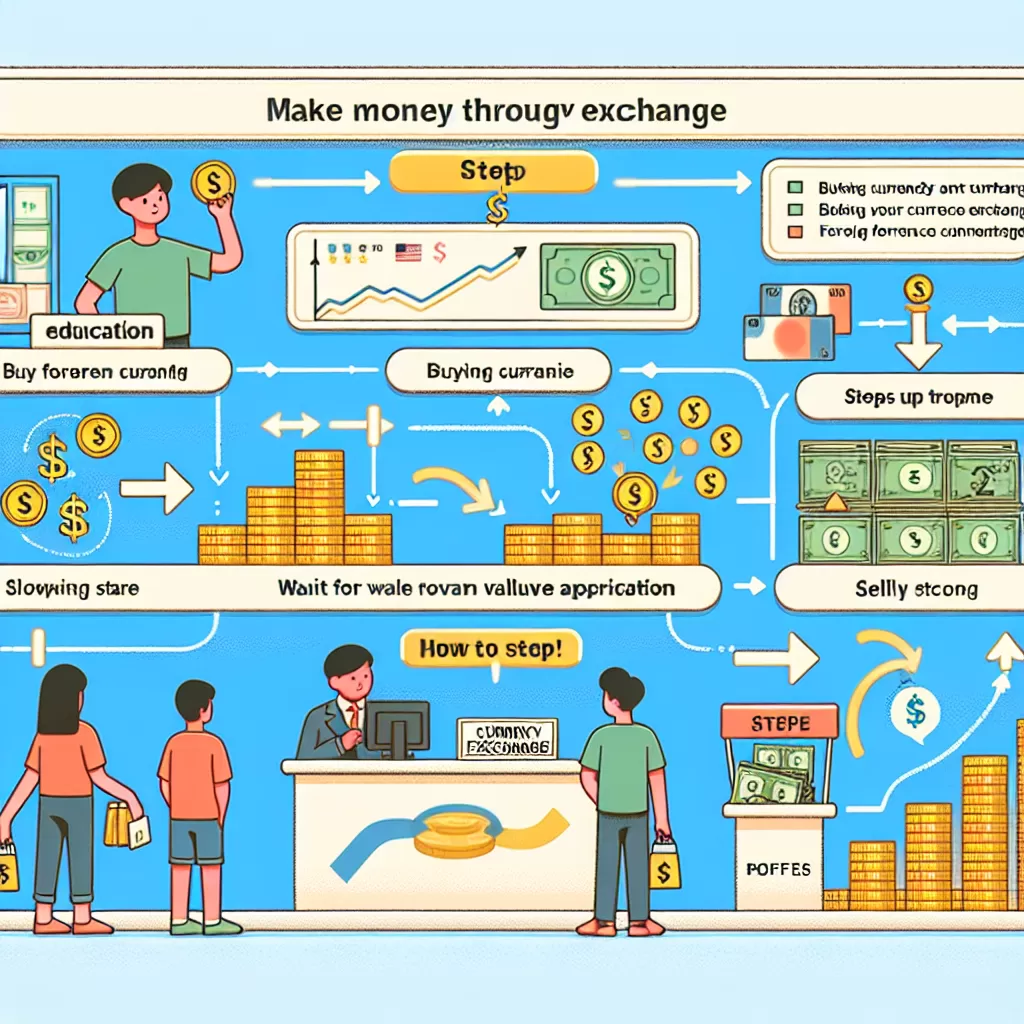

How To Make Money In Currency Exchange

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Introduction to Currency Exchange

Currency exchange, the practice of buying and selling various currencies, serves as the foundation of the modern financial world. It forms the basis of international trade and plays a vital role in economic growth by providing liquidity and accessibility between different countries. Whether you're traveling, investing, or running an international business, understanding the dynamics of currency exchange is essential. But did you know it's also a platform to make money? In this article, we'll discuss the strategies and methods to profit from currency exchange.Understanding the Basics

The currency exchange market is vast, so it's important to understand its basics before diving headfirst into trading strategies. Exchange rates fluctuate based on economic factors such as inflation, interest rates, and geopolitical events. By accurately predicting these changes, investors can buy currencies at a low price and sell them at a higher price, thereby making money.Engage in Forex Trading

Forex trading, or foreign exchange trading, is the most popular method to make money in currency exchange. In this platform, currencies are traded in pairs, and the objective is to speculate whether one currency will strengthen or weaken against the other. Forex trading requires market research, careful planning, and a keen understanding of financial indicators. It's a high-risk strategy but the rewards can be significant.Open a Currency Exchange Bureau

Setting up a currency exchange bureau or a money changer shop can be another viable strategy. These services cater to travelers needing to exchange currencies, offering competitive rates while making a profit from each transaction. Running a bureau requires a significant upfront investment but it provides a steady income stream once established.Invest in ETFs and Mutual Funds

Investing in Exchange Traded Funds (ETFs) and Mutual Funds that focus on foreign currencies is a less hands-on method to make money in currency exchange. These funds invest in a portfolio of different currencies and enable investors to spread their risk. It's a suitable strategy for those with less time to dedicate or who prefer a long-term investment approach.Consider International Bonds

Purchasing International bonds can be a savvy strategy. These bonds are issued in different currencies, and as the exchange rates fluctuate, the bond's value does as well. By strategically buying and selling these bonds based on exchange rate predictions, one can reap rewards.Try Currency Options Trading

Options trading is another method used by advanced investors. A currency option is a contract giving the holder the right (but not the obligation) to buy or sell a currency at a specific price within a specific timeframe. This strategy can offer high returns but requires a comprehensive understanding of the markets and a higher risk tolerance.Employ Carry Trade Strategy

The carry trade is a strategy where an investor borrows a currency with a low interest rate and uses it to purchase another currency yielding higher interest. The difference in interest rates will result in a profit for the trader. It's a complex strategy, suited for experienced investors with a good understanding of interest rate fluctuations and currency market dynamics.Conclusion

Making money with currency exchange is no easy venture; it demands ample knowledge, precision, calculation, and of course, some risk. Whether you're a savvy financial investor or a novice eager to diversify your portfolio, the strategies outlined here could pave your way to profitability in the vast realm of currency exchange. Remember, like any investment, the key to success lies in continuous learning, patience, and strategic planning.

Where to purchase Foreign Currencies?