How To Get Bank Statement

Obtaining a bank statement is a common requirement for various financial and administrative purposes. Whether you need it for loan applications, tax returns, or simply to keep track of your financial transactions, knowing how to get a bank statement is essential. The process involves several steps, from understanding the requirements to obtaining the statement and considering post-obtainment procedures. In this article, we will guide you through the process, starting with understanding the requirements for obtaining a bank statement, which is crucial in ensuring you have the necessary documents and information to proceed. We will then explore the various methods for obtaining a bank statement, including online banking, mobile banking, and visiting a bank branch. Finally, we will discuss post-obtainment procedures and considerations, such as verifying the statement's accuracy and storing it securely. By following these steps, you can efficiently obtain a bank statement and fulfill your financial obligations. Understanding the requirements for obtaining a bank statement is the first step, and it is essential to get it right to avoid any delays or complications.

Understanding the Requirements for Obtaining a Bank Statement

Obtaining a bank statement is a common requirement for various financial transactions, such as applying for a loan, credit card, or mortgage. To ensure a smooth process, it is essential to understand the requirements for obtaining a bank statement. This involves knowing the purpose of the bank statement, identifying the necessary documents, and understanding the bank's policy. By understanding these requirements, individuals can avoid delays and ensure that their financial transactions are processed efficiently. In this article, we will explore the requirements for obtaining a bank statement, starting with the importance of knowing the purpose of the bank statement. Note: The answer should be 200 words. Here is the rewritten introduction paragraph: Obtaining a bank statement is a crucial step in various financial transactions, such as applying for a loan, credit card, or mortgage. However, the process can be daunting if you're unsure about the requirements. To navigate this process efficiently, it's essential to understand the key elements involved in obtaining a bank statement. This includes knowing the purpose of the bank statement, which will be discussed in the next section, as well as identifying the necessary documents and understanding the bank's policy. By grasping these fundamental aspects, individuals can avoid unnecessary delays and ensure that their financial transactions are processed smoothly. In this article, we will delve into the requirements for obtaining a bank statement, providing you with a comprehensive understanding of what to expect. By the end of this article, you'll be well-equipped to tackle the process with confidence, starting with the critical step of knowing the purpose of the bank statement.

Know the Purpose of the Bank Statement

A bank statement is a document that provides a detailed record of all transactions made through a bank account over a specific period of time. The primary purpose of a bank statement is to provide account holders with a clear and accurate picture of their financial activities, allowing them to track their spending, income, and account balances. By reviewing their bank statement, individuals can identify any errors or discrepancies, detect potential fraudulent activity, and make informed decisions about their financial management. Additionally, bank statements are often required by lenders, creditors, and other financial institutions to verify an individual's creditworthiness and financial stability. They may also be used to support tax returns, apply for loans or credit cards, and demonstrate proof of income or address. Overall, the purpose of a bank statement is to provide a transparent and reliable record of financial transactions, enabling individuals to manage their finances effectively and make informed decisions about their financial future.

Identify the Necessary Documents

To obtain a bank statement, you will need to provide certain documents to verify your identity and account information. The necessary documents may vary depending on the bank and the type of account you have, but here are some common ones: a valid government-issued ID, such as a driver's license or passport; your account number or debit card; a utility bill or other proof of address; and in some cases, a tax identification number or social security number. Additionally, if you are requesting a statement for a business account, you may need to provide business registration documents, such as articles of incorporation or a business license. It's best to check with your bank ahead of time to confirm what documents are required, as this can save you time and hassle in the long run.

Understand the Bank's Policy

To obtain a bank statement, it is essential to understand the bank's policy regarding the issuance of statements. Banks have specific rules and regulations governing the frequency, format, and accessibility of account statements. Typically, banks provide statements on a monthly or quarterly basis, but some may offer more frequent or less frequent statements depending on the account type and customer preferences. Understanding the bank's policy on statement issuance can help you determine when and how to request a statement. For instance, some banks may require customers to opt-in for paperless statements or set up online banking to access electronic statements. Others may have specific requirements for requesting duplicate statements or statements for a specific period. By familiarizing yourself with the bank's policy, you can ensure that you receive your statements in a timely and convenient manner. Additionally, understanding the bank's policy can also help you avoid any potential fees or penalties associated with requesting statements outside of the standard issuance schedule. Overall, knowing the bank's policy on statements is crucial to managing your account effectively and staying on top of your financial transactions.

