How To Pay Mississauga Property Tax Online

Follow Currency Mart April 4, 2024

Where to purchase Foreign Currencies?

>

>Understanding and Paying Your Mississauga Property Tax Online

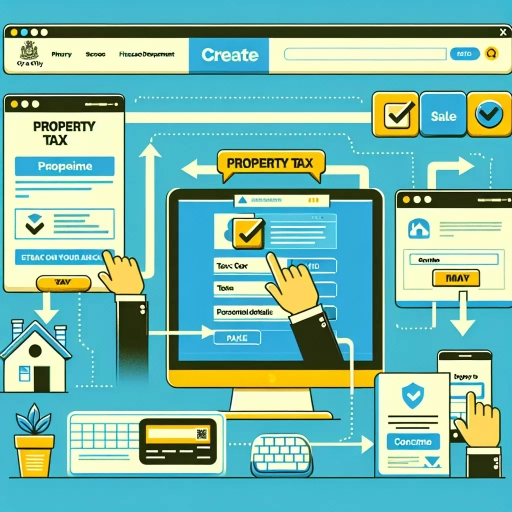

Mississauga, one of Canada's busiest metropolitans, ensures convenience when it comes to paying your property taxes. This article will guide you on how to navigate this process online, with a step-by-step guide for the city's safe, secure, and simple payment procedures.A Brief Overview of Property Tax in Mississauga

Property tax in Mississauga is determined by two key components: the assessed value of your property and the city’s tax rate. The assessed value reflects the property's market value, while the tax rate consists of rates set by the City of Mississauga, the Region of Peel, and the Province of Ontario for education purposes. For the latest tax rates, you can refer to the Mississauga city website.Setting Up Your Online Account

To begin, you need to create an online account on the City of Mississauga website. Here's how: 1. Visit the city's official website and click on "Register". 2. Fill in the required details including name, address, and email. 3. Click on "Create Account" and follow the instructions to verify your email and activate your account.Connecting Your Property Account

Once the account is activated, property owners need to link their property account to access their tax information online. 1. Log in to your account. 2. Under the My Accounts section, select "Add an Account". 3. Choose “Property Tax” and enter the 19-digit roll number found on your property tax bill.Accessing Your Property Tax Information

With your property tax account linked, you can now view your property tax information, including your billing history, upcoming due dates, and payment status.Pay Your Mississauga Property Tax Online

1. From your online account dashboard, click on 'Property Tax'. 2. Choose 'Make a Payment'. 3. Enter the payment amount and choose a payment method. 4. For online banking, select your bank from the list and log into your online banking account to complete the transaction. 5. For credit cards, input the card details and proceed to make a payment. A processing fee may be charged.Setting Up Pre-Authorized Payment Plan

Mississauga offers a pre-authorized payment option, which allows your property tax payments to be automatically withdrawn from your bank account on the designated dates. To sign up, select “Pre-Authorized Tax Payment” within your property tax account and follow the prompts.Online Property Tax Payment – Tips and Reminders

1. Payments should be made in Canadian funds. 2. Online property tax payments require at least 3-5 business days to process. Ensure you make your payment well before the due date. 3. Keep a record of your transactions for future reference.Customer Support for Online Tax Payments

If you encounter any issues or need assistance with your online tax payment, the City of Mississauga offers customer support. You can get in touch via email, phone, or visit the City Hall counter for in-person guidance.Conclusion

Paying your Mississauga property tax online is a simple and convenient process. Ensure you keep track of your payments and due dates to avoid late penalties. With these steps, you can easily navigate the City of Mississauga’s online tax payment system.

Where to purchase Foreign Currencies?