How Long Do You Have To Transfer Property After Death

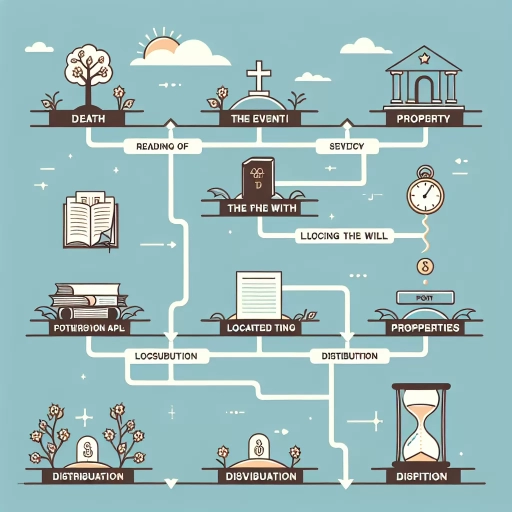

When a loved one passes away, dealing with the aftermath can be overwhelming, especially when it comes to managing their estate. One of the most critical tasks is transferring property, which can be a complex and time-consuming process. The question on everyone's mind is: how long do you have to transfer property after death? The answer lies in understanding the legal framework that governs property transfer, the timeframes involved, and the steps required to complete the process. In this article, we will delve into these aspects, starting with the legal framework that sets the stage for property transfer after death. By understanding the laws and regulations that apply, individuals can navigate the process with confidence and ensure a smooth transition of property. Understanding the Legal Framework is crucial in determining the next steps, and we will explore this topic in more detail.

Understanding the Legal Framework

Understanding the legal framework surrounding estate planning and administration is crucial for individuals, families, and businesses. This framework is composed of various laws and regulations that govern the distribution of assets, management of estates, and transfer of property. In this article, we will delve into the key aspects of the legal framework, including probate and estate administration, transfer of property laws, and the role of the executor or administrator. By understanding these concepts, individuals can ensure that their wishes are carried out and their loved ones are protected. Probate and estate administration, in particular, play a critical role in the legal framework, as they involve the process of managing and distributing a deceased person's assets according to their will or the laws of the state. In the next section, we will explore the intricacies of probate and estate administration in more detail.

Probate and Estate Administration

Probate and estate administration are the legal processes that occur after someone's death, aimed at settling their estate and distributing their assets according to their will or the laws of intestacy. Probate involves the court's validation of the deceased person's will, ensuring it is authentic and was not created under duress or undue influence. Once the will is validated, the court appoints an executor or personal representative to manage the estate, pay off debts, and distribute the remaining assets to beneficiaries. Estate administration, on the other hand, refers to the broader process of managing the deceased person's estate, including gathering assets, paying taxes and debts, and distributing assets to beneficiaries. The probate process can be lengthy and complex, taking several months to several years to complete, depending on the size and complexity of the estate. In some cases, probate can be avoided through the use of trusts, joint ownership, or other estate planning strategies. However, even if probate is avoided, some form of estate administration will still be necessary to settle the estate and distribute assets. Understanding the legal framework of probate and estate administration is essential for executors, beneficiaries, and heirs to navigate the process and ensure that the deceased person's wishes are carried out.

Transfer of Property Laws

The transfer of property laws is a complex and multifaceted area of law that governs the transfer of ownership of real and personal property from one person to another. These laws vary by jurisdiction, but generally, they cover the rules and procedures for transferring property through various means, such as sale, gift, inheritance, and court order. In the context of transferring property after death, the laws of intestacy and wills come into play. When a person dies without a will, the laws of intestacy dictate how their property is distributed among their heirs, typically following a predetermined order of priority. On the other hand, if a person dies with a will, the transfer of property is governed by the terms of the will, which must be probated and validated by the court. Additionally, transfer of property laws also address issues such as joint ownership, community property, and the rights of beneficiaries and heirs. Furthermore, these laws often intersect with other areas of law, such as tax law, estate planning, and family law, making it essential to understand the legal framework surrounding property transfer to ensure a smooth and lawful transfer of ownership.

