How Do Banks Exchange Foreign Currency

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Introduction

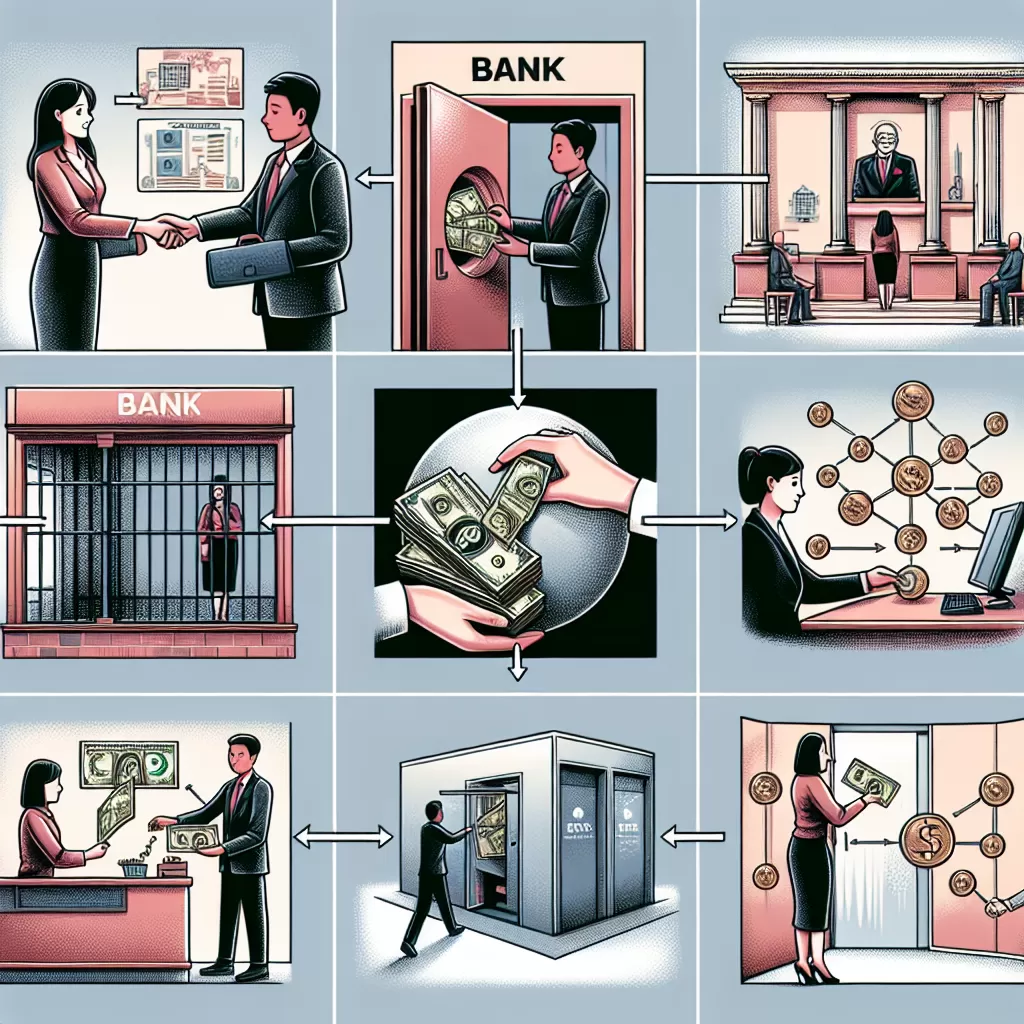

The realm of currency exchange is as vast and complex as it is influential, directly impacting economies and individuals worldwide. At the heart of this whirlwind are banks, the chief guardians and it isinstrumental in facilitation of exchange between currencies of different countries. This article delves into the depths of how these financial behemoths operate in foreign currency exchange.The Mechanics of Foreign Currency Exchange in Banks

It starts at a fundamental level. Banks are endowed with the responsibility of dealing in foreign currencies, whether it be for individual customers, businesses, or to balance their own financial portfolios. They purchase currencies from the international foreign exchange (FOREX) market, a decentralized global platform where currencies are traded 24/7. When you exchange your dollars for euros or yuan at the bank, you're tapping into this vast, global marketplace. Banks use the exchange rates listed in the FOREX market as a benchmark and add a margin or spread as compensation for providing this service to clients. This spread fluctuates throughout the day in response to changes in global supply and demand for different currencies.The Influence of Interest Rates

Central Banks play a critical role in the foreign currency exchange game, too. They set their country's interest rates, and these rates directly impact the value of that country's currency on the international FOREX market. Higher interest rates tend to attract foreign investment, boosting the demand and value of the local currency. On the contrary, lower interest rates can dissuade foreign investment and depreciate the currency's value.The Magic of Currency Pairs

In foreign currency exchange, currencies are traded in pairs – one against the other. The pair's exchange rate reflects the value of the first (base) currency, expressed in terms of the second (quote) currency. For example, if the exchange rate for CAD/USD is 0.75, then 1 Canadian dollar can buy 0.75 US dollars. Exchange rates can be driven by a multitude of factors, from economic indicators and market sentiment to political instability and natural disasters. All of these elements can affect the supply and demand for a particular currency pair and influence the rate at which they're traded on the FOREX market - and ultimately the rate offered to bank clients.Minimizing Exchange Fees

While it seems like the house always wins with those pesky exchange fees, there are strategies and spells to reduce the cost of your currency conversions. Shopping around for the best rates and being flexible with the timing of your exchange can help because the most favourable rates and lowest spreads are typically found when supply for a particular currency is high and demand is low. Online currency converters are excellent tools for tracking these ever-changing rates. Another way to minimize fees is to use a bank with which you have an existing relationship. Some banks may reduce or even waive their exchange fees for loyal customers. Finally, consider using digital, peer-to-peer exchange platforms as they may provide better rates and lower fees because they tend to have lower operating costs compared to traditional banks.Conclusion

The world of foreign currency exchange within banks can be full of twists, turns and fluctuations, but it's a vital part of the global economic machine. Understanding the mechanics behind it — from the influence of central bank interest rates to the strategies for minimizing conversion fees — equips you with the tools to navigate this intricate realm effectively.

Where to purchase Foreign Currencies?