What Is Lease Finance And Its Types?

Lease finance is a financial arrangement where one party, the lessor, grants the right to use an asset to another party, the lessee, for a specified period in exchange for periodic payments. This form of financing has become increasingly popular due to its flexibility and numerous benefits. In this article, we will delve into the concept of lease finance, exploring its fundamental principles and how it operates. We will also examine the various types of lease finance available, each with its unique characteristics and advantages. Additionally, we will discuss the applications and considerations of lease finance, highlighting its practical uses and the factors that should be taken into account when deciding whether to lease an asset. By understanding these aspects, individuals and businesses can make informed decisions about leveraging lease finance to meet their needs. To begin, let's start by **Understanding Lease Finance**.

Understanding Lease Finance

Understanding lease finance is a crucial aspect of modern business operations, offering a flexible and often more advantageous alternative to traditional financing methods. This article delves into the intricacies of lease finance, providing a comprehensive overview that includes three key components. First, we explore the **Definition and Purpose of Lease Finance**, which lays the groundwork for understanding how leasing works and its primary objectives. Next, we examine the **Key Players Involved in Lease Finance**, highlighting the roles of lessors, lessees, and other stakeholders. Finally, we discuss the **Benefits of Lease Finance Over Traditional Financing**, outlining why many businesses prefer leasing over purchasing assets outright. By grasping these fundamental aspects, readers can make informed decisions about whether lease finance is the right strategy for their business needs. Let's begin by defining what lease finance is and its purpose in the financial landscape.

Definition and Purpose of Lease Finance

**Definition and Purpose of Lease Finance** Lease finance is a financial arrangement where one party, the lessor, grants another party, the lessee, the right to use an asset for a specified period in exchange for periodic payments. This form of financing allows businesses and individuals to acquire the use of assets without the need for immediate full payment, thereby conserving capital and improving cash flow. The primary purpose of lease finance is to provide an alternative to purchasing assets outright, which can be particularly beneficial for entities that require specific equipment or property but lack the financial resources to purchase them. In essence, lease finance bridges the gap between asset acquisition and financial constraints by offering flexible terms that align with the lessee's operational needs. For instance, a company may lease machinery or vehicles necessary for its operations without committing to a large upfront investment. This approach enables businesses to maintain liquidity and allocate resources more efficiently towards core activities. Moreover, lease finance often includes maintenance and support services provided by the lessor, which can reduce the lessee's administrative burden and operational risks. This is particularly advantageous for assets that require frequent updates or have high maintenance costs. Additionally, lease agreements can be structured in various ways to suit different needs, such as operating leases and capital leases, each offering distinct benefits depending on the lessee's financial situation and tax implications. The flexibility inherent in lease finance also allows lessees to upgrade or change assets more easily compared to owning them outright. For example, a technology company might lease computer hardware and software to ensure they have access to the latest advancements without being tied to obsolete equipment. This adaptability is crucial in industries where technological advancements occur rapidly. From a financial perspective, lease finance can offer tax benefits as lease payments are typically considered operating expenses and may be deductible against taxable income. Furthermore, lease agreements can be tailored to match the useful life of the asset, ensuring that the lessee only pays for the period during which the asset is expected to generate returns. In summary, lease finance serves as a vital tool for managing capital expenditures by providing access to necessary assets while preserving cash reserves. Its purpose is multifaceted: it enhances financial flexibility, reduces operational risks, and aligns with the dynamic needs of businesses across various sectors. By understanding the definition and purpose of lease finance, individuals and organizations can make informed decisions about how best to acquire and utilize assets in a manner that optimizes their financial health and operational efficiency.

