How To Save Notice Of Assessment Cra

>

>How to Save Notice of Assessment from CRA in Different Ways: A Comprehensive Guide

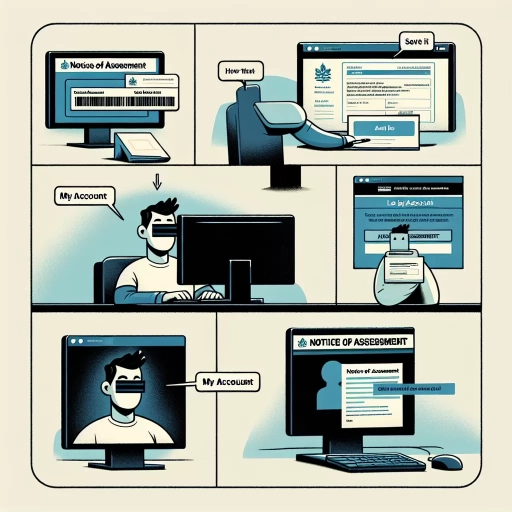

For Canadians, receiving and saving the Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) is a crucial part of their yearly financial tasks. To simplify this process and offer a guide, this article presents three effective ways to save your NOA: via the CRA website, the mobile app, and the call centre.

Website: Save the Notice of Assessment

The CRA's well-structured website provides a straightforward path to save your NOA. Following these steps will assist you to swiftly find and download your document:

- Access the CRA My Account portal on the website. Sign in with your user ID and password.

- In the "Tax Returns" section, click on the specific tax year for which you need the NOA.

- Your NOA will be available under the "Assessments" tab. Click on it to proceed.

- Select the "Download" option, which will save your NOA in a PDF format.

Remember, you should secure your data by logging out of your account as soon as you finish your task.

Mobile App: Save the Notice of Assessment

Using mobile technology is a convenient way to access your NOA. The CRA provides a trusted and handy mobile app - MyCRA. Let's discover the steps to get your Notice of Assessment saved on your device:

- First, download the MyCRA application from Google Play Store or Apple App Store.

- Sign in using your CRA My Account credentials.

- Navigate to "Tax Returns" and select the relevant tax year.

- Tap on the "Assessment" tab to view your NOA.

- Tap on the "Download" button to save the NOA to your device for future use.

Ensure to sign out after completing the process to ensure your personal information's security.

Call Centre: Request a NOA Copy

If online platforms aren't your preference, or you encounter technical issues, you can always turn to the CRA's service-oriented call centre for assistance. Here's a step-by-step guide:

- Contact the CRA Individual Tax Enquiries line at 1-800-959-8281.

- Provide your Social Insurance Number for identity verification.

- Request a copy of your NOA for the particular tax year concerned.

They will mail the NOA to the address they have on file, so ensure that your information is up-to-date.

In conclusion, the CRA offers several simple and accessible options for you to save your Notice of Assessment. Choose the most convenient method and never miss out on this important document.