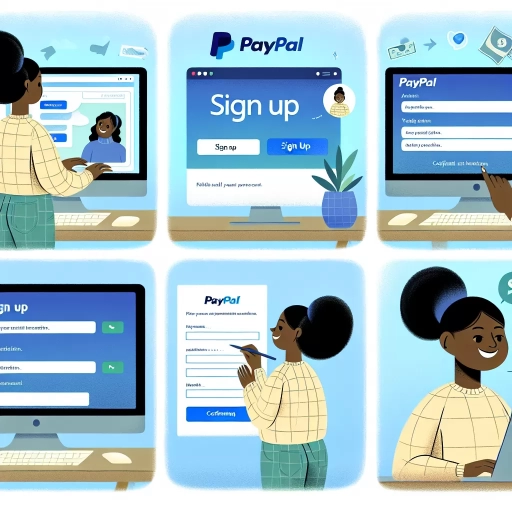

Setting up a PayPal account is a straightforward process that could open up a world of convenience when it comes to digital transactions. As a service that over 300 million people use globally, PayPal has positioned itself as a secure and efficient conduit for both personal and business use cases. To begin creating your PayPal account, visit the PayPal website and click on the 'Sign Up' button. Please note that you would be required to choose between a 'Personal' and a 'Business' account depending on your needs. While the 'Personal' account is designed for online shopping, making and receiving individual payments, the 'Business' account expands on these functionalities by accommodating transactions for goods and services, and offering customizable payment solutions through its platform. The primary information you need to provide includes your email address, a password, your legal first and last names. It's pivotal to use a valid email address as this serves as your PayPal account ID, and ensures you can receive all pertinent communications from PayPal. Following this, PayPal will require additional personal information. This could include your date of birth, Social Security Number, and phone number, as these details are crucial for account verification. The privacy and security of your information are of utmost importance to PayPal as they employ high-level encryption algorithms. Next, PayPal necessitates the linking of a credit or debit card, or a bank account to your PayPal account for payment processing. This connection provides the pathway for funds to be transferred between your bank and your PayPal account. It's worth mentioning that no charges are incurred for the set-up process itself. Once all your details are in and verified, you will have successfully set up your PayPal account. The platform's user-friendly interface, coupled with its robust security measures, ensures that whether you're making purchases or facilitating business transactions, your financial activities are seamless, secure, and straightforward. In the modern, fast-paced digital landscape, understanding PayPal and the account creation process forms the bedrock for navigating the ever-expanding realm of online transactions. Establishing a PayPal account is, therefore, an essential step towards unlocking a world of financial flexibility and convenience. Setting up a PayPal account isn't just about the mechanism of the process; it's a journey into a global network of commercial interconnectedness. By comprehending this fundamental aspect of PayPal, you're indeed a step closer to mastering the art of digital currency transactions.1.3 The Security Features of PayPal

1.3 The Security Features of PayPal

When exploring the fundamentals of PayPal, one key aspect we cannot overlook is its robust security system. PayPal stands tall as one of the world's leading online payment systems due to its advanced security features that set a benchmark in the industry. At the heart of PayPal's security features is its encryption technology. PayPal employs a combination of Secure Sockets Layer (SSL) protocol and a 128-bit encryption technology. This pair works together to ensure that all the transactions are encrypted, making it extremely hard for hackers to penetrate and steal user's information. The encrypted data is also stored on a server that is not connected to the Internet, which boosts the security up a notch. In addition to encryption technology, PayPal's automatic fraud screening measures are second to none. Each transaction made through PayPal undergoes rigorous screening for fraudulent actions using sophisticated algorithms. It worsens the situation for cybercriminals who often find themselves blocked from making unauthorized transactions. Moreover, the firm adheres strictly to the principles of Data Security Standard, set by the Payment Card Industry. This policy limits the amount of personal and financial information required from the customers, and any data retained is securely protected. A testament to this is the absence of a need for sharing card or bank details with vendors when making purchases, which greatly reduces the risk of data being misused. PayPal also offers 'Buyer Protection' and 'Seller Protection' policies- an additional layer of financial security for both parties involved in a transaction. In a scenario where a buyer doesn't receive their ordered item or a seller faces an unauthorized transaction, PayPal holds the capability to resolve these issues and provide compensation. Through its two-factor authentication feature, PayPal sends a message to the user's mobile phone every time their account is accessed, keeping them aware and giving them control over their account's security. This feature is particularly beneficial in keeping the users’ accounts off-limits to unauthorized users and its a fitting example of PayPal’s preventative measures against cybersecurity threats. Hence, PayPal's robust and all-encompassing security features provide the users with safe and secure transactions. Not just making the process hassle-free, but also keeping their financial credentials and personal information protected. While setting up a PayPal account, it's important to understand these security features to acknowledge how PayPal is committed to protecting your data and transactions. It's their relentless pursuit of achieving a secure digital payment environment that sets them apart in the online payment industry. Indeed, the ease of use of PayPal goes hand in hand with the sturdiness of its security system.2. The Setup Process: Your Step-By-Step Guide

