What Is The Variable That Links The Loanable Funds Market And The Foreign-currency Exchange Market?

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Introduction

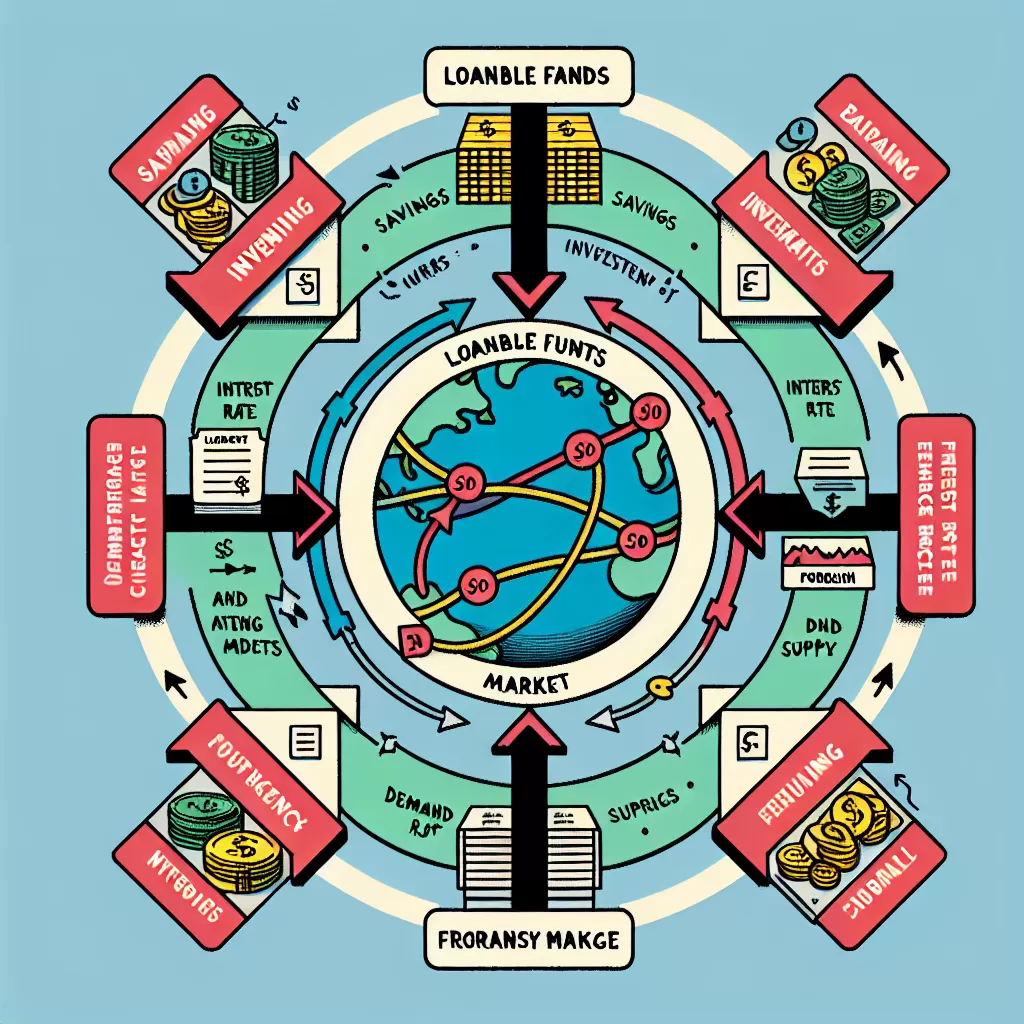

The global financial market is an intricate web of numerous interconnected sectors. Two significant sectors that investors, economists, and policymakers consistently monitor are the loanable funds market and the foreign-currency exchange market. Understanding both is essential, but it becomes more potent when we comprehend the variable that links them together.The Loanable Funds Market

The loanable funds market denotes the global market where borrowers and lenders come together. These participants can be individuals, businesses, or government entities seeking to borrow or lend funds for various reasons. Activities in the loanable funds market shape interest rates – a pivotal variable determining the cost of borrowing or the returns on lending.The Foreign-Currency Exchange Market

On the other hand, the foreign-currency exchange market encapsulates the global platform where the exchange of one currency for another takes place. Here, the prices of currencies, denoted by their exchange rates, are determined. The foreign-currency exchange market, like the loanable funds market, is influenced by a plethora of socio-economic and political factors, making it constantly fluctuating.The Linking Variable: Interest Rates

The fundamental variable linking the loanable funds market to the foreign-currency exchange market is interest rates. Interest rates impact both these markets which in turn affects the global economy. In the loanable funds market, interest rates reflect the cost of borrowing. Higher interest rates lead to costlier borrowing, hence discouraging individuals and businesses from taking loans. Conversely, lower interest rates make borrowing cheaper, incentivizing taking on more debt. In the foreign-currency exchange market, interest rates significantly affect how attractive a country's currency is to foreign investors. Higher interest rates can lead to an appreciation of the currency as it offers higher returns to investors, leading to an increased demand. Conversely, a drop in interest rates can depreciate a currency due to decreased foreign demand.The Dynamics of Interest Rates

Understanding the dynamics of interest rates provides critical insight into the link between these markets. For instance, if Canada's interest rates were to increase relative to other countries, its loanable funds market would become less appealing for borrowers due to higher borrowing costs. Simultaneously, the Canadian dollar might appreciate in the foreign-currency exchange market. The higher returns on Canadian bonds and other interest-bearing assets attract international investors, which increases demand for the Canadian dollar. This increased demand leads to the appreciation of the currency.Ripple Effects in the Economy

Changes in interest rates not only link the loanable funds market and the foreign-currency exchange market, but also create ripple effects in the entire economy. Variations in interest rates can lead to altered consumption patterns, investment decisions, inflation rates, and overall economic growth. Moreover, this continuous interplay creates a loop where the outcomes in one market affect the other. For example, an appreciation of currency due to high interest rates can then dampen the demand for exports due to increased prices, which might subsequently affect the loanable funds market.Conclusion

In summary, the seemingly complex linkage between the loanable funds market and the foreign-currency exchange market boils down to the dynamics of interest rates. By understanding this connection, investors, policy-makers, and observers can make informed decisions and predictions about economic trends and risks. The dance of numbers and values across borders then turns from a mystery into a harmonious symphony of global finance.

Where to purchase Foreign Currencies?