Key Players Involved in Lease Finance

In the realm of lease finance, several key players are instrumental in facilitating the process and ensuring its smooth operation. At the forefront are **Lessors**, who own the assets and lease them to lessees. These lessors can be financial institutions, leasing companies, or even manufacturers looking to monetize their products. **Lessees**, on the other hand, are the entities that use the leased assets for a specified period in exchange for periodic payments. Lessees can range from small businesses to large corporations across various industries. **Financial Institutions** play a crucial role by providing the necessary funding for leasing transactions. Banks, credit unions, and other financial entities often partner with leasing companies to offer lease financing options. **Leasing Brokers** act as intermediaries between lessors and lessees, helping to match the needs of both parties and facilitating the negotiation of lease terms. **Accountants and Auditors** are essential for ensuring that lease transactions are properly recorded and comply with accounting standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). **Lawyers and Legal Advisors** are involved in drafting and reviewing lease agreements to protect the interests of both lessors and lessees. They ensure that all legal requirements are met and that the terms of the lease are clear and enforceable. **Asset Managers** oversee the maintenance and upkeep of leased assets, ensuring they remain in good condition throughout the lease term. This is particularly important for assets like equipment or vehicles that require regular maintenance. **Regulatory Bodies** also play a significant role by setting guidelines and standards for lease finance transactions. These bodies help maintain transparency and fairness in the leasing market, protecting both consumers and businesses from potential abuses. Lastly, **Technology Providers** are increasingly important as they develop software solutions that streamline lease management, automate payments, and enhance overall efficiency in lease finance operations. Each of these key players contributes to the complexity and functionality of lease finance, making it a viable and attractive financing option for many businesses and individuals. Understanding their roles is crucial for navigating the landscape of lease finance effectively.

Benefits of Lease Finance Over Traditional Financing

Lease finance offers several compelling benefits over traditional financing methods, making it an attractive option for businesses and individuals alike. **Flexibility** is a key advantage, as lease agreements can be tailored to meet specific needs, allowing for more manageable monthly payments compared to the larger upfront costs associated with traditional loans. This flexibility extends to the end of the lease term, where lessees often have the option to return the asset, renew the lease, or purchase the asset at a predetermined price. **Lower Upfront Costs** are another significant benefit. Unlike traditional financing, which typically requires a substantial down payment, lease finance often involves minimal or no initial outlay. This conserves capital that can be used for other business purposes or investments. Additionally, lease payments are usually treated as operating expenses, which can provide tax benefits by reducing taxable income. **Risk Management** is also enhanced with lease finance. The lessor bears the risk of asset depreciation and obsolescence, which can be particularly advantageous for assets with rapid technological advancements or those prone to significant value decline over time. This shifts the burden from the lessee, allowing them to focus on core business activities without worrying about asset maintenance and disposal. Moreover, **Access to Latest Technology** is facilitated through lease finance. By leasing equipment or vehicles, businesses can stay updated with the latest models and technologies without the need for frequent capital outlays. This is especially beneficial in industries where technological advancements occur rapidly, such as IT and healthcare. **Improved Cash Flow** is another critical benefit. Lease payments are typically fixed and predictable, making it easier for businesses to budget and manage their cash flow. This stability helps in maintaining a healthy financial position and reduces the risk of cash flow disruptions that might occur with variable loan payments. In addition, **Off-Balance Sheet Financing** is a feature of lease finance that can improve a company's financial ratios. Since leased assets are not recorded on the balance sheet, this type of financing does not affect debt-to-equity ratios or other financial metrics, which can be advantageous for companies looking to maintain a certain financial profile. Lastly, **Simplified Asset Disposal** is a significant convenience offered by lease finance. At the end of the lease term, the lessee does not have to worry about selling or disposing of the asset, as this responsibility falls on the lessor. This simplifies asset management and reduces administrative burdens. In summary, lease finance provides a range of benefits that make it an appealing alternative to traditional financing methods. From lower upfront costs and improved cash flow to risk management and access to the latest technology, lease finance offers flexibility and convenience that can significantly enhance business operations and financial health.

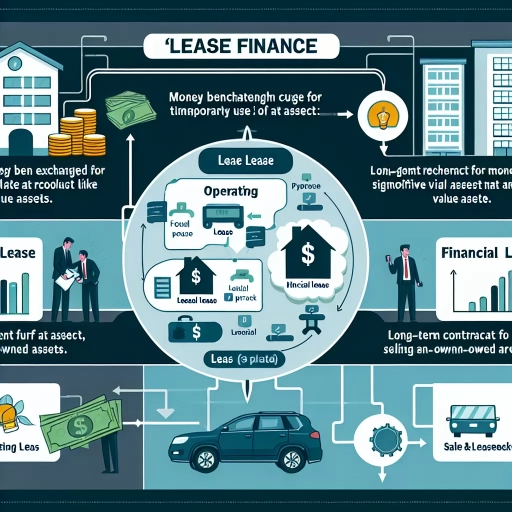

Types of Lease Finance

Lease finance is a versatile and widely used financial instrument that allows businesses to acquire assets without the immediate need for full ownership. It offers several types, each catering to different business needs and financial strategies. This article delves into three primary types of lease finance: Operating Leases, Capital Leases (Finance Leases), and Specialized Leases. Operating Leases provide flexibility and lower upfront costs, making them ideal for short-term asset usage. Capital Leases, on the other hand, are more akin to financing arrangements where the lessee bears the risks and rewards of ownership. Specialized Leases, such as Sale and Leaseback and Cross-Border Leases, offer unique solutions for specific business scenarios. Understanding these different types is crucial for businesses to make informed decisions about their asset acquisition and management strategies. Let's begin by exploring the first of these: Operating Leases.

