How To Dispute Cra Reassessment

>

>How to Dispute CRA Reassessment: A Comprehensive Guide

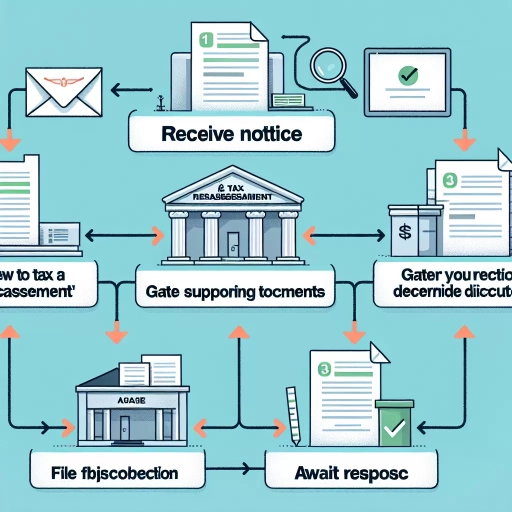

Disagreeing with the Canada Revenue Agency (CRA) about your tax assessment can seem daunting. However, with the right procedure, it's completely manageable. This guide will explain how to dispute a CRA reassessment using three different options: the CRA website, mobile app, and call centre. Remember, if you disagree with how your income tax return was assessed, you have the right to challenge it.

Option 1: Disputing Through the CRA Website

The CRA website is a valuable tool that you can use for refiling your taxes. You can create an account and have all your tax-related information at your fingertips. Here's how to use the website to dispute your CRA reassessment:

- Log in: Visit the CRA website, and log in to 'MyAccount' using your CRA login credentials.

- Find your notice of assessment: Under the 'Tax Returns' tab, click on 'Assessment and Balance', then find and click on your disputed tax year.

- File an objection: Click on ‘Register My Formal Dispute’. You will be prompted to provide the necessary information, such as why you disagree with the assessment and any relevant tax years.

Option 2: Using the CRA Mobile App

If you prefer using a smartphone for your finances, the CRA mobile app is a convenient option for disputing a reassessment. Below is the step-by-step guide:

- Download the App: First, you need to download the 'MyCRA' app from your device's app store.

- Login: Open the app and use your CRA login details to sign in to your account.

- Navigate to the objection option: On the main menu, click on 'Register My Formal Dispute', and then choose the year of the assessment you want to dispute.

- File your dispute: Follow the whole process through and provide all necessary information, and then submit your dispute. Don’t forget to keep a copy of your submission for your records.

Option 3: Dispute via CRA Call Centre

If you are not comfortable using the internet or the app, you can also dispute your reassessment by contacting the CRA call centre. Here are the steps:

- Prepare: Before making the call, ensure you have all the necessary paperwork in front of you for reference.

- Call: Dial the tax enquiry line provided on the CRA website. Remember to choose the menu that corresponds best to your enquiry about filing an objection.

- Discuss: Once connected to an agent, clearly explain why you're disputing your tax assessment. Be as specific as possible and mention any tax laws or regulations that support your standpoint.

In conclusion, disputing a CRA reassessment involves clear communication of your standpoint with supportive documents. Regardless of the option you choose, always remember to keep records of all your communications with the CRA. Also, consider seeking advice from tax professionals to help you navigate and understand the process better.