When Your Money Is Debited But Did Not Credited In Cibc Bank What To Do

>

>When Your Money is Debited But Not Credited in CIBC Bank: A Complete Guide

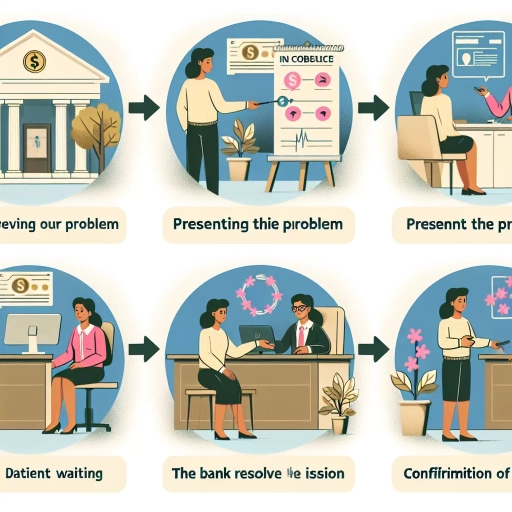

In an increasingly digital-centric financial landscape, online transactions are becoming more commonplace. With this, issues such as money being debited from your account but not appearing in the recipient's balance are also increasingly faced. When faced with such a situation in CIBC Bank, it's essential not to despair. Numerous possible paths forward may resolve this issue - using online banking, the mobile app, or reaching out to customer service. Read on for step-by-step guides on what to do.

1. Using Online Banking to Resolve the Issue

If you notice a transaction discrepancy within your CIBC bank account, the first option would be to address the issue via its online banking platform. Here's how:

- Login into your CIBC online account and navigate to the 'Transactions' section.

- Review your transaction history to confirm the funds have indeed been debited.

- If you have the recipient's consent, ask them to check their account too.

- Should the transaction not show up, open an 'Inquiry' about a specific transaction using CIBC's online banking tools. They provide an automated pathway to problem resolution.

- Wait for the bank's response. If they cannot resolve it, proceed to the last step which involves contacting customer service.

2. Using Mobile Banking App to Mitigate the Problem

Thanks to CIBC Bank's comprehensive mobile app, solving your issue can be just a few taps away. If you prefer a solution at your fingertips, follow these steps:

- Open the CIBC Mobile Banking App on your device and log in to your account.

- Go to the 'Transactions' tab to overview your recent activities.

- Identify the transaction in question and click on 'Details' to learn more about it.

- If the payment is showing as debited from your account but has not reached the intended account, use the 'Inquiry' function within the app.

- Make sure to provide detailed information when raising an inquiry. This could speed up the resolution process.

- Wait for a response. The bank typically communicates with updates and solutions via notifications in-app or email.

3. Contacting CIBC Customer Service for Prompt Resolutions

Perhaps you prefer speaking to a human, or the aforementioned online channels have not yielded the desired results. In such scenarios, reaching out to CIBC’s customer service would be a suitable option.

- Before calling, make sure to gather important information, such as account number, transaction date, and amount to facilitate the process.

- Contact CIBC customer service at their general inquiry line and briefly explain your problem.

- CIBC customer service is trained to handle transactions discrepancies and should be able to direct you on how to solve the issue or assist in rectifying it themselves.

- Make sure to follow through with any steps they advise - these should take priority over other suggestions.

Knowing there are multiple avenues available to rectify any transaction discrepancies in CIBC Bank can indeed be reassuring. Understanding these methods ensures you are prepared should the need occur. In this digitally connected age, having the knowledge to navigate digital banking challenges is truly empowering.