Operating Leases

Operating leases are a type of lease finance that allows lessees to use an asset for a period shorter than the asset's economic life. Unlike capital leases, which are more akin to financing arrangements where the lessee assumes many of the risks and rewards associated with ownership, operating leases are treated as rental agreements. Here, the lessor retains ownership of the asset and is responsible for its maintenance and insurance. This arrangement is particularly beneficial for businesses that require frequent updates or replacements of equipment, such as technology companies needing the latest software or hardware. In an operating lease, the lessee pays periodic lease payments that are typically lower than those of a capital lease because they cover only the asset's usage during the lease term. At the end of the lease, the lessee can return the asset to the lessor, who then sells or leases it to another party. This structure makes operating leases attractive for assets with high obsolescence rates or those that are subject to rapid technological advancements. From an accounting perspective, operating leases are treated as operating expenses rather than capital expenditures. The lease payments are expensed on the income statement, and there is no impact on the balance sheet. This can be advantageous for companies seeking to manage their financial ratios and avoid significant capital outlays. Another key feature of operating leases is their flexibility. They often include options for early termination or renewal, allowing lessees to adjust their asset usage according to changing business needs. Additionally, operating leases may include clauses that provide for upgrades or substitutions of assets during the lease term, ensuring that lessees always have access to current technology. For lessors, operating leases offer opportunities for residual value realization. Since the lessor retains ownership, they can benefit from selling or re-leasing the asset after the initial lease period ends. This residual value can significantly contribute to the lessor's revenue stream. In summary, operating leases provide a flexible and cost-effective way for businesses to access necessary assets without the long-term commitment associated with ownership. They are particularly suited for companies requiring frequent asset updates or those looking to manage their financial statements effectively. As a form of lease finance, operating leases offer a valuable alternative to traditional purchasing or capital leasing arrangements.

Capital Leases (Finance Leases)

Capital leases, also known as finance leases, are a type of lease agreement that closely resembles a purchase arrangement. In this context, the lessee (the party leasing the asset) has substantial control over the asset and bears most of the risks and rewards associated with its ownership. Here are the key characteristics and implications of capital leases: 1. **Ownership Transfer**: At the end of the lease term, the lessee often has the option to purchase the asset at a predetermined price, which is typically a nominal amount. This transfer of ownership is a hallmark of capital leases. 2. **Economic Life**: The lease term covers a significant portion or all of the asset's economic life. This means that the lessee will use the asset for most of its useful life. 3. **Present Value**: The present value of the lease payments is equal to or greater than 90% of the asset's fair market value at the inception of the lease. This indicates that the lessee is essentially paying for the full value of the asset over time. 4. **Accounting Treatment**: For accounting purposes, capital leases are treated as if the lessee has purchased the asset. The asset is recorded on the lessee's balance sheet, and the lease payments are split between interest expense and principal repayment. 5. **Tax Implications**: The lessee can claim depreciation on the asset and deduct the interest portion of the lease payments as an expense for tax purposes, similar to owning the asset outright. 6. **Risk and Reward**: Since the lessee bears most of the risks and rewards associated with ownership, they are responsible for maintenance, insurance, and other costs related to the asset. 7. **Examples**: Capital leases are commonly used for high-value assets such as aircraft, real estate, and heavy machinery where the lessee intends to use the asset for its entire economic life. In summary, capital leases provide lessees with long-term use of assets while allowing them to spread the cost over several years. This type of lease is particularly beneficial for businesses that need to use expensive equipment or property without immediate full payment, offering financial flexibility and tax benefits similar to ownership.

