How To Increase Credit Limit Bmo

How to Increase Your Credit Limit with BMO: Comprehensive Guide

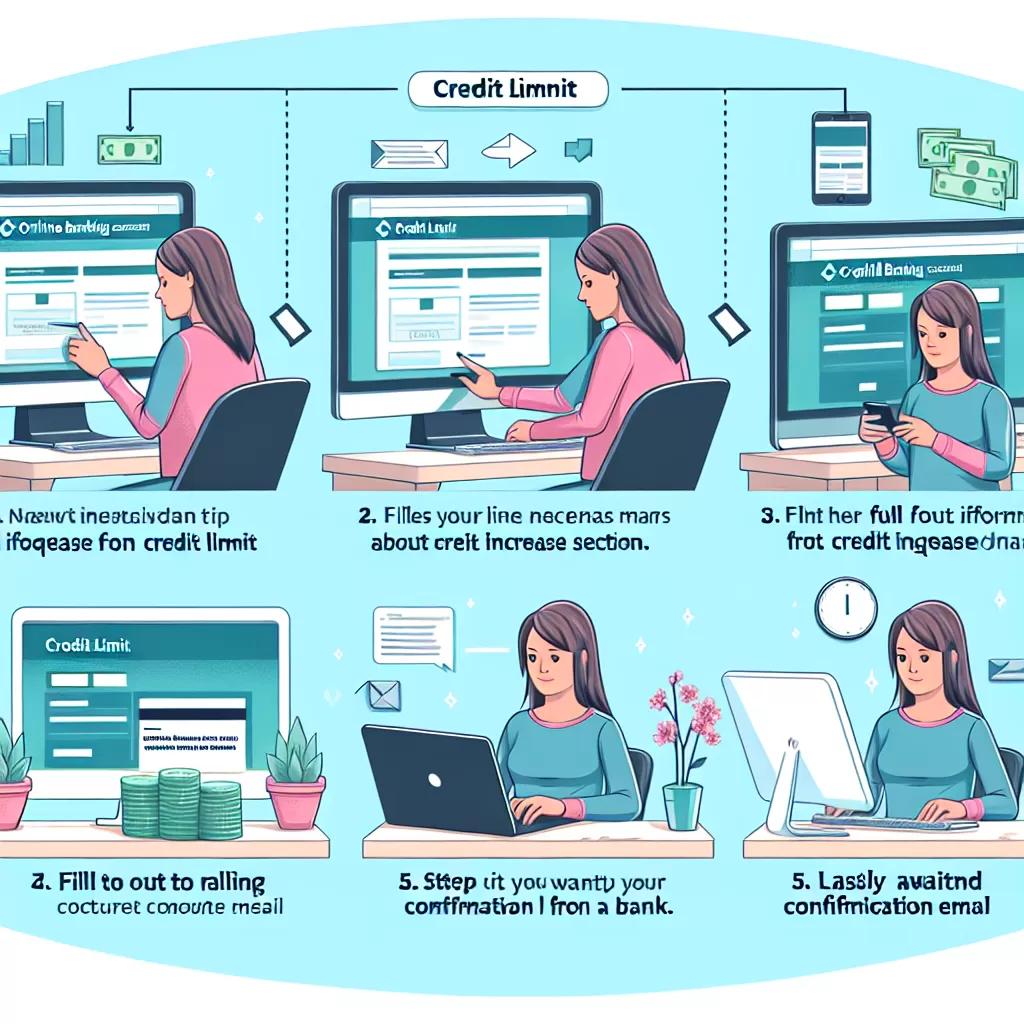

Are you looking to raise your credit limit with the Bank of Montreal (BMO)? Be it for emergency purposes, more purchasing power, or improving your credit score, this comprehensive guide will assist. We detail the three primary routes you can follow: online banking, mobile app, and customer service call.

Option 1: Increasing Your Credit Limit through BMO Online Banking

BMO online banking provides a straightforward pathway to raise your credit limit. The optimized platform offers a user-friendly interface to navigate this process. Here’s a step-by-step guide:

- Log into your BMO online banking account

- From your account dashboard, select "Account Management"

- Under “Account Management”, you’ll find an option for "Increase Credit Limit"

- Choose the credit account you wish to increase the limit for

- Input the new credit limit request and provide the required financial information, if asked

- Review your submission and hit "Submit"

Please note approval of your credit limit increase will depend on your credit history, income, and other financial considerations.

Option 2: Using the BMO Mobile App to Increase Your Credit Limit

If you're an active smartphone user, you might find the BMO Mobile App more convenient. Here’s how to increase your credit limit on the app:

- Open your BMO Mobile App and sign in

- Select "More" from the main menu

- Then, choose "Manage Credit Card"

- Click on "Manage Credit Limit" from the list

- Enter your preferred new credit limit

- Review your information and confirm your request

Again, your request's approval is subject to your financials and BMO's discretion.

Option 3: Call BMO Customer Service for a Credit Limit Increase

If you prefer a personalized approach, consider speaking with a BMO representative. Here’s how:

- Call the BMO customer service number at 1-800-263-2263.

- Choose the option to speak with a representative regarding credit account changes.

- Once connected, express your desire to increase your credit limit.

- They’ll ask for personal and financial information to evaluate your request.

This process has the advantage of letting you immediately ask questions or raise concerns. However, like the other methods, approval comes down to financial criteria and bank policies.

In conclusion, BMO provides multiple avenues for account holders to adjust their credit limits. Remember to handle increased credit responsibilities wisely to maintain a healthy credit score.

Please note that it's crucial to increase your credit limit responsibly, as this can impact your credit score. Always speak with a financial advisor or BMO representative if you're unsure about any aspect of your credit management.