The Setup Process for PayPal or any other digital payment system can often seem like a daunting task for a beginner. However, it is a simple process that boils down to three steps: Registering your email and creating your password, linking your bank account or credit/debit card, and verifying your PayPal account. This article will provide a concise, step-by-step guide to simplify this task and aid you on your journey to seamless digital payments. The first step, registering your email and creating your password, is the foundation of your PayPal account. This process not only creates the identity of your account but also safeguards your financial transactions. It is crucial that this step is executed with care, ensuring a strong password to protect your account. Continue reading as we delve into the intricacies of registering your email and creating your password in the following section.

2.1 Registering your Email and Creating Your Password

In the journey of setting up your PayPal account, the second step constitutes a critical component in the process — 2.1 Registering Your Email and Creating Your Password. This phase serves as the foundation of your virtual financial structure, an integral part to safeguarding your transactions. To commence with, your email acts as your identity in the PayPal universe. During registration, it's vital to use an active, accessible email address as your primary connection point. It is through this digital realm portal that PayPal will communicate with you regarding transactions, security alerts, updates, and more. Make sure you use an email account you frequently monitor. This is a preemptive measure to keep you apprised of any activity related to your PayPal account, thereby heightening the security efficiency. Creating your password, meanwhile, is akin to constructing a digital firewall. This is an essential security protocol—a safeguarding tool to fortify the armory of your account. In essence, your password is the bouncer that vets access to your PayPal hub. A strong password includes a combination of uppercase and lowercase letters, numbers, and special characters. It should be unique and memorable for you, but complex for others to guess. PayPal might provide on-screen tips to guide in creating a secure password. Committing this to memory or safely noting it down is advised as you will have to utilize it every time you log in. Remember, the goal of the email registration and password creation process is twofold: to establish a smooth line of communication between you and PayPal, and to ensure stringent safety measures. It's like setting up a fortified yet accessible fortress, where the email is the drawbridge, linking you to the outer world, and the password is the fortified wall, defending and safeguarding your sanctum from any possible intruders. This step, though seemingly simple, is crucially important in the grander scheme of setting up your PayPal account—your stepping stone in the vast sea of online financial transactions. Although it might seem tedious, each step of the process has been designed with your security in mind. The email registration and password creation form the initial line of defense in protecting your financial transactions. So, while it’s tempting to breeze through these steps, remember that spending a few extra minutes here can save you potential headaches in the future. The ease and security of your online transactions hinge on these fundamental aspects.

2.2 Linking Your Bank Account or Credit/Debit Card

Linking your bank account or credit/debit card to your newly setup Paypal account plays a pivotal link in the setup process. This not only serves as your primary payment source for your varied transactions but also validates and secures your financial foothold in the digital realm. To begin, ensure you have all relevant account information at hand - for a bank account, this means your routing and account number and for a card, it is your 16 digit card number, CVV, and expiry date. On the Paypal interface, select 'Wallet' on the top banner that takes you to 'Link a new card or bank.' Here you can choose between a bank account or card, based on your preference. Upon selecting your account type to link, you’ll be prompted to enter the relevant details. Ensure during this process to double-check the data to avoid any errors, which could create hiccups in transactions or delays in the verification process. Paypal places a high emphasis on user security, and in that regard, adheres to strict account verification procedures. As part of the procedure, when linking a bank account, Paypal may make two small deposits, usually less than a dollar each. You will need to report these amounts back to Paypal for confirmation, thus validating your ownership of the account. This process usually takes two to three business days. Linking a credit or debit card also demands similar verification for ensuring account ownership and user security. Paypal may charge a tiny amount, which would then be refunded once you have confirmed the exact amount charged to your card. Post account or card linking, they will function as a pivotal payment source for your Paypal account. However, you can always navigate to 'the Wallet' section of the platform to manage, add, or remove any linked payments. Simpler than it may initially seem, linking your bank account or card serves as an essential step in ensuring seamless transactions via Paypal. So whether using Paypal to shop from an array of international merchants, send money worldwide, or invoice clients, remember, it all essentially starts with this small but significant step in the setup process. As with all online financial transactions, ensure you navigate this process with a secure network connection and avoid shared or public devices to maintain your privacy and security. Paypal prides itself on trustworthiness and a seamless user experience, and linking your bank account or credit/debit card brings you one step closer to this suite of convenience. Keep these points in mind and tread forth - your easy, safe, and seamless financial transactions are only a few clicks away!

