How To Increase Credit Card Limit Cibc

>

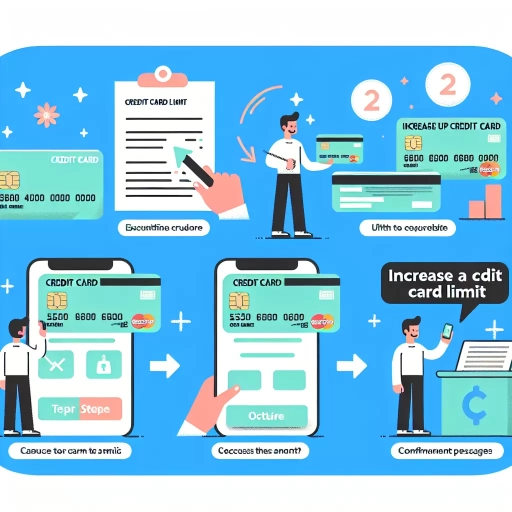

>How to Increase Your CIBC Credit Card Limit: A Comprehensive Guide

Managing your finances efficiently and responsibly can often warrant a sought-after increase in your credit card limit. At CIBC, there are multiple channels you can use to request such an increase, including online banking, the mobile app, and customer service. This guide elaborates on each method to help you determine the easiest and most convenient way to increase your CIBC credit card limit.

Increasing CIBC Credit Card Limit via Online Banking

One of the most straightforward ways to request a credit card limit increase is through CIBC's online banking platform. If you like to manage your banking affairs from the comfort of your home, this option is for you:

- Log into your online banking account with your card number and password.

- Navigate to your credit card account summary.

- Select "Manage My Account" and then "Increase Credit Card Limit".

- Follow the on-screen prompts to process your request.

Do keep in mind that the financial institution may have to review your request, which might entail checking your credit history or requiring additional information.

Increasing CIBC Credit Card Limit via Mobile App

If you are a person who is always on the move or prefer using your smartphone for banking transactions, using the CIBC mobile app to increase your credit card limit is an optimal choice:

- Open your CIBC mobile banking app and log in.

- Tap on "More" in the bottom right corner of the screen.

- Go to "Manage My Accounts" then click on "Increase Credit Card Limit".

- Provide necessary information and follow the prompts to submit your request.

A reputable feature of CIBC's mobile app is its built-in security, which ensures that your personal details remain private and protected.

Increasing CIBC Credit Card Limit via Customer Service

If you would rather gain assistance from a person, reaching out to CIBC's customer service is another excellent option for proving your creditworthiness and advancing your financial options:

- Call CIBC's customer service hotline at 1-800-465-2422.

- Confirm your identity for security purposes.

- Express your intention to increase your credit card limit.

- Provide them with any additional information they require for verification.

The customer service agent will guide you through the process, answering any questions or concerns you may have regarding the process or your new limit.

Bear in mind, regardless of the method chosen to apply for a credit card limit increase, approval is typically based on factors like your existing credit score, payment history, and income. Hence, always ensure you have maintained a good credit score and payment track record.

A credit card limit increase magnifies your financial flexibility but increases your responsibility. Remember to use your newly acquired financial power wisely to maintain a favourable credit reputation.