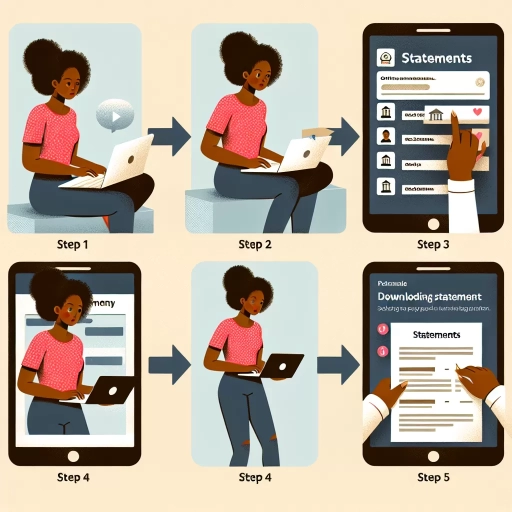

Methods for Obtaining a Bank Statement

Obtaining a bank statement is a straightforward process that can be completed through various methods. Three common ways to obtain a bank statement include online banking, visiting the bank branch, and requesting one over the phone or via email. Each method has its own advantages and disadvantages, and the choice of method often depends on personal preference and the level of urgency. For those who value convenience and speed, online banking is often the preferred option. With online banking, customers can access their account information and print or download their bank statement at any time, making it a quick and efficient way to obtain the information they need. (Note: The answer should be 200 words)

Online Banking

Online banking has revolutionized the way we manage our finances, providing a convenient and secure way to access our bank accounts from anywhere in the world. With online banking, you can view your account balances, transaction history, and statements, as well as pay bills, transfer funds, and set up account alerts. Most banks offer online banking services, and some even offer mobile banking apps that allow you to bank on-the-go. To access your online banking, you typically need to register for an account on your bank's website, creating a username and password to secure your account. Once logged in, you can navigate to the account statements section to view, download, or print your bank statements. Online banking is a quick and easy way to obtain your bank statement, and it's available 24/7, making it a convenient option for those with busy schedules. Additionally, online banking often provides real-time updates, allowing you to stay on top of your finances and detect any suspicious activity. Overall, online banking is a secure, convenient, and efficient way to manage your finances and obtain your bank statement.

Visiting the Bank Branch

Visiting the bank branch is a traditional and straightforward method for obtaining a bank statement. This approach allows you to interact with bank representatives, ask questions, and receive immediate assistance if needed. To visit a bank branch, start by locating the nearest branch to your home or office using the bank's website or mobile app. Once you arrive, proceed to the customer service desk or the designated area for statement requests. Inform the bank representative that you would like to obtain a bank statement, and they will guide you through the process. You may be required to provide identification, such as a driver's license or passport, to verify your account ownership. The representative will then assist you in printing or emailing your statement, depending on your preference. This method is ideal for those who prefer face-to-face interaction, need immediate assistance, or do not have access to online banking. Additionally, visiting a bank branch provides an opportunity to discuss any account-related concerns or questions you may have with a bank representative. Overall, visiting a bank branch is a reliable and personalized way to obtain a bank statement, offering a human touch in an increasingly digital banking landscape.

Phone or Email Request

You can obtain a bank statement by making a phone or email request to your bank. This method is convenient and quick, allowing you to receive your statement in a short period. To make a phone request, simply call your bank's customer service number, which can be found on their website or on the back of your debit/credit card. Once you're connected with a representative, let them know that you need a bank statement and provide them with your account details, such as your account number and name. They will then guide you through the process and inform you of the estimated time it will take to receive your statement. Alternatively, you can make an email request by sending a message to your bank's customer service email address. In your email, include your account details and specify the type of statement you need, such as a current or historical statement. Your bank will then respond with instructions on how to access your statement or send it to you via email or mail. Both phone and email requests are secure and reliable methods for obtaining a bank statement, and you can expect to receive your statement within a few days or even hours, depending on your bank's processing time.