Specialized Leases (e.g., Sale and Leaseback, Cross-Border Leases)

Specialized leases are a subset of lease finance that cater to specific needs and circumstances, offering unique benefits and structures. One prominent type is the **Sale and Leaseback**, where an asset owner sells the asset to a lessor and immediately leases it back. This arrangement allows the original owner to retain use of the asset while gaining immediate capital from the sale. It is particularly beneficial for companies looking to free up cash for other business needs or to reduce debt on their balance sheet. For instance, a company might sell its real estate holdings and then lease them back, thereby unlocking capital that can be reinvested in core operations. Another specialized lease is the **Cross-Border Lease**, which involves leasing transactions across international borders. These leases are complex due to varying legal, tax, and regulatory environments in different countries. However, they offer significant advantages such as access to global markets, diversified risk, and potentially more favorable lease terms. Cross-border leases often require careful planning and coordination with legal and financial experts to navigate the intricacies of multiple jurisdictions. For example, a multinational corporation might lease equipment from a lessor in one country and use it in another, taking advantage of tax incentives or lower leasing rates available in that jurisdiction. Other specialized leases include **Synthetic Leases**, which combine elements of both operating and capital leases to achieve specific financial reporting objectives. These leases allow lessees to keep the asset off their balance sheet while still benefiting from the tax deductions associated with ownership. **Leveraged Leases** involve multiple parties, including a lessor, a lessee, and lenders, where the lessor borrows funds from lenders to purchase the asset and then leases it to the lessee. This structure can provide tax benefits and reduce the lessor's initial capital outlay. In summary, specialized leases such as Sale and Leaseback, Cross-Border Leases, Synthetic Leases, and Leveraged Leases offer tailored solutions for various business needs. They provide flexibility in financing, risk management, and tax optimization, making them valuable tools in the broader landscape of lease finance. By understanding these specialized lease options, businesses can make informed decisions that align with their strategic objectives and financial goals.

Applications and Considerations of Lease Finance

Lease finance is a versatile and widely adopted financial instrument that offers numerous benefits across various industries. It allows businesses to acquire essential assets without the need for significant upfront capital, thereby enhancing cash flow and reducing financial strain. This article delves into the applications and considerations of lease finance, exploring three key aspects: Industry-Specific Uses of Lease Finance, Risk Management and Legal Considerations, and Financial Reporting and Tax Implications. Understanding these elements is crucial for making informed decisions about leasing. For instance, different industries leverage lease finance in unique ways, such as airlines leasing aircraft or healthcare providers leasing medical equipment. Additionally, risk management and legal considerations are vital to ensure that lease agreements are structured to mitigate potential risks and comply with regulatory requirements. Finally, the financial reporting and tax implications of lease finance can significantly impact a company's financial statements and tax obligations. By examining these facets, businesses can better navigate the complexities of lease finance and maximize its benefits. This article begins by exploring the diverse industry-specific uses of lease finance, highlighting how different sectors utilize this financial tool to drive growth and efficiency.

Industry-Specific Uses of Lease Finance

Lease finance is a versatile financial tool that caters to various industry-specific needs, offering tailored solutions to enhance operational efficiency and manage capital expenditures effectively. In the **aviation industry**, lease finance allows airlines to acquire aircraft without the significant upfront costs associated with purchasing. This enables them to maintain a modern fleet, manage cash flow better, and adapt quickly to changing market conditions. For instance, airlines can opt for operating leases which typically have shorter terms, allowing them to return or upgrade aircraft as needed. In the **healthcare sector**, lease finance is crucial for acquiring advanced medical equipment. Hospitals and clinics can lease state-of-the-art diagnostic tools and treatment machines without committing to full ownership, which helps in managing budget constraints and ensuring that they always have access to the latest technology. This is particularly beneficial in a field where technological advancements are rapid and frequent. The **technology and IT sector** also heavily relies on lease finance. Companies can lease hardware and software solutions, enabling them to stay updated with the latest technological trends without the burden of obsolescence. This is especially important in an industry where equipment becomes outdated quickly, and leasing allows for easier upgrades and replacements. In **manufacturing**, lease finance is used to acquire heavy machinery and equipment necessary for production processes. This helps manufacturers avoid large capital outlays, allowing them to allocate resources more efficiently. Additionally, leasing can provide tax benefits and reduce the risk of equipment becoming obsolete. For **retail businesses**, lease finance can be used to acquire point-of-sale systems, inventory management software, and other essential equipment. This allows retailers to maintain a competitive edge by leveraging the latest technology without significant upfront costs. In the **energy sector**, companies often use lease finance to acquire renewable energy systems such as solar panels or wind turbines. This model enables businesses and individuals to transition to sustainable energy sources without the high initial investment required for purchasing these systems outright. Lastly, **automotive businesses** benefit from lease finance by offering customers vehicle leasing options. This allows consumers to drive new vehicles regularly without the long-term commitment of ownership, while also providing dealerships with a steady stream of customers returning for new leases. Overall, industry-specific uses of lease finance highlight its flexibility and adaptability across diverse sectors, enabling businesses to manage their assets efficiently, reduce financial risks, and focus on core operations. By understanding these applications, businesses can make informed decisions about how to leverage lease finance to achieve their strategic goals.

