How To Apply Line Of Credit Cibc

>

>How to Apply for a Line of Credit with CIBC: Online Banking, Mobile App, or Customer Service Call

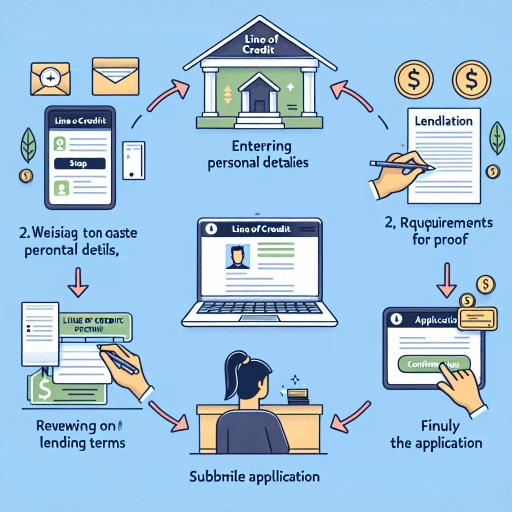

Steady financial management often requires the flexibility that a line of credit can offer, especially when dealing with unexpected expenses or consolidating debt. The Canadian Imperial Bank of Commerce (CIBC) offers attractive lines of credit that can empower you to approach your financial affairs with more confidence. Here, we explore three options for applying for a line of credit with CIBC - through online banking, the mobile app, or a call to their customer service.

Option 1: Applying for a Line of Credit via CIBC Online Banking

Online banking is a popular method of securing a line of credit because it can be done from the comfort of your own home, at a time that suits you. Here are the steps for applying through CIBC’s online banking platform.

- Log into your CIBC online banking account.

- From the dashboard, navigate to ‘Products & Services’.

- Under 'Borrowing', select 'Lines of Credit'.

- Review the options available, and select the one that you feel is right for your financial situation.

- Start your application by providing the necessary personal and income information to determine your eligibility.

- Confirm all of the details, then submit your application. A confirmation number will be sent to you, along with the details of when you can expect a reply.

Option 2: Applying for a Line of Credit via the CIBC Mobile App

These days most financial tasks can be completed using a mobile app, including applying for a line of credit. It offers the same convenience and functionality as online banking, but with greater accessibility since you can complete the process on-the-go. Here’s how you do it with CIBC's mobile app.

- Download and log into your CIBC mobile app.

- On the main menu, tap on ‘More’.

- Under 'Products & Services', select 'Lines of Credit'.

- Review the available options and select the line of credit that best fits your needs.

- Click ‘Apply Now’ and follow the prompts for filling out the application. The process is easy, interactive, and fast.

- After you submit your application, you’ll receive a confirmation number and details about the processing time.

Option 3: Applying for a Line of Credit via a CIBC Customer Service Call

If you prefer to talk to a representative directly, the best option would be a customer service call. Here, you will have the opportunity to discuss your financial situation and get assistance with your line of credit application. Here is a brief overview of what to expect.

- Call CIBC at 1-800-465-CIBC (2422) and choose the option for new credit applications.

- Report to the representative your financial needs and discuss what line of credit options are suitable for you.

- Provide all the necessary information requested by the representative, including name, address, date of birth, employment details, and income.

- The representative will guide you through the process, answer any questions, and complete the application on your behalf.

- After the call, the application will be processed, and you will be contacted with the result. They will also send you a letter displaying the result and next steps if approved.

In conclusion, applying for a line of credit with CIBC is a straightforward process, regardless of which option you choose. However, the choice depends on your level of comfort with technology, your familiarity with online banking platforms, and your personal preference for face-to-face or voice communication. Each method offers its own merits and allows you to get the financial aid you need with a convenience that fits your lifestyle.