How To Write Letter To Cra

>

>Introduction

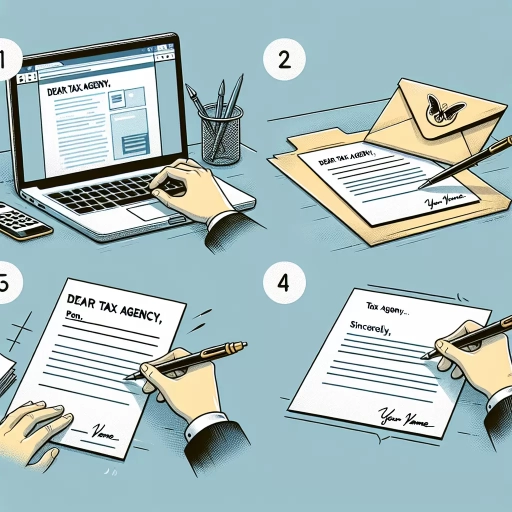

The Canada Revenue Agency (CRA), as the governing body for tax policies and regulations, often interacts with individuals and businesses across Canada. Whether you want to dispute an assessment, address errors, or simply ask questions, knowing how to communicate effectively with the CRA is crucial.

In this step-by-step guide, we will explore three different methods of composing a letter to the CRA: via the CRA website, the CRA mobile app, and the Call Centre. We'll also provide you with tips to get your issue resolved efficiently.

Communicating Through the CRA Website

The CRA website is a resourceful platform that offers a secure myAccount feature for individual users. This feature allows secure communication with the CRA.

- Access your myAccount: Navigate to the CRA website and click on Sign-In Partner Login or CRA Login. Make sure you have your CRA user ID and password.

- Compose a Message: Once logged in, click on “Mail” in the top navigation bar. Choose the type of enquiry, then click on “Compose Mail.” Write your letter in the following text box, ensuring you provide clear details.

- Attach files (if necessary): You can upload statements, receipts, or other supporting documents directly. However, do ensure each file is understandably labeled, error-free, and in an acceptable format.

- Send: After you've checked your letter for clarity and correctness, click the “Send” button. A confirmation message will appear.

Engaging Through the CRA Mobile App

The CRA mobile app is a simplified, user-friendly platform that supports your online communication needs with the CRA. The app includes an easy-to-use, secure mail feature.

- Login: Download the CRA app (if you haven’t already). Use your CRA login details to sign in.

- Compose a message: Navigate to the Mail section. Choose your enquiry type, then click on “Compose.” Write your message in the text box, providing all needed details.

- Attach Files: If you have supporting documents, take clear photos or scan them into a CRA accepted format, and attach them.

- Send: Once satisfied with your message, click on “Send.” You'll see a confirmation message to assure you that your letter has been sent.

Contacting Through the CRA Call Centre

For those who prefer telephone interactions, the CRA call centre offers a direct line of communication. Here's how to reach them with your letter:

- Prepare your letter: Write your letter ahead of time. Ensure it is clear, concise, and contains all relevant information.

- Call the CRA: Dial the official CRA contact line. Be prepared to verify your identity with your SIN and other personal details.

- Explain your issue: If the customer service representative cannot resolve your issue on the call, ask them how you can send your written letter. They may provide you with a fax number or physical address.

- Send: Fax or mail your letter as instructed. Make sure you include any pertinent supporting documents.

Conclusion

Effectively communicating with the CRA is essential for resolving any tax-related issues. Whether you choose to send your letter via the CRA website, the mobile app, or the call centre, the process is relatively straightforward if you follow these steps. Always remember to provide complete and clear details in your letter to facilitate a smooth resolution.