How To Cash Out Crypto In Canada

Here is the introduction paragraph: Cashing out cryptocurrency in Canada can be a daunting task, especially for those new to the world of digital assets. With the rise of cryptocurrency adoption in the country, it's essential to understand the process of converting your crypto holdings into Canadian dollars. To successfully cash out your crypto, you need to understand the basics of cryptocurrency in Canada, choose the right platform to facilitate the transaction, and follow a step-by-step guide to ensure a smooth process. In this article, we'll delve into these essential aspects, starting with the fundamentals of cryptocurrency in Canada. By grasping the basics, you'll be better equipped to navigate the process of cashing out your crypto and making informed decisions about your digital assets. So, let's begin by understanding the basics of cryptocurrency in Canada.

Understanding the Basics of Cryptocurrency in Canada

In recent years, cryptocurrency has become increasingly popular in Canada, with many Canadians investing in and using digital currencies like Bitcoin and Ethereum. However, for those who are new to the world of cryptocurrency, it can be overwhelming to understand the basics. In this article, we will delve into the world of cryptocurrency in Canada, exploring what it is and how it works, the popular types of cryptocurrencies available, and the regulations and tax implications that come with investing in digital currencies. By understanding these fundamental concepts, Canadians can make informed decisions about whether or not to invest in cryptocurrency and how to navigate the complex world of digital finance. So, let's start by exploring the basics of cryptocurrency and how it works.

What is Cryptocurrency and How Does it Work?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it's not controlled by any government or financial institution. Transactions are recorded on a public ledger called a blockchain, which helps to ensure the integrity and transparency of the network. Cryptocurrencies are created through a process called mining, in which powerful computers solve complex mathematical problems to validate transactions and add them to the blockchain. The most well-known cryptocurrency is Bitcoin, but there are many others, such as Ethereum, Litecoin, and Monero. Cryptocurrencies can be used to purchase goods and services from merchants who accept them, and they can also be traded for other currencies, including traditional fiat currencies like the Canadian dollar. In Canada, cryptocurrencies are considered commodities and are subject to taxation, and the country has a number of cryptocurrency exchanges and other businesses that support the use of digital currencies.

Popular Types of Cryptocurrencies in Canada

In Canada, several popular types of cryptocurrencies have gained significant attention and adoption. Bitcoin (BTC) is the most widely recognized and widely held cryptocurrency, often considered the gold standard of cryptocurrencies. Ethereum (ETH) is another highly popular cryptocurrency, known for its smart contract functionality and decentralized application (dApp) ecosystem. Other notable cryptocurrencies in Canada include Litecoin (LTC), Bitcoin Cash (BCH), and Cardano (ADA), which offer faster transaction processing times and lower fees compared to Bitcoin. Additionally, popular altcoins like Dogecoin (DOGE) and Shiba Inu (SHIB) have gained a significant following in Canada, often driven by community support and social media hype. Furthermore, stablecoins like Tether (USDT) and USD Coin (USDC) have also gained traction in Canada, offering a stable store of value and a hedge against market volatility. Overall, the Canadian cryptocurrency market is diverse, with a wide range of options available for investors and users.

Regulations and Tax Implications for Cryptocurrency in Canada

In Canada, the regulations and tax implications for cryptocurrency are governed by various federal and provincial laws. The Canada Revenue Agency (CRA) considers cryptocurrency to be a commodity, not a currency, and therefore subject to capital gains tax. This means that any profits made from buying and selling cryptocurrency are considered taxable income and must be reported on an individual's tax return. The CRA also requires individuals to keep accurate records of their cryptocurrency transactions, including the date, time, and amount of each transaction, as well as the value of the cryptocurrency in Canadian dollars. Additionally, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) regulates cryptocurrency exchanges and other businesses that deal with cryptocurrency, requiring them to report suspicious transactions and maintain anti-money laundering and anti-terrorist financing controls. Furthermore, the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Securities Administrators (CSA) regulate cryptocurrency trading platforms and initial coin offerings (ICOs), ensuring that they comply with securities laws and regulations. Overall, it is essential for individuals and businesses dealing with cryptocurrency in Canada to understand and comply with these regulations and tax implications to avoid any potential penalties or fines.

