How Long Before Cra Garnish Wages

Understanding How Long Before The CRA Garnishes Wages: A comprehensive guide

When facing potential wage garnishment from the Canada Revenue Agency (CRA), it's crucial to understand the timeline and explore all available options. This article will explain how the CRA wage-garnishing process tailors and provide you with insights about your options, including using the CRA's website, mobile app, and call centre.

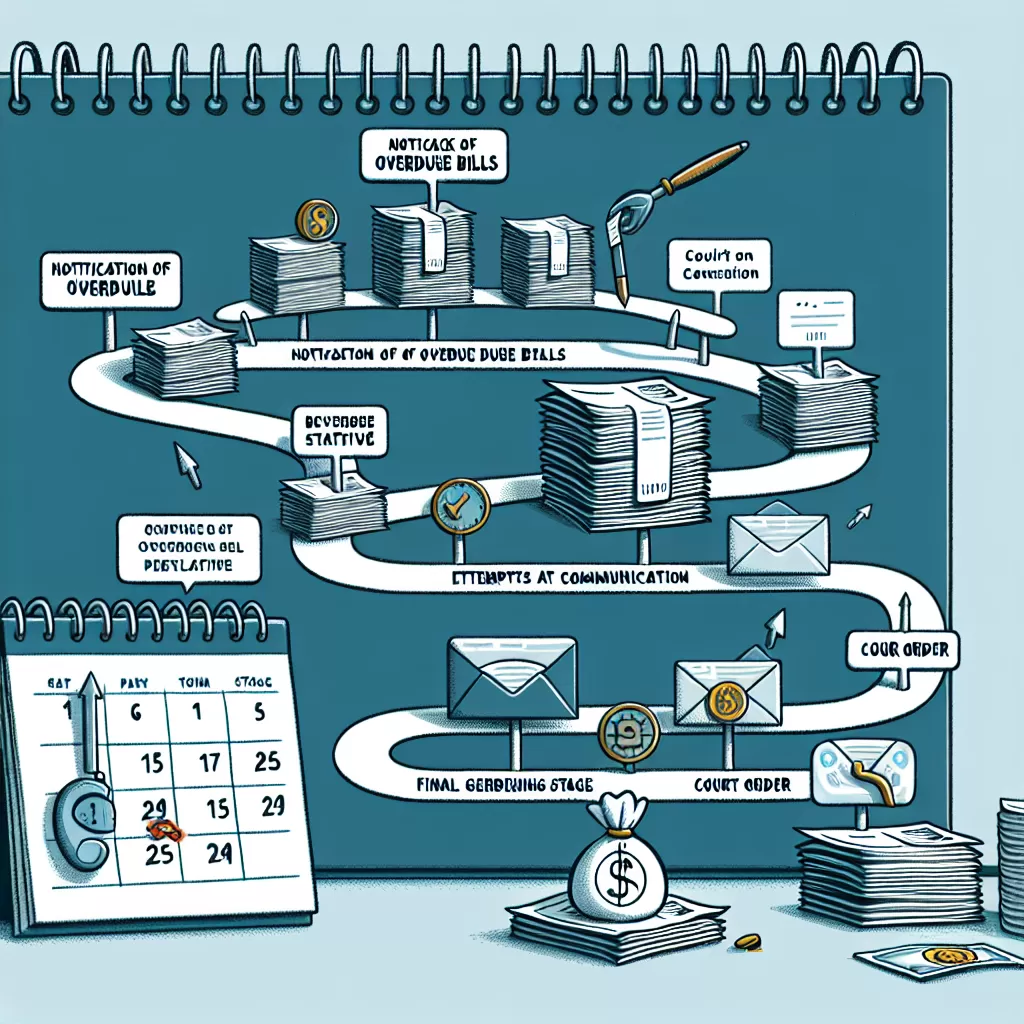

The CRA Wage-Garnishing Process

When collecting outstanding tax debts, the CRA doesn't seize wages at first notice. The process starts with a series of reminders, at which point the taxpayer has options to respond adequately to prevent further action.

If reminders are ignored, the agency will likely garnish your wages. Although timelines may vary based on individual situations, in most cases, wage garnishment can come into effect around six months after the initial reminder.

Exploring Your Options through the CRA Website

The CRA website provides various resources for taxpayers with outstanding debts. The options include submitting a payment or a payment plan proposal online, requesting taxpayer relief, or filing an objection.

By logging in to 'MyAccount,' you can track your tax debt status, make payments, and negotiate a payment plan. However, it's advisable to act swiftly and avoid last-minute rushes that could result in wage garnishment.

Using the CRA Mobile App

With the CRA mobile app, 'MyCRA,' managing your tax affairs becomes handier. You can view your account balance, set up a payment plan, and even make payments towards your owing directly from your smartphone.

Just like with the online portal, the mobile app provides an option to submit a proposal to negotiate a payment plan. However, remember to act promptly. Time is of the essence when dealing with potential wage garnishments.

Contacting the CRA Call Centre

If you prefer a more personalized approach or need further clarifications, reaching out to the CRA call centre can be a viable option. The call centre agents can guide you through setting up a payment plan or furnish you with more information about wage garnishment.

Ensure to have your Social Insurance Number (SIN) and recent Notice of Assessment ready when calling, to swiftly access your tax details. Once again, immediacy is critical to avoid wage garnishment.

In Conclusion

While it remains essential to understand how long the CRA takes to garnish wages, it's more vital to familiarize yourself with the available resources to handle this potential situation proactively. By leveraging the options on the CRA website, mobile app, or through their call centre, you equip yourself with the necessary tools to prevent or navigate wage garnishing.

Remember, the key to avoiding unexpected wage garnishment lies in promptly addressing any outstanding tax debts, preferably before it escalates to CRA reminders.