What Is The Variable That Links The Loanable Funds Market And The Foreign-currency Exchange Market?

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Introduction

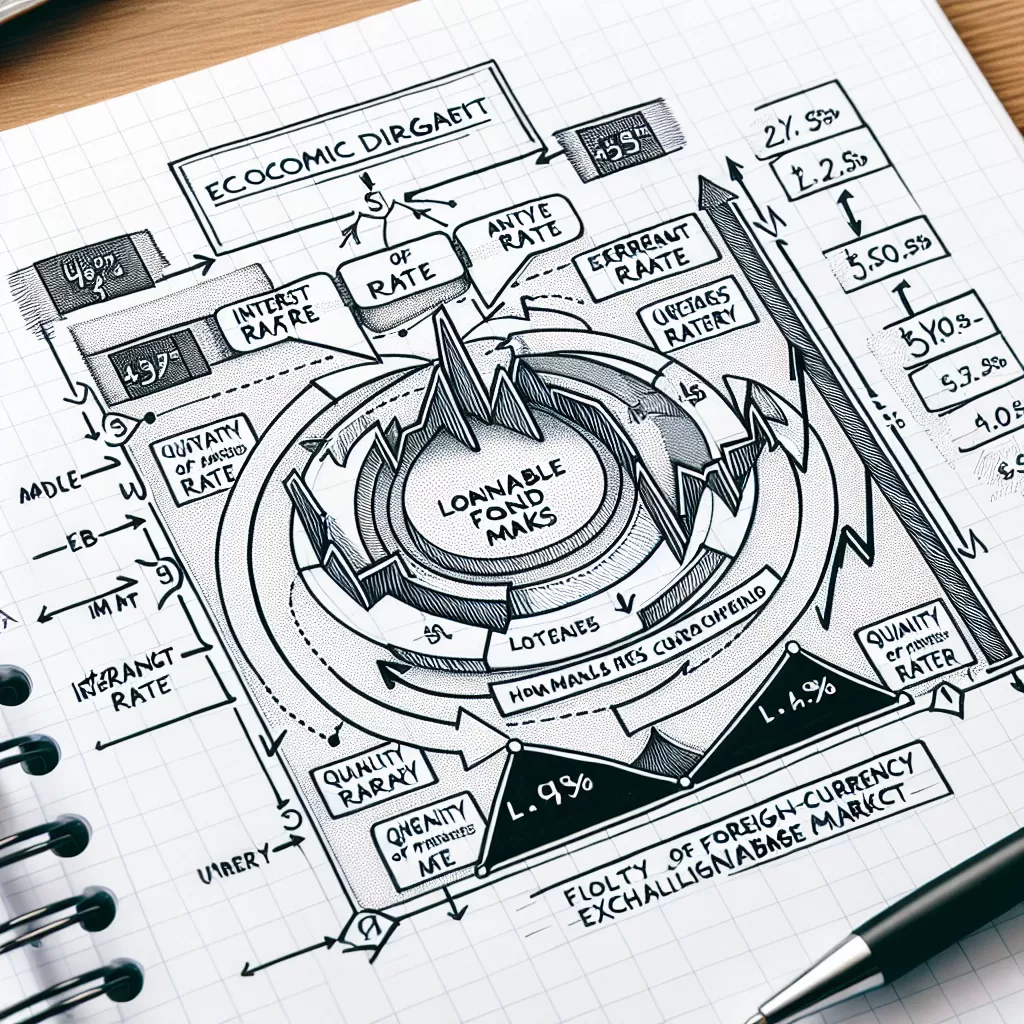

As the Guardian of foreign exchange, I enlighten individuals about two significant financial markets: the loanable funds market and the foreign-currency exchange market. At first glance, they may seem detached. However, a common variable links these two markets together - interest rates. To fully comprehend the relationship, it's necessary first to understand these two markets individually.The Loanable Funds Market

The loanable funds market is an economic model representing the available capital for loans at various interest rates. This market is not bound to a physical location. Instead, it exists as a conceptual field where lenders, often banks and other financial institutions, supply funds, and borrowers demand these funds. Interest rates play an essential role in this market. Theoretically, at lower interest rates, more potential borrowers would be enticed to take out loans, increasing the demand for loanable funds. Conversely, as the interest rate increases, the demand decreases as borrowing becomes more expensive.The Foreign-Currency Exchange Market

On the other hand, the foreign-currency exchange market (Forex) is a global arena for trading national currencies against one another. It operates around the clock, enabling constant conversion of currencies for trade and investment purposes. Similar to the loanable funds market, interest rates also play a vital role in the foreign exchange market. Exchange rates often fluctuate based on the difference in interest rates between the two nations' currencies. A country with higher interest rates can attract more foreign capital, strengthening its currency as demand for it increases.The Intersection: Interest Rates

Now, let's delve into the interest rate that links these two markets. Simply put, interest rates dictate the cost of borrowing and the return on savings. Varying interest rates have a direct impact on both loanable funds and foreign exchange markets.Interest Rates and Loanable Funds Market

In the loanable funds market, the interest rate acts as a price tag that balances the supply and demand for loanable funds. An increase in interest rates discourages potential borrowers as the cost of borrowing escalates. On the contrary, higher interest rates incentivize lenders, increasing the supply of loanable funds.Interest Rates and Foreign-Currency Exchange Market

Then, in the context of the foreign exchange market, interest rates represent a country's return on their money. When a country has higher interest rates compared to others, it tends to attract foreign investment. This influx of outside capital perennially increases the demand for the country's currency, subsequently escalating its value.Conclusion

In conclusion, the adjustable nature of interest rates allows these two markets to be intrinsically interconnected. Changes made in the policies that influence interest rates resonate through both markets indirectly. With this understanding, one can better navigate the global economic environment, making more informed financial decisions. These financial markets are sophisticated, so remember, the guardian of foreign exchange is always standing by to guide and assist.

Where to purchase Foreign Currencies?