How To Respond To Cra Reassessment

>

>How to Respond to CRA Reassessment: A Comprehensive Guide

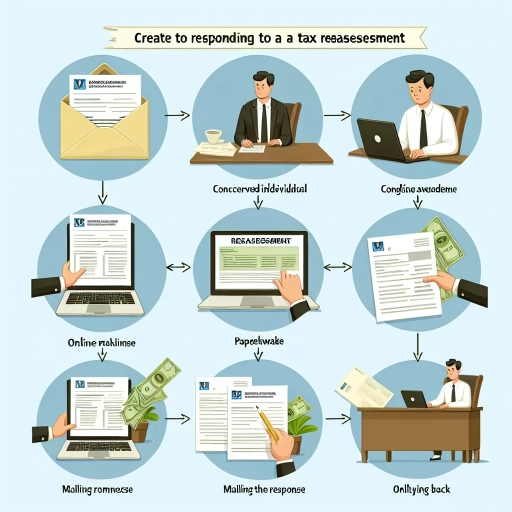

The Canada Revenue Agency (CRA) conducts routine reassessments to verify the accuracy of tax returns. Oftentimes, the findings differ from what was initially reported, necessitating a response from the taxpayer. This article offers a comprehensive guide on how to respond to a CRA reassessment using three main options: through the CRA website, mobile app, and call centre.

1. Using the CRA Website

The CRA website is an efficient portal for addressing your reassessment. Follow these steps:

- Go to the CRA My Account page and log in using your credentials. Register if you do not have an account.

- Find the "Taxes and Levies" section and click on "Reassessment".

- Review the details of your reassessment and don't hesitate to seek clarification on any confusing points.

- Submit your response using the Electronic Post option.

Remember to provide complete details and attach any supporting documents to avoid further issues.

2. Using the CRA Mobile App

If you prefer using a smartphone, the CRA mobile app is your tool. With seamless navigation and a user-oriented interface, responding to a reassessment is easy.

- Download the CRA Mobile App from your smartphone's app store.

- Login using your account. If you don't have one, create it.

- Once inside, go to the “Taxes” tab and select “Reassessment”.

- Read your reassessment details and prepare a response.

- Use the “Reply to CRA” option to submit your response.

As with the website, ensure your response is comprehensive and supported with appropriate documents.

3. Using the CRA Call Centre

Another option to consider if dealing with technology isn't your forte is the CRA call centre.

- Find the relevant phone number on the CRA Contact page.

- Keep your tax papers handy for reference during the call.

- Once connected, explain your situation to the representative. They will guide you on the next steps.

While this method may include longer wait times and limited hours of service, it offers personalized guidance.

Conclusion

Reacting appropriately to a CRA reassessment is crucial in maintaining a clean tax profile. This guide provides you with the knowledge to make the right choice among the options available to you. Reach out to CRA via their website, mobile app, or call centre to ensure you’re complying with all due obligations.