How To Download Notice Of Assessment From Cra

>

>Introduction

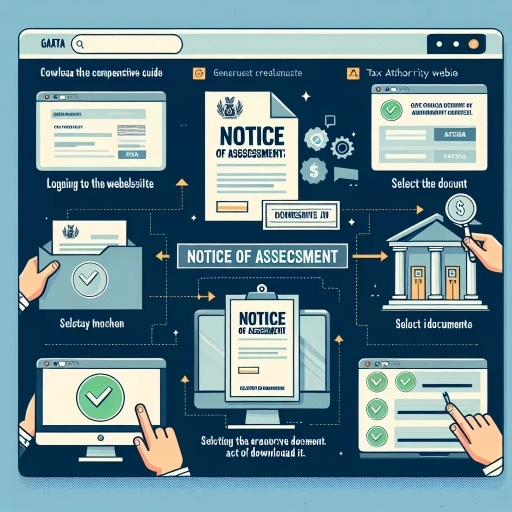

The quest for tax information can often lead one on a seemingly endless search through the maze of government bureaucracy. One of the documents Canadian taxpayers commonly seek is the Notice of Assessment (NOA) from the Canada Revenue Agency (CRA). Luckily, the Canadian government makes this document readily available through various methods, including website, mobile app, and call centre. This guide will provide a step-by-step process to obtain your NOA using these three options.

Option 1: Downloading your NOA from the CRA Website

The most popular method to download your NOA is through the CRA website. The steps include the following:

- Visit the CRA's official website:http://www.canada.ca/en/revenue-agency.html

- Click on 'Sign in to a CRA account'.

- Select the 'CRA login' button.

- Input your user ID and password, then click 'Login'.

- Under 'Related Services', select 'View mail'.

- You can find your NOA under the 'Your Income Tax and Benefit Return'

- Click 'Download NOA' to save it on your device.

Option 2: Using the CRA Mobile App

The CRA has made it even more convenient for taxpayers through its mobile app. You can download your NOA with the following steps:

- Download the CRA's 'My Account' mobile app through Google Play or the Apple App Store.

- Launch the app and select 'Sign in to My Account'.

- Enter your user ID and password to log in.

- In the app dashboard, click on 'Tax Returns'.

- Select the 'Notice of Assessment' option.

- Choose the notification you want to view then select 'Download NOA'.

Option 3: Obtaining your NOA through the CRA Call Centre

If you're more comfortable speaking with someone directly, the CRA call centre is a further option to access your NOA. Here are the steps:

- Phone the CRA call centre at 1-800-959-8281.

- Prepare your SIN and some personal identification information for verification.

- Request for your NOA. The agent will mail it to your registered address.

Conclusion

While initially daunting, accessing your Notice of Assessment doesn't need to be a difficult task. Whether you prefer surfing the net, scrolling your mobile screen, or making a phone call, the CRA has made it easy for you. Always ensure your contact details are up to date with the CRA, allowing for easy access and communication of your tax documents.