2.3 Verification of Your PayPal Account

2. The Setup Process: Your Step-By-Step Guide

In setting up your PayPal account, one critical step that often goes unnoticed but bears significant importance is the verification of your account. This process, which we will refer to as 2.3 Verification of Your PayPal Account, is an integral part of the setup process, essential for the full functionality of your account on the platform. Upon successfully creating your account, PayPal necessitates this verification process. The main reason is to ensure the security and authenticity of the account. It involves confirming your identity, thus giving PayPal a tangible assurance that you are not a fraudulent user, but a legitimate account holder intending to use the platform for bona fide transactions. To begin the verification process, PayPal will request some essential information. This may include your Social Security Number (SSN), proof of address (such as a utility bill), and a photograph of a government-issued identification card, such as a driver's license or passport. While the requisition of such details may seem invasive, remember PayPal's primary concern is securing its users and platforms. Log into your PayPal account and head to the "Wallet" page. From there, you'll find the "Verification" option. By clicking on it, you'll be directed to a form where you'll enter the required information. Once you input and submit the data, PayPal will review the information. This process may take a couple of business days, so ejercicio patience. Upon confirming your details as accurate, PayPal will then verify your account. This verification not only increases the reliability of your account but also unlocks features such as unlimited payments and fund transfers. This broadened access gives you more flexibility in managing your financial transactions through your PayPal account. In conclusion, the 2.3 Verification of your PayPal account is a critical process that enhances your PayPal experience. It offers additional protection against fraudulent activities, increases your transactional limits, and fortifies your overall account reliability. It's a small step towards securing your financial transactions, which goes a long way in facilitating a seamless online financial experience. Remember, the setup process doesn't end with account creation. Ensuring that your account goes through the verification process is a crucial step toward unlocking the full benefits and functionalities that PayPal has to offer. Enhancing your financial management online starts with taking the time to set up your accounts correctly and securely. Remember, your path to a more seamless online payment experience is just a verification process away!3. Making the Most Out of Your PayPal Account

PayPal, the digital payment giant, offers an array of features that can amplify online transactions, streamline finance management and ensure robust safety protocols. This comprehensive guide will walk you through various mechanisms to harness the full potential of your PayPal account, exploring areas such as sending and receiving money effectively, resolving commonly encountered issues, and sustaining safe practices for maximum benefit. Our first stop, "Sending and Receiving Money: How it Works With PayPal," demystifies the transactional machinery. Here, you will comprehend the nuances of making payments or receiving funds in a swift, efficient manner, with a special focus on tips and troubleshooting methods. Following this, we will delve into "The Approach to Resolving Issues With Your PayPal Account". This section provides an in-depth look into frequent account concerns and viable solutions, aiming at equipping you with the knowledge to navigate any problem areas. Finally, we move on to "Useful Tips on Safe and Effective Use of PayPal", offering you astute advice on maintaining a secure digital finance environment. From setting up effective security measures to understanding your rights as a consumer, this chunk encapsulates vital safety features you need to be aware of. Now, let's begin with an essential aspect, learning how to proficiently send and receive money using your PayPal account.

