How To Account For Foreign Exchange Gains And Losses

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Accounting for Foreign Exchange Gains and Losses: An Informative Guide

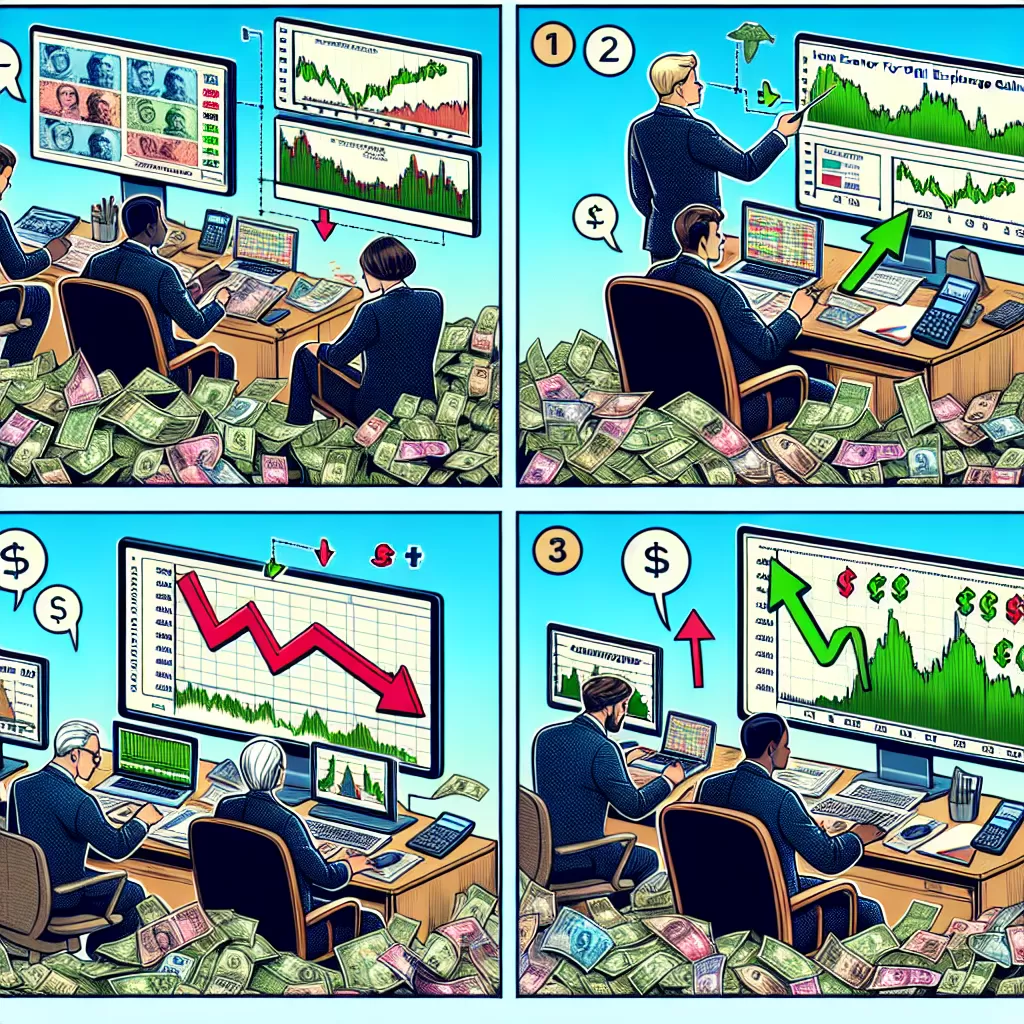

Navigating the ever-changing landscape of foreign exchange can be quite a task. Gains and losses become an integral part of the journey. Understanding how to account for these changes in an efficient manner can help fine tune your financial decisions.Understanding Foreign Exchange Gains and Losses

Foreign exchange gains and losses comprise the changes in value between the acquisition and the selling, or settlement, of currencies. The fluctuations can be traced to the dynamics of global economies and their inherent uncertainties. Having a clear understanding of these will allow you to devise effective strategies for gaining better control over your foreign exchange dealings.It All Starts With The Accounting Standard

The International Financial Reporting Standard (IFRS) and the General Accepted Accounting Principles (GAAP) provide a framework for handling foreign exchange gains and losses. Local elements factor into these regulations, so it’s important to have expert advice which is grounded in your geographical context.Transaction Date and Exchange Rates

Always remember that the transaction’s original date is crucial. When you first acknowledge a foreign exchange transaction in your books, you should record it at the exchange rate of that date. Therefore, keeping accurate records is paramount.Consider the Spot Rate

For monetary items such as cash or accounts payable and receivable, use the spot rate - the exchange rate of the currency on that particular day. This method is the most straightforward in updating your books. Non-monetary items like property and equipment have different rules for their respective initial and subsequent measurements.The End of The Financial Period

At the end of each reporting period, you should delineate both monetary and non-monetary items. Monetary items are retranslated using the year-end spot rate, and any differences found are treated as exchange gains or losses. Non-monetary items remain at the historical exchange rate, with no recalculations performed unless impairments need to be accounted for.Treatment of Gains and Losses

Depending on your jurisdiction, the foreign exchange gains and losses may be treated differently. While some consider them as revenue—consequently adding them to the income statement—others treat them as a separate component of equity. Ensure you're aware of the treatment procedures in your domain.Utilize Foreign Exchange Risk Management

By having robust forex risk management policies in place, you can mitigate the impact of unprecedented currency fluctuations. Two common methods include hedging financial risks using derivatives or locking in rates with forward exchange contracts.Conclusion

To effectively manage and account for foreign exchange gains and losses, understanding the intricacies of the foreign exchange market is essential. Turning this knowledge into a useable structure, incorporating practical methods and adhering to the standards set by accounting regulatory bodies will assist in navigating the foreign exchange landscape with confidence and ease. Navigating the bustling markets of foreign exchange gains and losses need not be a daunting task. Embrace the dance of numbers, let the values transform, and command the globe-spanning realm of foreign exchange. Let the Guardian guide you through the ancient exchanges of foreign markets to the modern online platforms. Your journey across borders begins here. Let's exchange.

Where to purchase Foreign Currencies?