What Is The Best Way To Exchange Currency

The Best Ways to Exchange Currency: A Comprehensive Guide

Whether you're traveling abroad, making overseas payments, or investing in foreign markets, you need to understand how currency exchange works. Deciphering the best ways to exchange currency implicates evaluating factors like convenience, costs, and exchange rates. This article explores your options.

Banking Institutions

Traditional banks are the go-to for many when it comes to currency exchange. From a local community bank to a large national institution, most offer this service.

Advantages include ease, as you're likely already a customer, and security, as banks are regulated entities. However, banks may not always offer the best exchange rates. Similarly, transaction fees can be comparatively high, particularly for small amounts. Therefore, it's crucial to enquire about both aspects beforehand.

Credit and Debit Cards

Credit or debit cards can provide a seamless way to access foreign currency. When used at foreign ATMs or point-of-sale, your home currency is automatically converted.

However, consider both your card issuer's foreign transaction fees and the ATM's own charges. Also, note that some card companies use their own exchange rates, potentially less favourable than market rates.

Online Money Transfer Services

Online money transfer services have emerged as a popular option due to their competitive rates. Companies like Wise (formerly TransferWise) or Revolut directly deal with currency exchanges following real-time exchange rates.

These platforms allow for quick transfers and minimal transaction fees. However, both parties must be registered with the service, and setup might require additional time and verification.

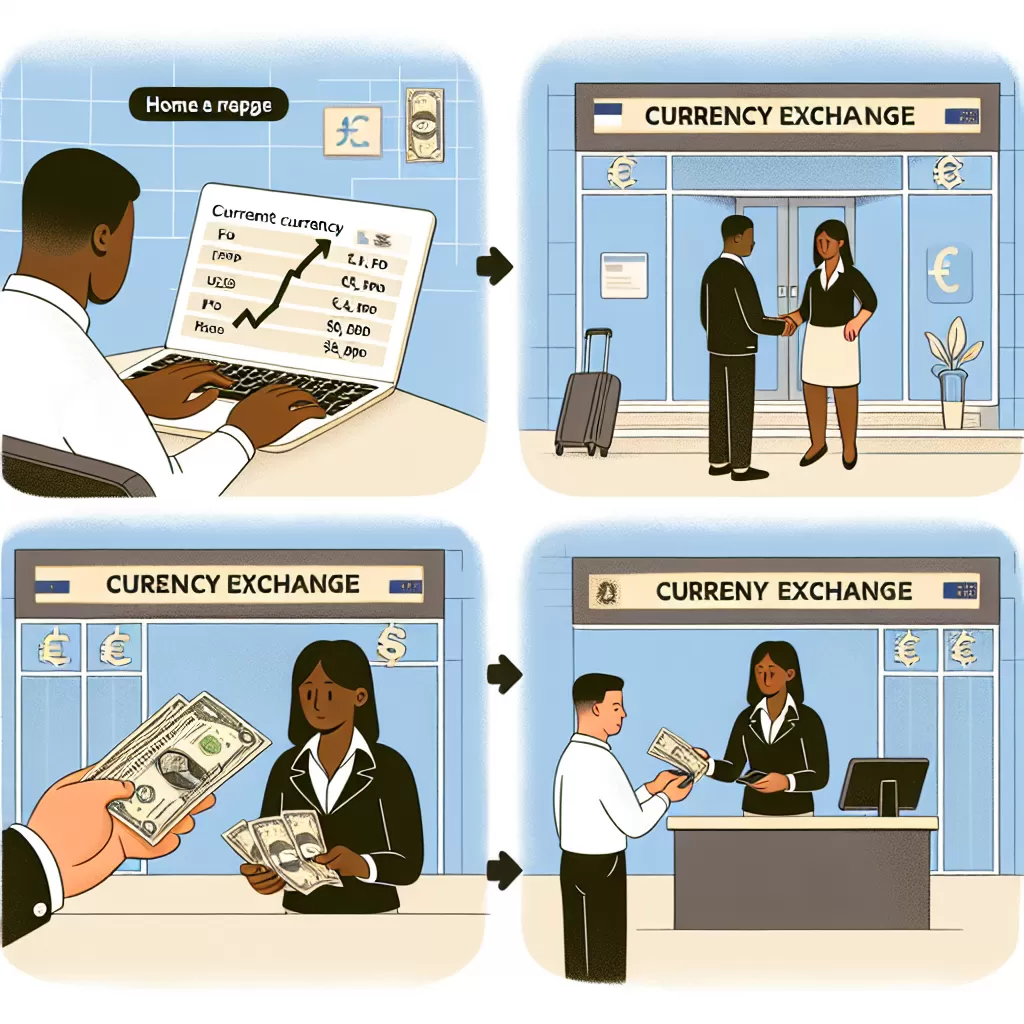

Bureaux de Change

Bureaux de Change, or currency exchange offices, are often conveniently located in airports and tourist centres. These bureaus can offer competitive rates for tourists.

Despite their convenience, it's crucial to be aware of potentially high service charges. Always compare rates and fees beforehand, and ensure they’re regulated by the appropriate financial authorities.

Decentralized Exchange Platforms (DEX)

Emerging with the rise of cryptocurrency, decentralized exchange platforms like Uniswap or 1inch allow you to switch between different digital assets at market rates. DEXs employ blockchain technology to bypass currency exchange fees, making them increasingly popular.

But remember, they’re typically more complex and come with their own fees. Plus, the volatility of digital currencies may present financial risks.

Foreign Currency Exchange-Traded Funds (ETFs)

For investors, foreign currency ETFs permit benefiting from currency fluctuations without directly buying foreign currencies. These ETFs mimic the performance of a specific currency or group of currencies.

Keep in mind, ETFs involve brokerage commissions and fund management fees. Make sure you understand these fees and the risks associated with currency fluctuation before investing.

Conclusion

Choosing the best method to exchange currency depends on your individual circumstances. Carefully consider the rates, fees, convenience, and potential financial risks associated with each option. Always monitor the markets and consult a financial advisor before making significant currency exchanges. In the realm of currency exchange, knowledge remains your greatest asset.