Risk Management and Legal Considerations

Risk management and legal considerations are pivotal components in the realm of lease finance, ensuring that both lessors and lessees navigate the complex landscape with clarity and protection. Effective risk management involves a thorough assessment of potential risks such as credit risk, where the lessee may default on lease payments, and residual value risk, where the lessor may face losses if the leased asset does not retain its expected value at the end of the lease term. To mitigate these risks, lessors often require lessees to provide financial statements, credit reports, and sometimes collateral or guarantees. Additionally, lease agreements should include clear terms regarding maintenance and upkeep to prevent asset depreciation. From a legal standpoint, lease agreements must be meticulously drafted to comply with relevant laws and regulations. This includes adherence to consumer protection laws, tax laws, and specific legislation governing leasing transactions. For instance, in many jurisdictions, lease agreements must disclose all terms and conditions clearly to avoid disputes. The Uniform Commercial Code (UCC) in the United States provides a framework for leasing transactions, outlining responsibilities and obligations for both parties. Furthermore, legal considerations extend to issues such as ownership transfer, termination clauses, and dispute resolution mechanisms. Ensuring that all legal requirements are met helps in preventing costly litigation and maintaining a smooth leasing process. Moreover, lessors need to be aware of tax implications associated with leasing. For example, operating leases are generally treated as expenses for tax purposes, while capital leases are considered as assets on the balance sheet and may offer tax benefits through depreciation. Understanding these nuances is crucial for optimizing financial performance and compliance with tax authorities. In conclusion, robust risk management strategies and adherence to legal considerations are essential for successful lease finance transactions. By carefully evaluating potential risks and ensuring compliance with legal requirements, parties involved in leasing can protect their interests and foster mutually beneficial agreements. This proactive approach not only safeguards against unforeseen challenges but also enhances the overall efficiency and reliability of lease finance as a financing option.

Financial Reporting and Tax Implications

Financial reporting and tax implications are crucial aspects to consider when evaluating lease finance, as they significantly impact a company's financial health and compliance. Under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), leases are categorized into operating and finance leases. For operating leases, the lessee records lease payments as operating expenses, while the lessor recognizes these payments as revenue. In contrast, finance leases (or capital leases) are treated as if the lessee has acquired the asset and incurred a liability; thus, the lessee capitalizes the asset and recognizes depreciation and interest expenses over the lease term. This distinction affects key financial metrics such as earnings before interest, taxes, depreciation, and amortization (EBITDA), return on assets (ROA), and debt-to-equity ratios. From a tax perspective, lease payments can be deductible as operating expenses for tax purposes if the lease is classified as an operating lease. For finance leases, the lessee can claim depreciation deductions on the asset and interest deductions on the lease liability. However, tax laws vary by jurisdiction, and certain types of leases may be subject to specific tax treatments. For instance, in the United States, the Tax Cuts and Jobs Act (TCJA) introduced changes that affect how lease payments are treated for tax purposes, particularly impacting the deductibility of interest and depreciation. Moreover, lease accounting standards have undergone significant changes with the implementation of ASC 842 (Accounting Standards Codification) in the U.S. and IFRS 16 globally. These new standards require lessees to recognize most leases on their balance sheets, which can lead to increased reported assets and liabilities. This shift can have material impacts on financial ratios and covenants, potentially affecting a company's ability to secure additional financing or comply with existing debt agreements. In addition to these accounting and tax considerations, companies must also consider the broader implications of lease finance on their financial reporting. For example, lease obligations can influence a company's credit rating and borrowing costs. Transparent and accurate disclosure of lease arrangements is essential for stakeholders to make informed decisions about the company's financial health and future prospects. Ultimately, understanding the financial reporting and tax implications of lease finance is vital for making informed decisions about whether to lease or purchase assets. It requires careful analysis of the specific terms of the lease agreement, the applicable accounting standards, and the relevant tax laws to ensure compliance and optimal financial outcomes. By doing so, companies can leverage lease finance effectively while maintaining robust financial reporting practices and minimizing potential tax liabilities.