How To Get T1 General From Cra Account

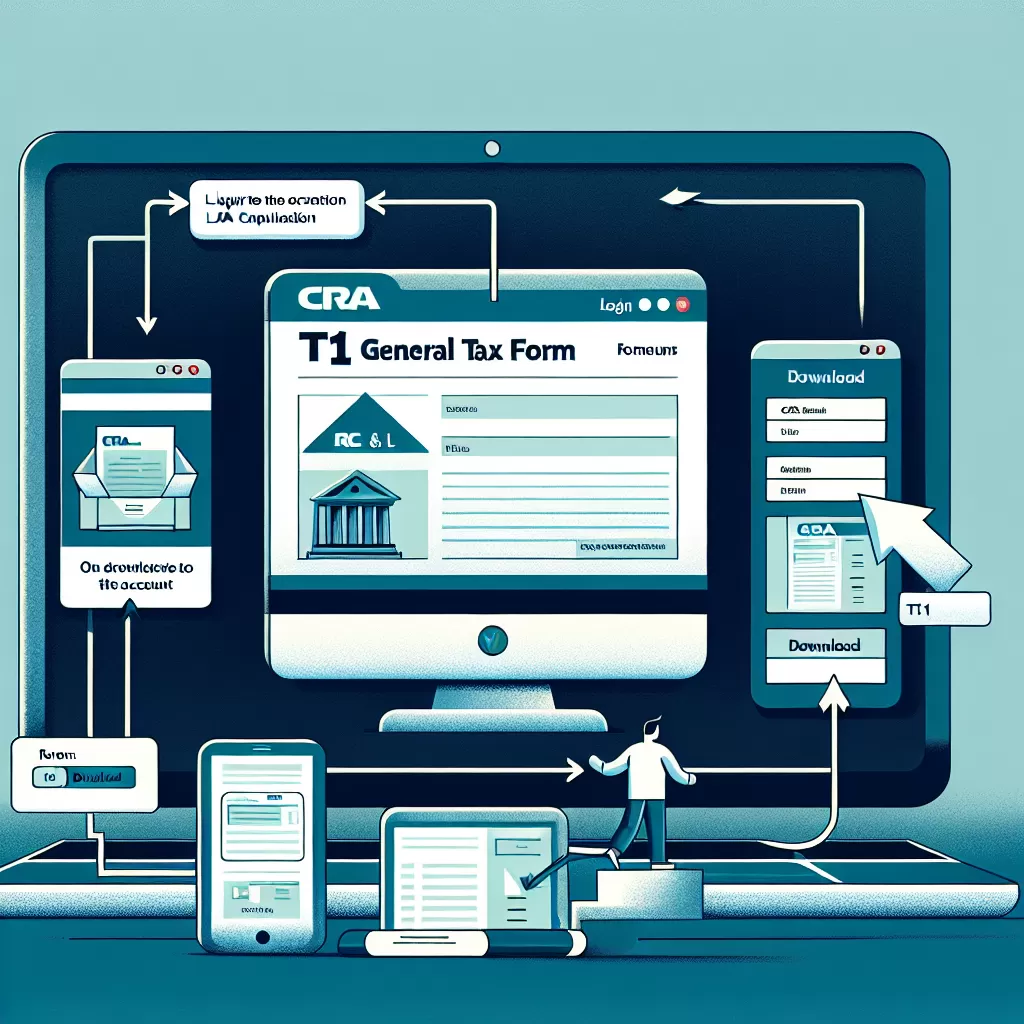

Guide to Getting T1 General from CRA Account: Website, Mobile App, and Call Centre Options

Are you looking to retrieve your T1 General from your Canada Revenue Agency (CRA) account but unsure of how to proceed? This comprehensive guide will walk you through three distinct options: through the CRA website, the mobile app, and the call centre.

Option 1: CRA Website

To get your T1 General through the CRA website, follow these simple steps:

- Visit the CRA website and click on "Log in."

- Select the option to log in with a CRA user ID and password or use one of the sign-in partners.

- Enter the necessary credentials to access your account.

- Navigate to the "T1 General" section in your account.

- Click on the relevant tax year to view and retrieve your T1 General.

Remember, the CRA website typically updates its information regularly, so make sure you have the most up-to-date data when looking at your T1 General.

Option 2: CRA Mobile App

If you prefer navigating on mobile, here's how you can get your T1 General using the CRA's mobile app:

- Download and install the "MyCRA" mobile app from the App Store or Google Play Store.

- Open the app and log in using your CRA user ID and password, or use a sign-in partner.

- Once logged in, scroll down to the "Tax Returns" section.

- Look for the "T1 General" option, and select the appropriate tax year.

- From there, you can download and access your T1 General.

The mobile app provides the convenience of accessing your tax documents on-the-go, making this a popular option for many Canadians.

Option 3: CRA Call Centre

If you're more comfortable speaking to a CRA representative, the call centre option might be the best for you. Here's how:

- Dial the CRA's general inquiries line at 1-800-959-8281.

- After providing your Social Insurance Number, date of birth, and an amount you entered on one of your income tax and benefit returns, you will be connected to a CRA representative.

- Request for your T1 General, specifying the tax year you're interested in.

- The representative will guide you through the process, and you can ask for your T1 General to be sent via mail or via the CRA's online portal.

The call centre route, while more traditional, also has the benefit of personalized assistance in case you encounter difficulties or have specific questions.

Each of these three routes offer unique benefits catered to your comfortability with technology and personal preferences. No matter your choice, retrieving your T1 General from the CRA can be a simple and hassle-free process.