How To Apply For Overdraft Bmo

How to Apply For Overdraft Protection: A BMO Guide

In an increasingly digital world, certain traditional banking features, like overdraft protection, continue to be an essential tool for managing our financial lives. Considered by many as a financial safety net, it gives the assurance that, if ever you find yourself a little short on money, your checks will still clear, and debit transactions will continue to go through without the harsh materialization of NSF (Non-Sufficient Fund) fees.

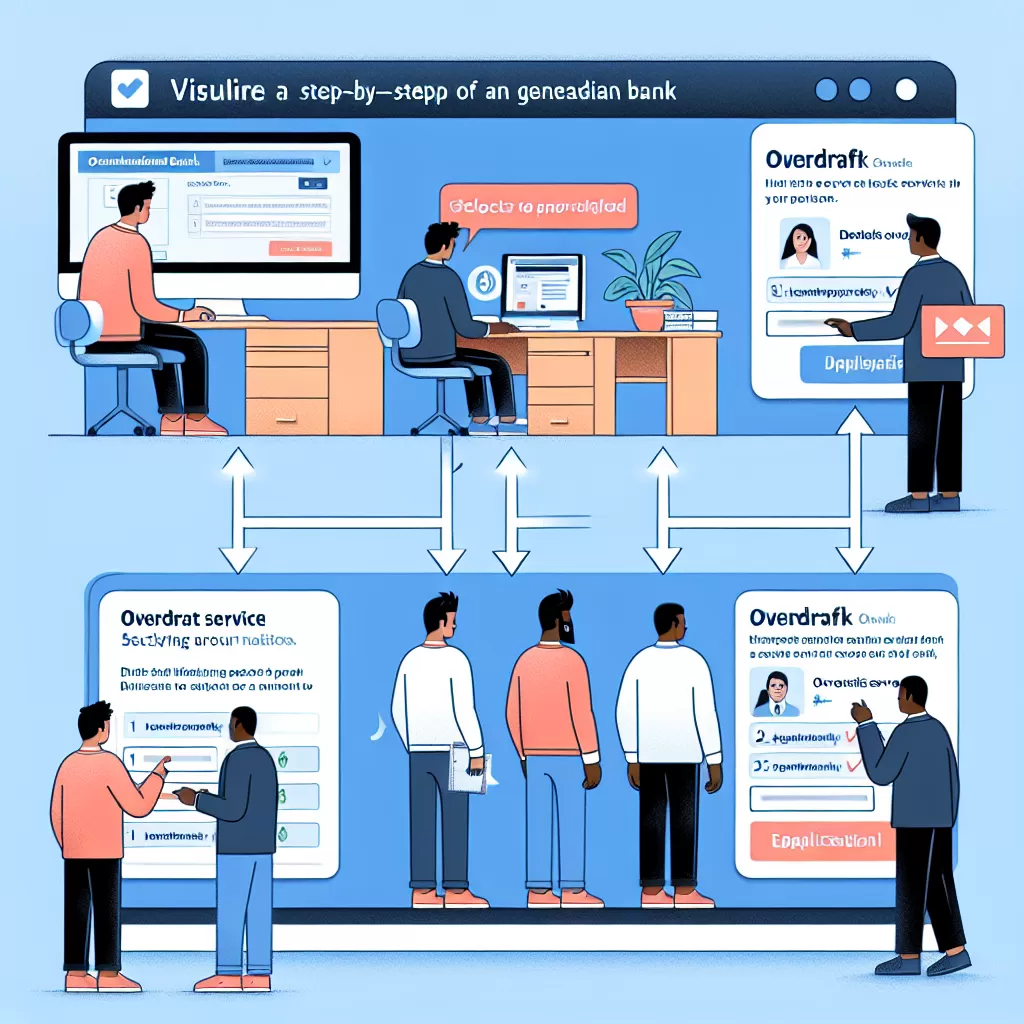

This article will guide you through the process of applying for overdraft protection with The Bank of Montreal (BMO). You will be guided through three avenues - online banking, the mobile app, and customer service.

Online Banking

Online banking provides a convenient means to manage your money, including the ability to apply for overdraft protection from the comfort of your home.

Step 1: Go to the BMO homepage and click on 'Login' at the top right. Enter your username and password to log into your online banking account.

Step 2: Navigate to the 'Accounts' section.

Step 3: Look for the ‘Apply for Overdraft’ option. Complete the application form and click 'Submit.'

Mobile App

With the BMO mobile app, you can manage your funds easily, anywhere you are. Applying for overdraft protection can be done with just a few taps.

Step 1: Download the BMO Mobile Banking app from Google Playstore or the Apple App Store. Open the app and log in with your BMO online banking details.

Step 2: Navigate to 'My Accounts' section and select your checking account.

Step 3: Tap on ‘More Actions’ and choose ‘Apply for Overdraft’. Complete the form and tap 'Submit'.

Customer Service

If you are unable to apply for it online or prefer more personalized assistance, calling BMO’s customer service is a great option.

Step 1: Dial BMO’s customer service number – 1-844-837-9228.

Step 2: Speak with a representative to begin the process of setting up your overdraft protection. They will guide you through the entire process, step by step.

Conclusion

Overdraft protection is an excellent tool to safeguard against accidental overdrafts and the associated fees. With multiple ways to apply for overdraft protection with BMO, you can take proper steps right from your home or wherever you are, even on your mobile device. However, it’s essential to use your overdraft wisely and not to consider it as an extension of your income. By doing so, you can efficiently manage your financial safety net.