Role of the Executor or Administrator

The role of the executor or administrator is a crucial one in the process of transferring property after death. The executor, also known as the personal representative, is responsible for managing the deceased person's estate, including their assets, debts, and property. The executor's primary duty is to carry out the instructions outlined in the deceased person's will, if they had one, and to ensure that the estate is distributed according to the deceased person's wishes. If there is no will, the administrator, who is typically appointed by the court, will be responsible for managing the estate and distributing the assets according to the laws of the state. The executor or administrator is responsible for a range of tasks, including gathering and valuing the deceased person's assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. They must also ensure that all necessary paperwork and documentation is completed, including filing tax returns and obtaining any necessary court approvals. Throughout the process, the executor or administrator must act in the best interests of the estate and the beneficiaries, and must be transparent and accountable in their decision-making. Overall, the role of the executor or administrator is a significant one, requiring a high level of responsibility, organization, and attention to detail.

Timeframes for Transferring Property

When it comes to transferring property, understanding the timeframes involved is crucial to ensure a smooth and efficient process. The duration of property transfer can vary significantly depending on several factors, including the type of transfer, the complexity of the transaction, and the jurisdiction in which the property is located. In this article, we will delve into the key timeframes associated with transferring property, including the probate process timeline, statutory time limits for filing, and factors that can affect the speed of transfer. By understanding these timeframes, individuals can better plan and prepare for the transfer of property, whether it's due to inheritance, sale, or other circumstances. Let's start by examining the probate process timeline, which can significantly impact the overall duration of property transfer.

Probate Process Timeline

Here is the paragraphy: The probate process timeline varies depending on the complexity of the estate, the jurisdiction, and the efficiency of the executor or personal representative. Generally, the probate process can take anywhere from 6 months to 2 years or more to complete. Here's a breakdown of the typical probate process timeline: * Filing the petition for probate: 1-3 months * Appointing the executor or personal representative: 1-2 months * Gathering assets and paying debts: 3-6 months * Filing tax returns and paying taxes: 3-6 months * Distributing assets to beneficiaries: 3-6 months * Closing the estate: 1-3 months Overall, the probate process can be lengthy and time-consuming, but it's essential to ensure that the deceased person's assets are distributed according to their wishes and that all debts and taxes are paid.

Statutory Time Limits for Filing

The timeframes for transferring property after a person's death are governed by statutory time limits, which vary by jurisdiction. In general, the executor or personal representative of the estate has a limited time to file certain documents and take specific actions to transfer the deceased person's property. For example, in many states, the executor has 30 to 90 days to file the will with the probate court and begin the probate process. Additionally, the executor may have a limited time, typically 6 to 12 months, to file tax returns and pay any taxes owed by the estate. Failure to meet these deadlines can result in penalties, fines, and even the loss of certain rights or benefits. It is essential for the executor to be aware of the statutory time limits in their jurisdiction and to take prompt action to ensure that the estate is administered efficiently and in accordance with the law. In some cases, the time limits may be extended or waived, but this typically requires a court order or the consent of all interested parties. Overall, understanding the statutory time limits for filing is crucial for ensuring that the transfer of property after death is handled correctly and in a timely manner.

Factors Affecting Transfer Speed

Here is the paragraphy: The transfer speed of property after death can be influenced by several factors, including the complexity of the estate, the number of beneficiaries, and the efficiency of the executor or personal representative. If the deceased had a large number of assets, such as real estate, investments, and personal property, the transfer process may take longer due to the need to value, appraise, and distribute these assets. Additionally, if there are multiple beneficiaries with competing interests, the transfer process may be delayed due to disputes or negotiations. The executor's level of experience and organization can also impact the transfer speed, as a well-prepared and efficient executor can navigate the process more quickly. Furthermore, the transfer speed can be affected by the need to obtain court approval or resolve any outstanding debts or taxes owed by the estate. In some cases, the transfer process may be delayed due to unforeseen circumstances, such as the discovery of unknown assets or the need to resolve disputes with creditors. Overall, the transfer speed of property after death can vary significantly depending on the specific circumstances of the estate.