3.1 Sending and Receiving Money: How it Works With PayPal

Sending and receiving money via PayPal simplifies digital transactions, providing a reliable platform for a seamless financial exchange. As the third plank under the heading "Making the Most Out of Your PayPal Account," understanding how it works is crucial. When it comes to sending money, PayPal has set up a system that is efficient, easy to navigate, and fast. With a few clicks, users can transfer funds to anyone around the world, provided they also have a PayPal account. All that's required is the recipient's email address or phone number. After entering these details, specify the amount to be sent, the currency, and the payment type - whether a personal or business transaction - and the job is done. What makes PayPal even more user-friendly is the fact that it doesn't require the balance to be pre-loaded. The system is linked directly to a user's bank account or credit card, making instant transactions possible. On the receiving end, PayPal is just as efficient. When a payment arrives, an alert is sent to the recipient, notifying them of the incoming funds. The money can then be transferred to a bank account or saved in the PayPal account for future transactions. For businesses, PayPal offers a "Request Money" function, allowing for easy invoicing and payment recording. By merely clicking on the agreed amount, a customer can quickly settle their bills, making it a popular tool for many online enterprises. Ensuring the safety of these transactions is a tiered security system that adds an element of trust to the process. With encrypted information and 24/7 transaction monitoring, PayPal provides users with a highly secure platform that safeguards their finances. When using PayPal, an understanding of this sending and receiving process is fundamental to unlocking the full potential of this platform. With its robust features and easy-to-navigate interface, PayPal has become a vital tool for conducting personal and business transactions worldwide. Users know that whether they're sending a birthday gift or receiving a business payment, with PayPal, it's in safe hands.

3.2 The Approach to Resolving Issues With Your PayPal Account

3.2 The Approach to Resolving Issues With Your PayPal Account One of the primary stepping stones towards making the most out of your PayPal account revolves around implementing a proactive approach to issue resolution. While PayPal is largely known for its streamlined operation, occasionally technical issues or misunderstandings might crop up that could disrupt the efficient flow of your transactions. When this happens, the way you respond and resolve these issues can significantly affect your user experience and overall satisfaction with the service. Firstly, it is paramount to ascertain the nature of the problem you are encountering. Whether it's a login issue, a dispute with a vendor, or difficulties in processing a transaction, it is essential to arm yourself with full knowledge of your situation. This will be instrumental in guiding your subsequent steps and interactions with the PayPal customer support system. Secondly, make use of PayPal's comprehensive Help Center and Community forum. These platforms are curated with an abundance of common troubleshooting tips and peer insights that might mirror your exact predicament. Utilizing these resources not only allows for a swift and independent problem resolution but also fosters a sense of community within the platform’s user base. Should the problem persist, escalating the issue to PayPal’s official customer support is a recommended avenue. Crafting a clear, concise, and factual description of your problem will prompt specific and helpful assistance. Remember to arm yourself with patience and persistence when dealing with customer service, as your dedication to finding a solution will mirror on their effort to assist. Lastly, take note of the lessons learned during your resolution process. Adopt a reflective mindset, and identify areas where you might have prevented or mitigated the issue. Use these experiences to fortify your understanding of the platform and to navigate around future potential mishaps. In essence, transforming unexpected issues into opportunities for learning is integral to making the most out of your PayPal account. Adopting a proactive, informed, and patient approach in resolving PayPal issues is both a testament and a catalyst to effective digital financial management.

3.3 Useful Tips on Safe and Effective Use of PayPal

PayPal has evolved as a safe, convenient, and globally recognized method for online transactions. Below are some useful tips on the safe and effective use of PayPal which will aid you in making the most out of your account. Firstly, always keep your account details secure. Treat your PayPal account as your virtual wallet and safeguard it accordingly by ensuring that your password is unique and difficult-to-guess. Use combinations of letters, numbers, and special characters for added security. You should only access your PayPal account from your own personal devices and refrain from logging in on public terminals to prevent potential data theft. Secondly, consider enabling two-factor authentication to add an extra layer of security to your PayPal account. This step would require anyone attempting to log into your account to enter a special code that PayPal sends to your mobile phone. With this feature, even if someone gets hold of your login details, they still wouldn't be able to access your account without your mobile device. Lastly, be aware of phishing scams. PayPal will never directly ask you for your login details via email or text. Legitimate communication from PayPal will always address you by your full name, and the domain of the email will be '@paypal.com'. If you receive an email asking for your login information or other confidential details, report it immediately to PayPal’s customer service. The safety and effectiveness of PayPal lie in its robust security measures. By following these tips, you can leverage the convenience of online transactions while ensuring that your financial details stay protected.