How To Put A Stop Payment Cibc

>

>How to Put a Stop Payment with CIBC: A Comprehensive Guide

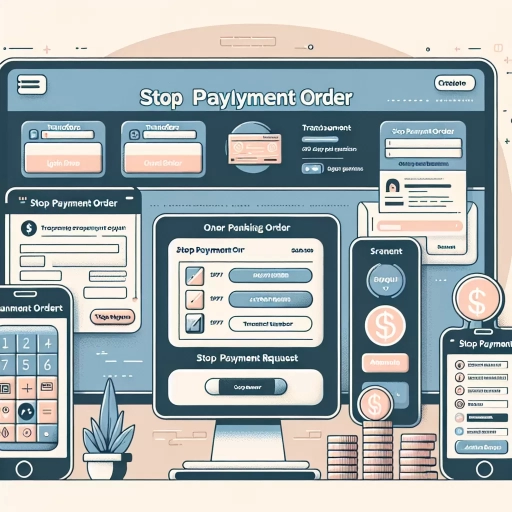

With modern banking advances, putting a stop payment on checks or pre-authorized payments has never been easier. Whether you wish to do it via online banking, a mobile app, or by contacting customer care, CIBC offers a variety of methods to cater to your preferences. This article delves into the step-by-step process of each method to help you achieve this with ease.

1. Online Banking

Online banking is a convenient and easy solution for putting a stop payment without leaving the comfort of your home. Here is how you can accomplish it:

- First, log into your CIBC online banking account.

- On your account summary page, select the account that you issued the check or pre-authorized payment from.

- Select “Customer Services” from the menu on the left.

- Click on "Stop Payments".

- Follow the prompts to enter the information about the check or pre-authorized payment you wish to stop - including the payee's name, check number, and the amount.

- Review all the information and confirm your request. A stop payment fee may apply.

2. CIBC Mobile App

If you're always on-the-go, the CIBC Mobile Banking App offers a convenient solution for managing your banking needs, including stop payment. Here’s how you go about it:

- Log into your account on the CIBC mobile banking App.

- Select the hamburger menu in the top left corner.

- Choose “Stop Payments” under the “Bank Accounts” section.

- Indicate the account you wish to stop payment from, and enter the necessary check or pre-authorized payment details.

- Review and confirm your stop payment request.

3. Calling Customer Services

If you prefer a more personal touch or need additional assistance, calling their customer service can be the best option. Here's what you need to do:

- Dial the CIBC customer service number at 1-800-465-CIBC (2422).

- Follow the voice prompts to reach the “Banking” section.

- When connected to a representative, request to put a stop payment on a check or pre-authorized payment.

- Provide the necessary account information and details about the check or payment in question.

- The representative will then process your request and provide you with a confirmation. Note that, like online and mobile banking, a stop payment fee will apply.

In conclusion, CIBC tries to make the process of putting a stop payment as seamless as possible for its customers. With the online banking portal, mobile app, and call center, you have multiple convenient channels at your disposal. Be sure to verify all details before putting a stop payment and be aware of the associated fees.