How To Cancel Etransfer

Understanding How eTransfer Works

What is eTransfer and How it Works?

eTransfer is a secure and convenient way to send money directly from one bank account to another. The service, which is offered by most major banks and financial institutions, allows you to email money to anyone with an email address and a bank account in Canada. This makes it an easy and popular method of transferring funds, especially for things like splitting a bill, paying rent, or even sending a gift. The money is not actually sent via email, rather the email is a notification that lets the recipient know they have funds waiting. They must log into their online banking and answer a security question in order to receive the funds.

The Benefits and Downsides of eTransfer

There are numerous advantages to using eTransfer including the convenience, the speed, and the security. It can be done from anywhere, at any time, and the funds usually arrive instantly. Plus, because you don’t have to share any sensitive personal information or banking details with the recipient, it’s more secure than handing over cash or writing a cheque. However, one potential downside to eTransfer is that it can be difficult to cancel once you’ve sent it. If the recipient has already deposited the money into their account, it’s too late to cancel.

Steps in Executing an eTransfer

To send an eTransfer, you simply log into your online banking and select the option to “send money” or “transfer money” via eTransfer. You’ll need to input the recipient’s email address, decide on a security question and answer (which you will need to share with the recipient separately), and specify the amount of money you want to send. You can also add a message or memo if you like. Once you confirm the details and hit send, an email notification will be dispatched to the recipient’s email address. They can then log into their own online banking to answer the security question and deposit the funds.

Steps to Cancel an eTransfer

When Can an eTransfer be Cancelled?

An eTransfer can only be cancelled if the recipient has not yet deposited the money into their bank account. Once the money has been deposited, it cannot be cancelled or taken back. You will not even have the option to cancel in your online banking if the money has been deposited. The best time to cancel an eTransfer is shortly after it has been sent, before the recipient has a chance to accept the funds. However, keep in mind that the recipient may accept the funds almost immediately, particularly if they were expecting the transfer.

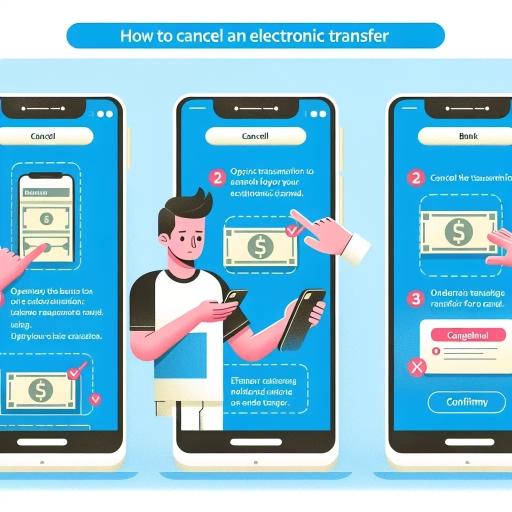

How to Cancel an eTransfer?

To cancel an eTransfer, you should log back into your online banking and navigate to the list of your sent eTransfers – this is usually under the “payments & transfers” section. Find the eTransfer you would like to cancel and click “cancel” or “stop payment” (the wording will differ depending on your bank). Note that there may be a fee for cancelling an eTransfer, depending on your bank’s policy. Once you’ve completed the cancellation, the funds will be credited back into your account, typically within a day or two.

Cancellation Fees and Restrictions

While cancelling an eTransfer can be a useful feature, it’s important to be aware that there may be some fees and limitations associated with it. Many banks charge a fee to cancel an eTransfer – this can range from a few dollars to more than $10. Also, keep in mind that you can usually only cancel an eTransfer if it has not yet been deposited by the recipient. Once the money has been transferred into the recipient’s account, it cannot be cancelled or reversed.

Avoiding eTransfer Mistakes

Knowing the Correct Recipient Details

One of the most common reasons for wanting to cancel an eTransfer is a mistake in the recipient’s details. To avoid this, double-check the recipient’s email address before clicking send. It's also crucial to share the security question and answer with the recipient beforehand. If they fail in answering the question, the eTransfer can be locked and you may need to pay a fee to cancel or resend it.

Checking the Said Amount

Another typical error is entering the wrong amount of money. This can be particularly problematic if you accidentally send too much, as you cannot simply “take back” the extra amount. As such, always double-check the amount you entered before confirming the eTransfer. If you do end up making an error, you’ll need to ask the recipient to send back the extra funds or you might need to cancel the eTransfer immediately before it's accepted.

Using a Memorable Security Question

The security question and answer are an important part of the eTransfer process. If the recipient cannot answer the question correctly, they will not be able to access the funds. To avoid any issues, use a question and answer that the recipient will definitely know, but others will not. Furthermore, it’s important to never share the security question and answer in the same communication method used for the eTransfer notification to ensure security.