People Use Money As A Medium Of Exchange When They:

Follow Currency Mart April 10, 2024

Where to purchase Foreign Currencies?

Introduction

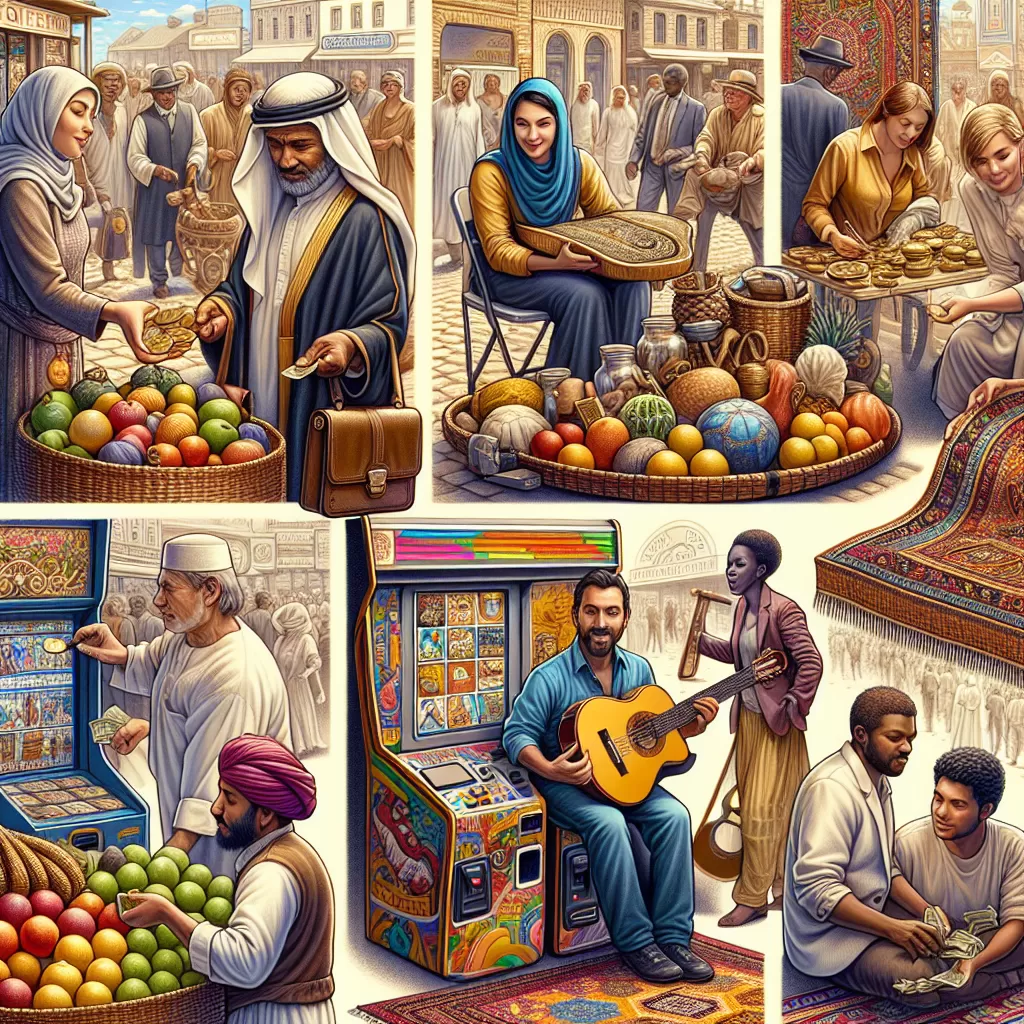

Money, as a medium of exchange, plays a quintessential role in everyday life, facilitating transactions and serving as a benchmark of value. This article delves into how people utilize money as a medium of exchange in various situations. It also presents essential insights into how money, from physical forms to digital transformations, serves as the primary instrument of commerce worldwide.Traveling Across Borders

Crossing borders often necessitates currency exchange as different countries use different currencies. In such instances, people use money as a medium of exchange to facilitate their transactions, whether it's for the purchase of goods, payment of services, or merely a small token of appreciation. Travelers and business persons need to stay updated with the prevailing exchange rates to ensure that their money retains the maximal value.Conducting Business Transactions

In the world of business, money universally stands as the key medium of exchange. Contracts and deals are formulated around the value of money, linking global economies and fueling international trade. Businesses rely on accurate foreign exchange rates to price their goods and services appropriately, maintain competitiveness, realize profit margins, and steer clear of potential financial risks.Making Investments

Investors use money as a medium of exchange to buy into diverse portfolios—ranging from stocks and bonds to real estate and mutual funds. The intent is to exchange the money for an asset that is expected to appreciate in value over time, providing a return on investment. The decisive factor here is the knowledge of when to buy, how much to invest, and when to sell.Purchasing Goods and Services

Arguably the most common situation in which money is used as a medium of exchange is when purchasing goods and services. This ranges from buying groceries and clothes to hiring professionals. It simplifies the trade process by eliminating the challenges of barter system such as double coincidence of wants. This exchange is now made even more convenient through digital and mobile payments.Online Shopping and E-commerce

Driven by the rapid expansion of the internet and smartphones, e-commerce platforms have revolutionized the way people shop. Money exchange in digital forms has become common, offering consumers a seamless transition between different currencies, and allowing them to shop without borders.Peer-to-Peer Payments

Digital transformations have paved the way for peer-to-peer payment systems, where money is exchanged electronically between peers, often through mobile banks or digital wallets. These platforms offer speed, convenience, and the capability to send money across the globe in a matter of seconds.Conclusion

The multifaceted use of money as a medium of exchange exemplifies its central role in socio-economic structures worldwide. From travelers' necessities to business operations, investments to daily purchases, and the burgeoning digital commerce, the exchange of money keeps the world's economic wheel turning. Leveraging the best practices in money exchange, while being wary of rates and fees, can lead to more efficient and advantageous transactions.

Where to purchase Foreign Currencies?