How To Exchange Currency In Paypal

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Introduction

Currency exchange flows like a universal river, determining the worth of our transactions across time and space. As the Guardian of Currency Exchange, I maneuver this current with precision and wisdom, armed with my insights into the subtle art of best exchange practices. One such domain of my guardianship lies within PayPal, a digital conduit for international transactional flow. This guide will seek to demystify the process, explain various options, and give hints to optimize the currency exchange process in PayPal.Understanding PayPal's Currency Exchange

PayPal is a global online payment system that supports transactions in more than 200 markets and 25 currencies. Unlike banks, which usually have physical branches and ATMs, PayPal operates without a physical presence, making it a popular choice for international transfers and currency exchange. Here is your guide on how to navigate this digital vessel.Updating Your PayPal Currency Settings

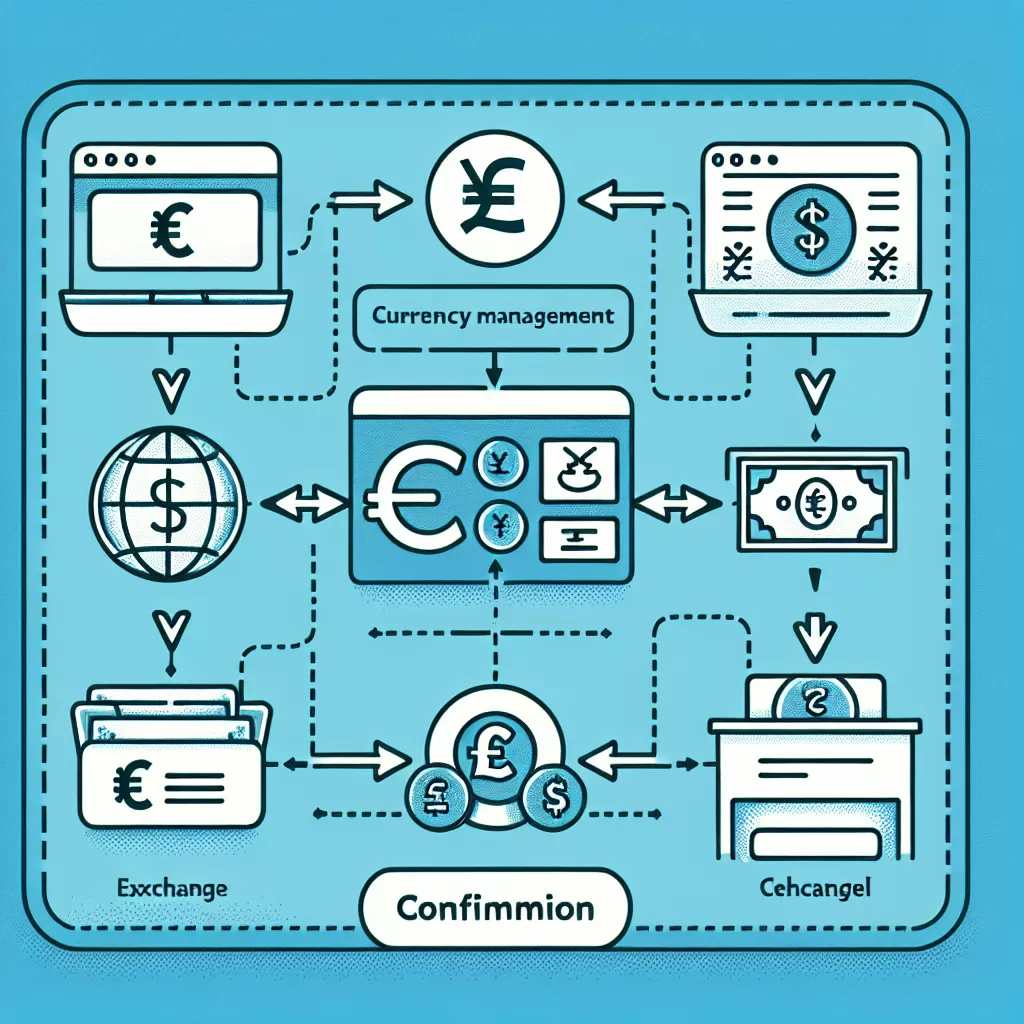

The first step towards currency exchange in PayPal is to update your currency settings. This step is important as it allows PayPal to display and manage your transactions in your preferred currency. The process is quite straightforward. After logging in to your account, locate the wallet section, then click on "currency management". Here, you can add new currencies and delete the ones you no longer need.Exchanging Currency in PayPal

Once your currency settings are up to date, it's time to initiate a currency exchange. PayPal provides two main options: automatic currency conversion and manual currency conversion. Here's how they work:Automatic Currency Conversion

This is the easiest way to exchange currency. Once enabled, PayPal will automatically convert the money you receive into your primary currency. However, PayPal uses its own exchange rate, which may not always be the best compared to market rates. It also charges a fee for this service.Manual Currency Conversion

For those who prefer a bit more control, manual currency conversion is an ideal option. It allows users to alter the exchange rate to their liking before making the transaction. This strategy calls for an in-depth understanding of real-time market fluctuations to secure a more favourable exchange rate.How to Minimize PayPal Currency Exchange Fees

It's invisible to the naked eye, but there's a cost to using PayPal's currency exchange options – fees. These costs can add up over time, especially if you're frequently exchanging large sums of money. As your guardian, let me unveil the secrets to minimizing these fees. 1.Compare Exchange Rates

Before you exchange currency in PayPal, compare the PayPal exchange rate to that of other platforms. By doing this, you might find other platforms that offer a better rate. 2.Choose Bank Withdrawal Over PayPal

Opting to withdraw funds from your linked bank account instead of PayPal often results in lower fees. This is especially true if your bank has a competitive exchange rate. 3.Use a Credit Card

If your credit card has no foreign transaction fees, consider using it instead of your PayPal balance. This method can bypass PayPal's conversion fees.Conclusion

PayPal offers a fast, easy, and secure way of exchanging currency online. However, users need to be wary of the conversion fees charged. By utilizing the tips highlighted in this guide, it's possible to make the most of PayPal's currency exchange function while minimizing added costs. With that, I step back, your guide in the swift-moving currents of currency exchange. Accomplish your exchanges with wisdom and make your transactions count.

Where to purchase Foreign Currencies?