Steps to Transfer Property After Death

When a loved one passes away, dealing with the aftermath can be overwhelming, especially when it comes to transferring their property. The process can be complex and time-consuming, but it's essential to ensure that the deceased person's assets are distributed according to their wishes. To navigate this process, it's crucial to follow the necessary steps to transfer property after death. The first step involves gathering all the necessary documents, including the will, death certificate, and property deeds. Notifying interested parties, such as beneficiaries, heirs, and creditors, is also a critical step to ensure that everyone is aware of the transfer process. Finally, executing the transfer of property requires careful attention to detail and compliance with legal requirements. By understanding these steps, individuals can ensure a smooth transition of property and avoid potential disputes or complications. To begin the process, it's essential to start by gathering all the necessary documents.

Gathering Necessary Documents

When transferring property after death, gathering necessary documents is a crucial step that requires attention to detail and organization. The first document to obtain is the death certificate, which is usually issued by the local vital records office or the funeral home. This document is essential for proving the deceased's passing and is required by most institutions and government agencies. Next, locate the deceased's will, if they had one, as it outlines their wishes for property distribution. If there is no will, the estate will be distributed according to state intestacy laws. You will also need to gather property deeds, titles, and any other documents that prove ownership of the assets in question. Additionally, collect financial documents such as bank statements, investment accounts, and tax returns to understand the deceased's financial situation. If the deceased had any outstanding debts, gather documents related to these debts, such as loan agreements and credit card statements. Finally, obtain any relevant court documents, such as probate records or court orders, that may be necessary for the transfer process. By gathering these necessary documents, you will be well-prepared to navigate the property transfer process and ensure that the deceased's assets are distributed according to their wishes or state law.

Notifying Interested Parties

When a loved one passes away, it's essential to notify interested parties about the transfer of property. This step is crucial in ensuring a smooth transition of assets and avoiding potential disputes. Interested parties may include beneficiaries, heirs, creditors, and other individuals or organizations with a stake in the deceased person's property. Notifying them promptly allows them to take necessary actions, such as filing claims or making arrangements to receive their inheritance. The notification process typically involves sending a formal letter or notice to each interested party, providing details about the deceased person's estate, the property being transferred, and any relevant deadlines or requirements. It's recommended to work with an attorney or estate administrator to ensure that all necessary parties are notified and that the process is handled correctly. Additionally, it's essential to keep a record of all notifications, including dates, times, and methods of delivery, to avoid potential disputes or claims of inadequate notice. By notifying interested parties in a timely and proper manner, you can help prevent unnecessary complications and ensure that the transfer of property after death is handled efficiently and effectively.

Executing the Transfer

Here is the paragraphy: Executing the transfer of property after death involves several steps that must be taken to ensure a smooth and lawful process. The first step is to gather all necessary documents, including the deceased's will, death certificate, and any relevant property deeds or titles. Next, the executor or personal representative must notify the relevant authorities, such as the county assessor's office and the state's department of motor vehicles, of the deceased's passing. The executor must also pay any outstanding debts or taxes owed by the deceased, using funds from the estate if necessary. Once these steps are complete, the executor can begin the process of transferring the property to the beneficiaries, which may involve preparing and filing new deeds or titles, and updating the property records. Throughout the process, the executor should keep detailed records of all transactions and communications, and seek the advice of an attorney if necessary to ensure that the transfer is carried out in accordance with the deceased's wishes and the laws of the state. By following these steps, the executor can ensure that the transfer of property after death is executed efficiently and effectively, and that the beneficiaries receive their inheritance in a timely manner.