How To Apply For Overdraft Cibc

>

>How to Apply for Overdraft Protection With CIBC: A Comprehensive Guide

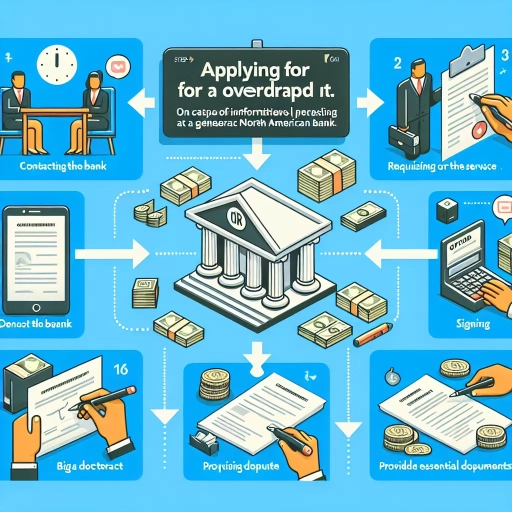

Excessive bank charges caused by an unlucky miscalculation can be distressing. One of the quickest ways to protect yourself from these types of charges is by applying for an overdraft protection service. This article will explore different options on how to apply for an overdraft at the Canadian Imperial Bank of Commerce (CIBC) through online banking, the mobile app, and the customer service hotline.

Online Banking: Hassle-free Overdraft Application

Applying for overdraft protection through CIBC online banking is a convenient option. It allows you to set up overdraft protection without leaving the comfort of your home. Here are the steps:

- Access your CIBC online banking account with your card number and password.

- Go to the 'My Accounts' section, and choose the account you want to extend the coverage.

- Select 'Overdraft Protection' under the account management header.

- Fill out the form, then submit.

- CIBC will review your application and inform you of the results by email or phone.

CIBC Mobile App: Applying Overdraft Protection on the Go

The CIBC mobile app allows you to apply for overdraft protection from anywhere, anytime, conveniently from your handy mobile device. Here's how to use it:

- Open the CIBC Mobile Banking® App on your smartphone and log in.

- Tap on 'More' at the bottom right corner of the screen.

- Under 'Banking,' choose 'Overdraft Protection.'

- Select the account you would want the overdraft to be applied to.

- Complete the form, then submit.

Call Customer Service: Get Assisted While Applying for Overdraft Protection

If you prefer a more personalised service or have further questions regarding overdraft protection, you can contact the CIBC Customer Service. They can guide you through the process and answer all your queries. Here's how:

- Dial 1-800-465-CIBC (2422) and talk to a personal banker.

- When asked, choose the banking services option.

- Ask the personal banker for help with applying for Overdraft Protection.

In conclusion, CIBC offers multiple ways to apply for overdraft protection. You can use the online banking portal, the mobile app or the customer service hotline - each offering their unique benefits and catering to preferred methods of communication. Choose the one that suits you best, and protect yourself from unnecessary bank charges today.

While you are protected against unforeseen overdrafts, it's still important to keep track of your bank balance, spend within your bounds, and continue with your journey towards financial success.