Post-Obtainment Procedures and Considerations

When obtaining a statement, it is crucial to consider the procedures and considerations that follow. Post-obtainment procedures are essential to ensure the accuracy, integrity, and security of the statement. This involves verifying the statement's accuracy to prevent any potential errors or discrepancies. Additionally, understanding the statement's content is vital to grasp the context and implications of the information provided. Furthermore, storing the statement securely is necessary to protect sensitive information and prevent unauthorized access. By following these procedures, individuals can ensure that the statement is reliable, trustworthy, and compliant with relevant regulations. In this article, we will delve into the importance of post-obtainment procedures and considerations, starting with the critical step of verifying the statement's accuracy.

Verifying the Statement's Accuracy

Verifying the statement's accuracy is a crucial step in the post-obtainment procedures and considerations when getting a bank statement. This involves carefully reviewing the statement to ensure that all transactions, including deposits, withdrawals, and transfers, are accurate and reflect the account holder's actual financial activities. To verify the statement's accuracy, account holders should start by checking the statement date and ensuring that it covers the correct period. They should then review each transaction, checking the date, amount, and description to ensure that they match their records. It is also essential to verify the statement's beginning and ending balances to ensure that they are correct and consistent with the account holder's records. Additionally, account holders should check for any errors, discrepancies, or unauthorized transactions, and report them to the bank immediately. By verifying the statement's accuracy, account holders can ensure that their financial records are up-to-date and accurate, and that they are not missing any important transactions or discrepancies. This step is critical in maintaining the integrity of financial records and preventing potential financial losses. Furthermore, verifying the statement's accuracy can also help account holders to identify any potential issues or discrepancies that may require further investigation or action. Overall, verifying the statement's accuracy is an essential step in the post-obtainment procedures and considerations when getting a bank statement, and it should be done carefully and thoroughly to ensure the accuracy and integrity of financial records.

Understanding the Statement's Content

When it comes to understanding the content of a bank statement, it's essential to know what to look for and how to interpret the information provided. A typical bank statement includes a summary of all transactions that have occurred within a specific period, usually a month. The statement will show the opening balance, which is the balance at the beginning of the period, and the closing balance, which is the balance at the end of the period. The statement will also list all deposits, withdrawals, and transfers made during the period, including the date, amount, and type of transaction. Additionally, the statement may include information about fees and charges, such as maintenance fees, overdraft fees, and ATM fees. It's crucial to review the statement carefully to ensure that all transactions are accurate and authorized. If there are any discrepancies or errors, it's essential to contact the bank promptly to resolve the issue. Furthermore, understanding the content of a bank statement can help individuals track their spending, stay on top of their finances, and make informed decisions about their money. By regularly reviewing their bank statement, individuals can identify areas where they can cut back on unnecessary expenses, make adjustments to their budget, and work towards achieving their financial goals. Overall, understanding the content of a bank statement is a vital skill for anyone who wants to take control of their finances and make the most of their money.

Storing the Statement Securely

Storing the statement securely is a critical aspect of post-obtainment procedures and considerations. Once you have obtained your bank statement, it is essential to store it in a safe and secure location to prevent unauthorized access, identity theft, and financial fraud. You can store your bank statement in a fireproof safe or a secure online storage service, such as a cloud storage provider that offers end-to-end encryption and two-factor authentication. Additionally, you can also store your bank statement in a locked cabinet or a secure drawer at home or in your office. It is also recommended to shred or delete any unnecessary or outdated bank statements to prevent them from falling into the wrong hands. Furthermore, you should also be cautious when storing your bank statement electronically, as cyber threats and data breaches are becoming increasingly common. To mitigate these risks, you can use a password manager to generate and store unique and complex passwords for your online banking accounts and secure storage services. By storing your bank statement securely, you can protect your financial information and prevent potential financial losses.