Choosing the Right Platform to Cash Out Crypto in Canada

Here is the introduction paragraph: Choosing the right platform to cash out cryptocurrency in Canada can be a daunting task, especially with the numerous options available. To make an informed decision, it's essential to consider several key factors. Firstly, it's crucial to have an overview of the popular cryptocurrency exchanges in Canada, understanding their reputation, user base, and the types of cryptocurrencies they support. Additionally, comparing the fees and services of different exchanges is vital to ensure you're getting the best deal. Furthermore, security measures should be a top priority when selecting a platform, as the safety of your assets is paramount. By considering these factors, you can make a well-informed decision and choose a platform that meets your needs. In this article, we'll start by taking a closer look at the overview of popular cryptocurrency exchanges in Canada.

Overview of Popular Cryptocurrency Exchanges in Canada

In Canada, numerous cryptocurrency exchanges offer a range of services, catering to diverse investor needs. Among the most popular exchanges are Coinbase, Binance, and Kraken, which provide a user-friendly interface, robust security measures, and competitive fees. Coinbase, a well-established platform, supports a wide variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, and offers a simple, intuitive interface suitable for beginners. Binance, on the other hand, is a more advanced platform, offering a vast selection of cryptocurrencies, including some lesser-known altcoins, and a more complex trading interface. Kraken, a veteran exchange, is known for its high-security standards, offering advanced trading features and a wide range of cryptocurrencies. Other notable exchanges in Canada include Bitbuy, Coinberry, and NDAX, which offer a more localized experience, with features such as CAD funding options and customer support tailored to Canadian investors. When choosing a cryptocurrency exchange in Canada, it's essential to consider factors such as fees, security, and the range of supported cryptocurrencies to ensure a seamless and secure experience.

Comparing Fees and Services of Different Exchanges

When it comes to cashing out cryptocurrency in Canada, one of the most important factors to consider is the fees and services offered by different exchanges. With so many options available, it can be overwhelming to navigate the various platforms and determine which one is the best fit for your needs. To make an informed decision, it's essential to compare the fees and services of different exchanges. For instance, some exchanges like Coinbase and Binance charge a flat fee of around 1.5% to 2% for transactions, while others like Kraken and Bitfinex offer more competitive rates, often as low as 0.1% to 0.2%. Additionally, some exchanges offer more advanced features, such as margin trading, futures contracts, and staking, which may be attractive to more experienced traders. On the other hand, some exchanges prioritize simplicity and ease of use, making them more suitable for beginners. It's also crucial to consider the security measures in place, such as two-factor authentication, cold storage, and insurance coverage, to ensure that your assets are protected. Furthermore, some exchanges offer more flexible payment options, such as credit card, bank transfer, or e-transfer, which can be a significant factor for those looking to cash out quickly. By carefully evaluating the fees and services of different exchanges, you can make an informed decision and choose the platform that best aligns with your needs and goals. Ultimately, the right exchange for you will depend on your individual circumstances, trading experience, and priorities, so it's essential to do your research and compare the options before making a decision.

Security Measures to Consider When Selecting a Platform

When selecting a platform to cash out your cryptocurrency in Canada, it's essential to consider the security measures in place to protect your assets. Look for platforms that have implemented robust security protocols, such as two-factor authentication (2FA), multi-signature wallets, and encryption. A reputable platform should also have a clear and transparent security policy, including regular security audits and penetration testing. Additionally, consider platforms that are registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and comply with Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations. Furthermore, check if the platform has a good reputation, is transparent about its fees, and has a responsive customer support team. It's also crucial to read reviews and do your own research to ensure the platform is trustworthy and secure. By prioritizing security, you can minimize the risk of your cryptocurrency being compromised and ensure a safe and successful cash-out experience.

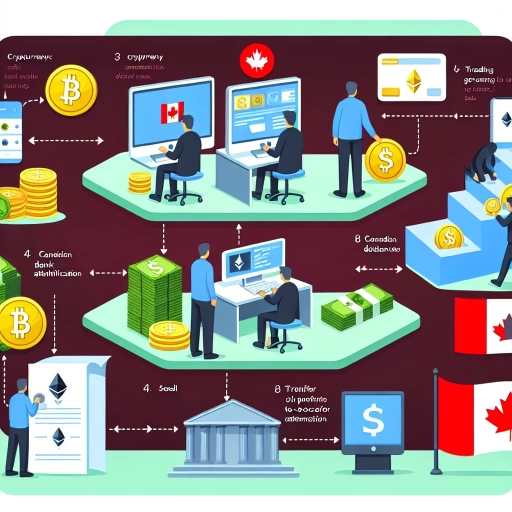

Step-by-Step Guide to Cashing Out Crypto in Canada

Cashing out cryptocurrency in Canada can be a daunting task, especially for those new to the world of digital currencies. However, with the right guidance, it can be a straightforward process. To successfully cash out your crypto, you'll need to follow a step-by-step approach that involves setting up a cryptocurrency wallet and exchange account, converting your cryptocurrency to Canadian dollars, and withdrawing the funds to a bank account or debit card. In this article, we'll break down each of these steps in detail, starting with the first crucial step: setting up a cryptocurrency wallet and exchange account. By the end of this guide, you'll be equipped with the knowledge and confidence to cash out your crypto in Canada with ease. So, let's get started by exploring the importance of setting up a cryptocurrency wallet and exchange account.

Setting Up a Cryptocurrency Wallet and Exchange Account

To set up a cryptocurrency wallet and exchange account, start by choosing a reputable exchange that operates in Canada, such as Coinbase, Binance, or Kraken. Create an account on the exchange's website by providing basic information like name, email, and password. Verify your account through email and set up two-factor authentication for added security. Next, fund your account with Canadian dollars using a payment method like Interac e-transfer, credit card, or bank transfer. Once your account is funded, you can purchase cryptocurrencies like Bitcoin or Ethereum. To store your cryptocurrencies safely, set up a digital wallet like MetaMask, Ledger, or Trezor. Download the wallet's software or app and follow the setup instructions. Make sure to write down your recovery seed phrase and store it in a secure location. Link your wallet to your exchange account to easily transfer funds between the two. Finally, familiarize yourself with the exchange's interface and fees to ensure a smooth experience when cashing out your crypto.

Converting Cryptocurrency to Canadian Dollars

Converting cryptocurrency to Canadian dollars is a straightforward process that can be completed through various methods. One of the most popular ways is through cryptocurrency exchanges, such as Coinbase, Binance, or Kraken, which allow users to sell their cryptocurrencies for Canadian dollars. These exchanges typically have a user-friendly interface, making it easy to navigate and complete transactions. Another option is to use a cryptocurrency broker, such as Bitbuy or Coinsquare, which can facilitate the conversion process and provide competitive exchange rates. Additionally, some cryptocurrency ATMs (BTMs) in Canada also allow users to sell their cryptocurrencies for cash, which can then be deposited into a bank account. It's essential to note that each method may have its own fees, exchange rates, and processing times, so it's crucial to research and compares the options before making a decision. Furthermore, it's also important to ensure that the chosen method is reputable and secure to avoid any potential risks or losses. By following these steps, Canadians can easily convert their cryptocurrencies to Canadian dollars and access their funds.

Withdrawing Funds to a Bank Account or Debit Card

When it comes to withdrawing funds from your cryptocurrency exchange or wallet, you have two primary options: transferring to a bank account or debit card. Both methods have their own set of benefits and drawbacks, which are essential to consider before making a decision. Transferring funds to a bank account is often the more popular choice, as it allows for larger withdrawal amounts and lower fees. This method typically involves linking your bank account to your exchange or wallet, verifying the account, and then initiating the transfer. The processing time may vary depending on the exchange and bank, but it usually takes a few business days. On the other hand, withdrawing funds to a debit card is often faster, with some exchanges offering instant or same-day transfers. However, debit card withdrawals usually come with higher fees and lower limits. Additionally, not all exchanges support debit card withdrawals, so it's crucial to check the availability of this option before initiating the transfer. Regardless of the method chosen, it's essential to ensure that the recipient account or card is in the same name as the exchange or wallet account to avoid any potential issues or delays. Furthermore, it's recommended to review the exchange's terms and conditions, as well as any applicable fees, before withdrawing funds to a bank account or debit card. By understanding the pros and cons of each method, you can make an informed decision and efficiently cash out your cryptocurrency in Canada.